Yardi Matrix: Sacramento, Capital Appreciation

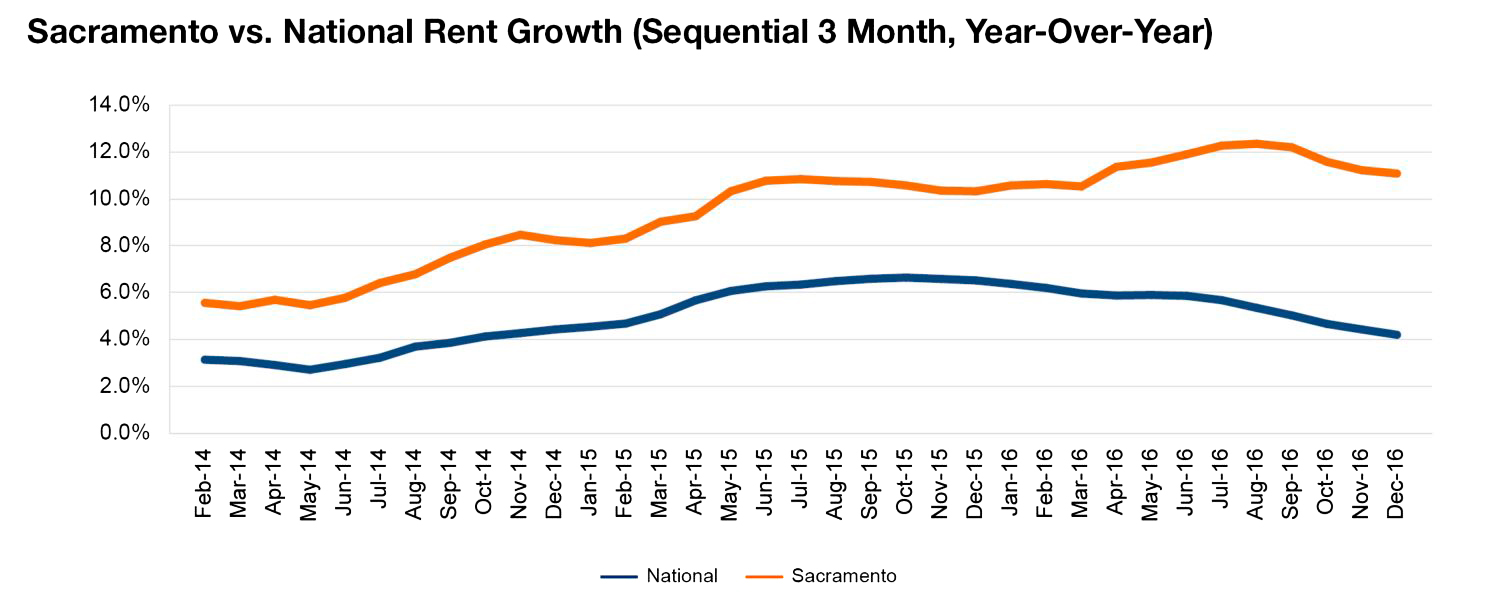

The only remaining U.S. metro with year-over-year rent appreciation in double figures seems unfazed by the national downward trend.

By Alex Girda

Sacramento rent evolution, click to enlarge

As the only remaining metro with year-over-year rent appreciation in double figures, Sacramento seems unfazed by the national downward trend. Completions have been added at a slow pace throughout the cycle, and with only 1,600 units under construction, the supply-constrained market is expected to see occupancy continue to dwindle.

As the capital of California, Sacramento relies on the public sector, with roughly a quarter of the active population employed by the state and local governments. Job growth has been consistent over the past few years. The city’s core is spawning new development projects with entertainment options, while companies are in need of updated office and retail space. Although little progress has been made on the Downtown Riverfront Streetcar project, the $3 billion transit project would galvanize the city’s downtown, especially as new major mixed-use developments are coming to the Capitol Mall, near the newly completed Golden 1 Center sports arena.

Going forward, Sacramento’s multifamily market is expected to remain steady. Despite the recent growth, the metro’s rents are affordable relative to nearby San Francisco and are incentivizing the creation of new households. Investors have also taken note of the improvement, with more than $2 billion in multifamily assets trading since 2015.

Read the full Yardi Matrix report.

You must be logged in to post a comment.