REIT Property Acquisitions Fall Back to Earth

The trend of weak net acquisitions may continue in 2017.

By David Dent, Real Estate Market Analyst, Yardi Matrix

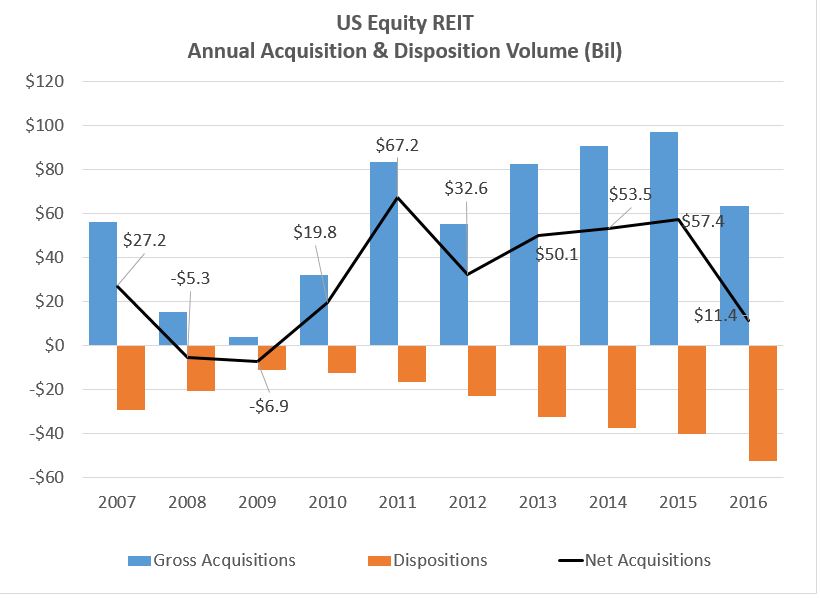

REIT acquisitions declined to a trickle while dispositions increased in 2016, and the signs are that the trend of weak net acquisitions may continue in 2017.

Acquisition activity for equity REITs totaled $63.6 billion in 2016, down 35 percent year-over-year, and fourth quarter volume of $7.9 billion was the lowest quarterly total since 2Q10, according to NAREIT’s quarterly T-Tracker. Meanwhile, REIT dispositions rose 31 percent year-over-year in 2016 to $52.2 billion, the highest annual figure in industry history. Disposition activity was led by apartment and office REITs.

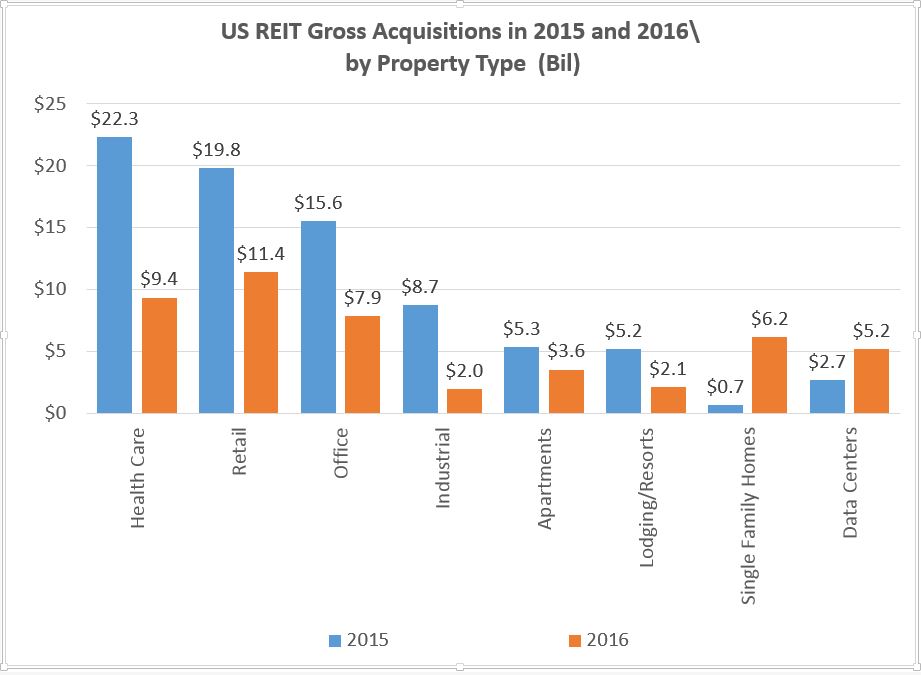

Net acquisitions totaled $11.4 billion, the lowest figure since the recovery from the last recession, and early indications are that purchase volumes remain muted in 2017 as the real estate recovery hit its peak stride. Nearly all property sectors were less acquisitive in 2016, with the exception of single-family homes and data centers, two small specialty categories.

The decline in net acquisitions has a number of causes, from the concern about record-high prices in core markets, rising interest rates and tightening in lending markets. Given that those conditions are not changing, and with so much uncertainty in the near term about tax policies that could affect the industry, REITs are likely to remain cautious about net acquisitions in coming months.

Most larger REITs specialize in major property types in core markets, such as New York, Boston, Los Angeles and San Francisco. Acquisition yields have hit record levels in most of those cities, and REIT managements are becoming more careful about taking on properties at what some feel might be the top of the cycle. In some cases, foreign investors are less concerned about low yields on trophy-type assets, and REITs are reluctant to bid against those types of investors.

At the same time, REIT managers are taking advantage of the high prices to shed non-core assets in primary markets. That enables them to recoup a high return, rebalance portfolios and balance sheets, and wait for more suitable opportunities or even the next market cycle.

Rising interest rates have created some trepidation. Since July 2016, 10-year Treasury interest rates have risen 112 bps from 1.37 percent to 2.49 percent, and the market expects the Federal Reserve to raise the discount rate by another 50-75 basis points in 2017. Not only are REIT share prices are sensitive to rising rates, but rising rates could increase acquisition yields. Whether they do or not is unclear, but the prospect of rising rates has led to a growing disconnect between buyers and sellers that is reducing overall property transaction activity in public and private markets.

What’s more, the Federal Reserve’s Senior Loan Officer Opinion Survey reports that throughout 2016 credit officers raised underwriting standards for commercial real estate loans, both construction and permanent. The Fed survey reveals decreasing demand for commercial real estate loans as potential buyers move to the sidelines in the wake of higher rates and credit standards. Bank regulators have also pressured many small- and regional-sized banks to not overextend in commercial property lending.

Net acquisition levels in 2016 were down 80 percent from the record $57.4 billion in 2015. Fourth quarter results were slightly positive but now down to levels not seen since 2009 when REITs were net property sellers in the wake of the Great Recession. Health care continues to lead property types with $7 billion in net acquisitions in 2016, but even that number is down over 60 percent compared to 2015’s net acquisitions of $20 billion.

The slowdown in acquisitions in 2016 has an approximate corollary in the weakness witnessed in 2012 and 2013. In July 2012, 10-year Treasury rates touched record lows of 1.43 percent and then began to drift 161 bps higher by December 2013 when rates crested at 3.04 percent. In the wake of this back-up in rates, gross acquisitions dropped 34 percent.

It is worthwhile noting that in 2014 acquisition volume boomed again once interest rates began falling in the wake of additional quantitative easing plans implemented by the European Central Bank and Bank of Japan. However, 2017 begins with a stock market rally and hawkish comments by central bankers so it seems unlikely that commercial real estate transactions will soon get much of a tailwind from the credit markets.

You must be logged in to post a comment.