Yardi Matrix: San Francisco—Suburbs Rising

The metro has been the poster child for booming technology markets on the West Coast, but the effects of those surging years are coming back to haunt its multifamily market.

By Alex Girda

San Francisco rent evolution, click to enlarge

San Francisco has been the poster child for booming technology markets on the West Coast, but the effects of those surging years are coming back to haunt its multifamily market. Supply is lagging demand, pushing rents past any reasonable level of affordability, even for high-paid workers. Renters are moving into the suburbs, driving up rents there as a result. Meanwhile, demand for Bay Area assets has compressed acquisition yields to some of the lowest levels in the nation, sending investors toward the lower Peninsula and Alameda County.

Technology remains a key driver of growth, but other job segments—such as education and health services, and hospitality—are also surging. The Transbay Transit Center is one of the most significant multimodal transit hubs taking shape in the Western United States. Once completed, it will create an entire neighborhood, with 4,000 new units, more than a third of which will be designated for affordable housing. In addition, the development will contain 6 million square feet of office space.

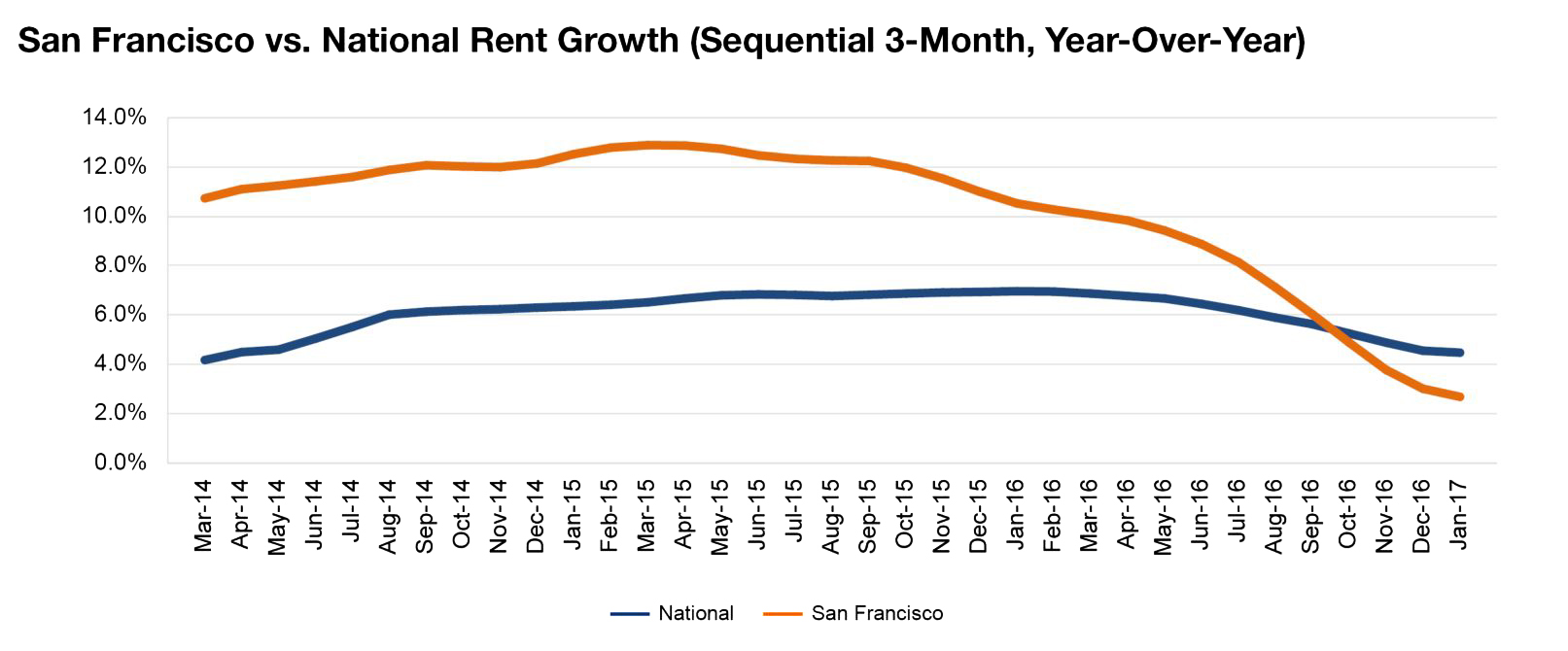

Roughly 15,000 units are underway in the Bay Area, pointing toward an escalation in completions. However, demand is very high, due to employment and population growth. Rent gains have decelerated, improving affordability, but we expect growth to rebound to moderate levels in 2017.

Read the full Yardi Matrix report.

You must be logged in to post a comment.