Niche Plays: The Rise of Specialty Sectors

Technological advancements and demographic patterns are giving rise to new needs. Which are the sectors seeing the benefits—and offering long-term investment opportunities as a result?

By Sanyu Kyeyune

GEICO signed a 12-year lease within seven months of CenterSquare Investment Management’s 2014 acquisition of a vacant, 229,000-square-foot office building in Richardson, Texas, 20 minutes northeast of Dallas. Courtesy of CenterSquare Investment Management

Technological advancements and demographic patterns are giving rise to new needs. Data centers and health-care facilities are two of the most promising niche sectors seeing the benefits—and offering long-term investment opportunities as a result.

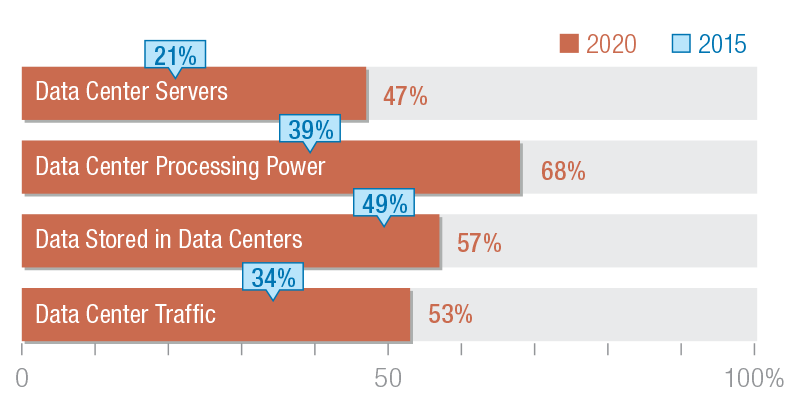

At 357.9 megawatts in the top U.S. markets, data center absorption rates have climbed to a record level, according to JLL’s 2017 Data Center Outlook. The service provider listed Northern Virginia, Northern California and Chicago as leading the pack. Demand for data center solutions remains high, spurred by corporations racing to adopt cloud connectivity and optimize their IT infrastructures, along with the global trend of increasing bandwidth.

The Cisco Global Cloud Index, which forecasts global data center cloud-based IP traffic growth, predicts traffic within the super-size hyperscale data centers will quintuple within the next three years. Already, these facilities handle 34 percent of total traffic within all data centers, and in 2020, they will account for 53 percent.

Data Merge

Major-league mergers and acquisitions are laying the groundwork for industrywide consolidation and heating up competition for these assets. In May 2017, colocation data center REIT Equinix Inc. expanded its global portfolio by 3 million square feet with the purchase of 29 data centers from Verizon Communications Inc. The $3.6 billion, all-cash buy brought Equinix’s footprint to 175 International Business Exchange assets spanning some 17 million square feet in 44 markets across the Americas; Europe, Africa and the Middle East; and Asia. It also represented the firm’s entry into two new markets: Houston and Culpeper, Va. Prior to this pickup, Equinix scored London-based Telecity Group plc for $3.8 billion, before selling eight carrier-neutral data centers in Europe to San Francisco-based Digital Realty Trust Inc. for $874 million in 2016.

Major-league mergers and acquisitions are laying the groundwork for industrywide consolidation and heating up competition for these assets. In May 2017, colocation data center REIT Equinix Inc. expanded its global portfolio by 3 million square feet with the purchase of 29 data centers from Verizon Communications Inc. The $3.6 billion, all-cash buy brought Equinix’s footprint to 175 International Business Exchange assets spanning some 17 million square feet in 44 markets across the Americas; Europe, Africa and the Middle East; and Asia. It also represented the firm’s entry into two new markets: Houston and Culpeper, Va. Prior to this pickup, Equinix scored London-based Telecity Group plc for $3.8 billion, before selling eight carrier-neutral data centers in Europe to San Francisco-based Digital Realty Trust Inc. for $874 million in 2016.

Though specialty REITs are clamoring for data center sites and corporations continue to chase cloud-based solutions, the sector is vulnerable to disruption. Citing his background in electrical engineering, Sam Chandan, associate dean, clinical professor & Larry and Klara Silverstein Chair in Real Estate Development and Investment at NYU’s Scool of Professional Studies Schack Institute of Real Estate, noted that a single technological change could jeopardize demand for these properties.

“If we were to have some quantum leap in storage technology,” he cautioned, “we might need less physical space for data storage.” This type of shift would accelerate the miniaturization of information storage, and if it were to occur suddenly, the entire sector could feel the adverse impact.

Healthy Demographics

While the policy outlook for health care remains uncertain, the sector’s real estate fundamentals benefit from demographic trends.

While the policy outlook for health care remains uncertain, the sector’s real estate fundamentals benefit from demographic trends.

“Aging Baby Boomers and longer life expectancies have been great for health-care real estate, across all subsectors,” Deloitte’s Global and U.S. Real Estate & Construction Leader Bob O’Brien said. Even though the demand for skilled nursing facilities will grow over the next decade, operators of these assets face increasing costs and decreasing reimbursement rates. Greater stability around how health care is financed could remedy these issues and make skilled nursing a more sustainable investment. For now, while skilled-nursing facilities may not offer breakout returns, other property subtypes, such as medical offices, might.

Research firm Revista counted 37,322 medical office buildings in the U.S., totaling 1.4 billion square feet and valued at $363 billion. Average occupancy was 92.5 percent, contributing to long-term NOI growth. Demand for these properties should continue to rise over the next several years, as more hospitals and health systems seek to reach a greater number of patients by extending their service delivery options through affiliated outpatient care centers.

The Right M.O.

Investing in the sector has its perks. Tenants of medical office buildings that are affiliated with large health-care systems tend to have high credit quality. Typically, they occupy buildings for longer than tenants of other asset types and invest heavily in improving and customizing their spaces. For these reasons, said Jason Kern, Americas CEO of LaSalle Investment Management, his firm often underwrites lease renewal probabilities as high as 90 percent for medical offices, a category to which the company has heavy exposure through its various core funds and separate accounts.

“Historically, medical offices and health-care facilities are not really affected by the recession,” said Yildiray Yildirim, director & William Newman Chair in Real Estate at Baruch College’s Steven L. Newman Real Estate Institute.

The sector’s customer base extends beyond older adults, Yildirim explained. “Urgent-care centers are a perfect product for Millennials, because they can be impatient, so it’s important to understand the demographics.”

You’ll find insight into opportunities in additional property sectors in “The Way Forward” in the June 2017 issue.

You must be logged in to post a comment.