Miami Beach Asset Commands $283M

CBRE Global Investors teamed up with Universal-Investment to acquire 1111 Lincoln, a fully leased office and retail property designed by Herzog & de Meuron Architects.

By IvyLee Rosario

CBRE Global Investors and Universal-Investment acquired 1111 Lincoln, a fully-leased mixed-use property in Miami Beach, Fla. The acquisition was made on behalf of Bayerische Versorgungskammer, one of Germany’s largest institutional investors. The asset sold for $283 million, according to Yardi Matrix.

Property Details

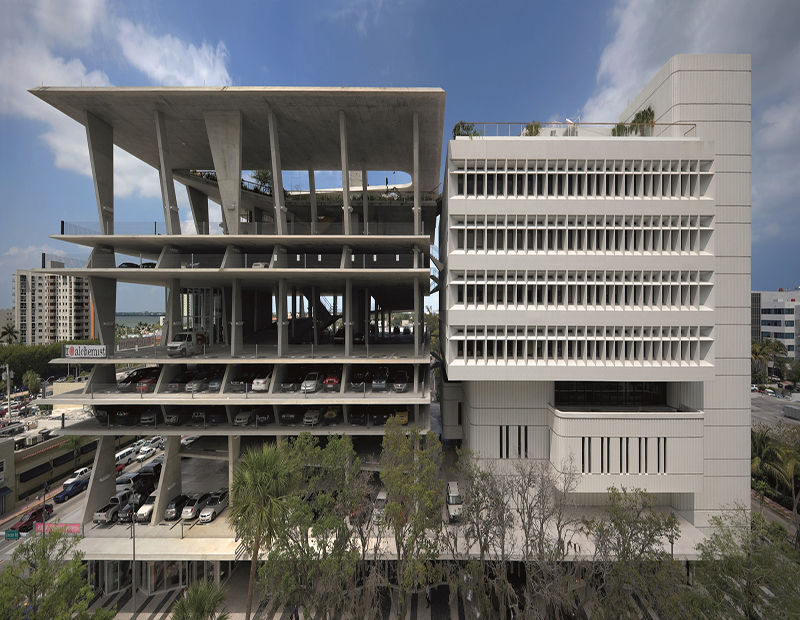

Designed by Herzog & de Meuron Architects, the building offers 94,488 square feet of office, 51,839 square feet of retail and a seven-level, 300-space parking garage and event space. 1111 Lincoln retail features glass storefronts and high ceilings, while the office includes a renovated lobby, up to 14-foot ceilings, views of Miami Beach and on-site amenities. The property was originally completed in 2010 and underwent cosmetic renovations in early 2017. Current tenants include Shake Shack, Douglas Elliman, Viacom, Adidas, Ted Baker and UIA Management.

“We see great opportunity with this newly redeveloped, one-of-a-kind property in the Miami market,” said Stuart Sziklas, managing director for CBRE Global Investors-Americas, in prepared remarks. “1111 Lincoln is one of the most recognized, best located commercial properties in Miami Beach, in one of the top retail districts in the country. This represents experiential retail at its best. 1111 Lincoln is well-suited to a changing retail environment, and we look forward to working to enhance it further through our active asset management approach and our international platform.”

In May, CBRE Global and Universal-Investment also partnered to acquire North Point MarketCenter, a 427,053-square-foot Class A regional retail center in Alpharetta, Ga.

Image courtesy of CBRE

You must be logged in to post a comment.