The Houston CRE Market in Hurricane Harvey’s Aftermath

The metro’s office market emerged mostly unscathed following the Category 4 storm, while the retail, industrial and hotel industries were affected in certain areas. The flooding did the most damage on residential properties, according to a CBRE report.

By Timea Papp

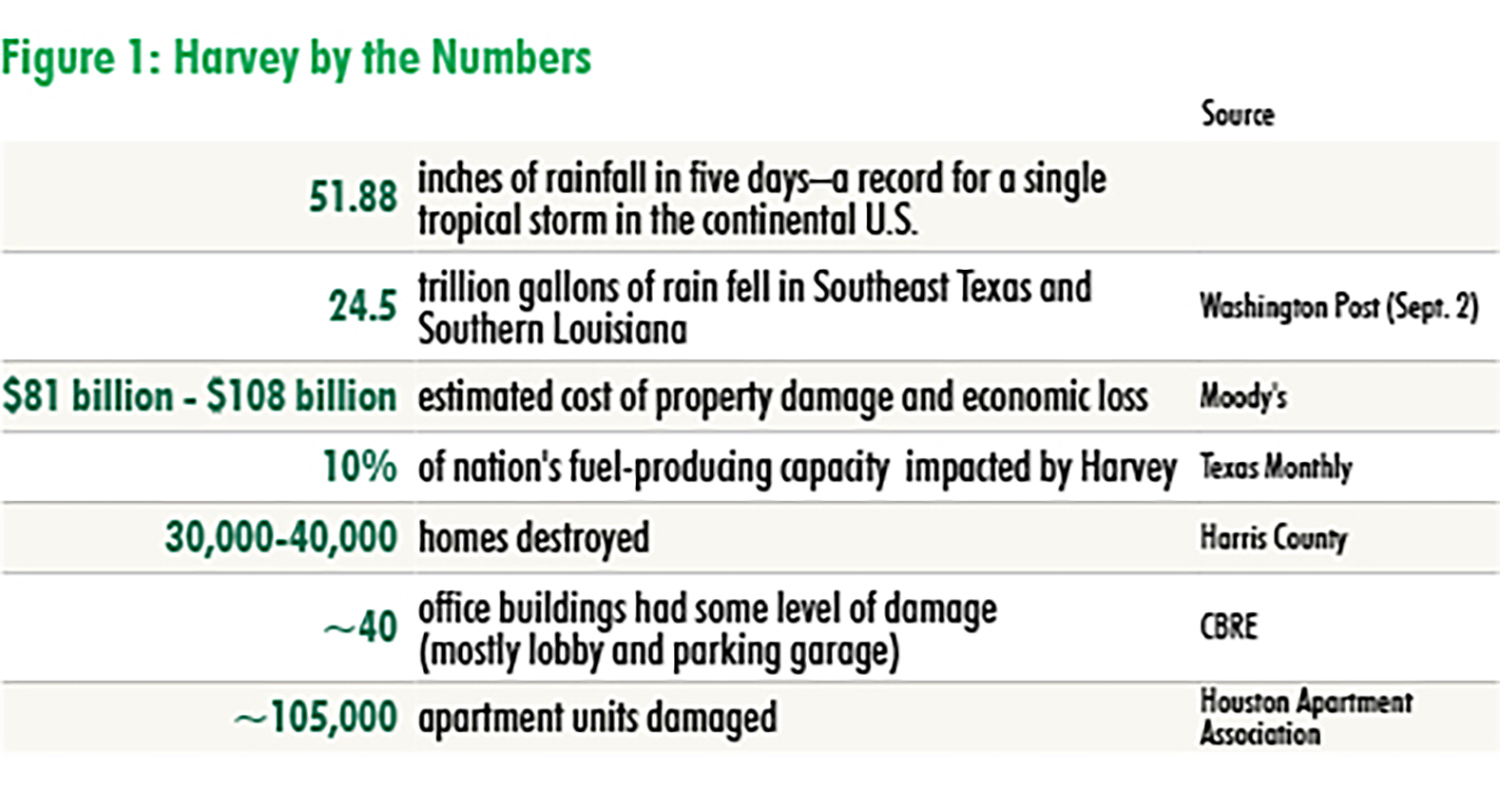

Houston and the surrounding Texas Gulf region are not unfamiliar with hurricanes, tropical storms and floods, with more than eight severe weather events impacting the Houston metro area since 1998. Hurricane Harvey struck the area on August 25 and dumped more than 50 inches of rain in a matter of days. The Category 4 storm was the strongest to hit the region since 1961. The subsequent flooding caused massive damage to office, industrial and retail assets, particularly affecting residential properties. CBRE’s extensive report highlights the magnitude of Harvey’s consequences on the Houston real estate market.

Hurricane Harvey’s impact has effects on a national level as well, beyond the Greater Houston area. Most refineries along the Texas Gulf Coast have restarted operations, while Port Houston, the largest U.S. port in foreign tonnage, reopened on September 1 after being closed for four and a half days. CBRE Research estimates an increase in gas prices of about $0.08-$0.10 in the upcoming months.

Short-term lease on the rise

A small percentage of Houston’s office buildings was affected by the worst flooding, with nearly 40 buildings (9 million square feet) out of the total 214 million-square-foot office inventory suffering some degree of damage. The office product affected by the flooding is located mostly in the western and northwestern ends of the Central Business District-West Houston, Allen Parkway, West Loop/Galleria and Farm to Market Road 1960/Highway 249 submarkets, which total 74.6 million square feet or 35 percent of the total Houston office market.

Displaced tenants seeking temporary space will most likely sign very short-term leases, as they expect to return to their original locations as soon as next month. CBRE indicates that some direct tenants previously marketing sublease space have removed their listings from the market. The explanation for this is that organizing an office move will be difficult for the next several months and office build-outs will face construction delays due to a shortage of materials and construction workers.

Most of the metro’s industrial product weathered the storm with no significant structural damage. Isolated instances occurred on the West Side and along the Interstate 10 corridor, where Class A, institutional assets suffered damage. Per the Federal Emergency Management Agency (FEMA), the inner North/Northeast, Houston’s largest industrial cluster, reported few “major damaged” or “destroyed” properties. Older properties located near Houston’s bayous are likely the most damaged.

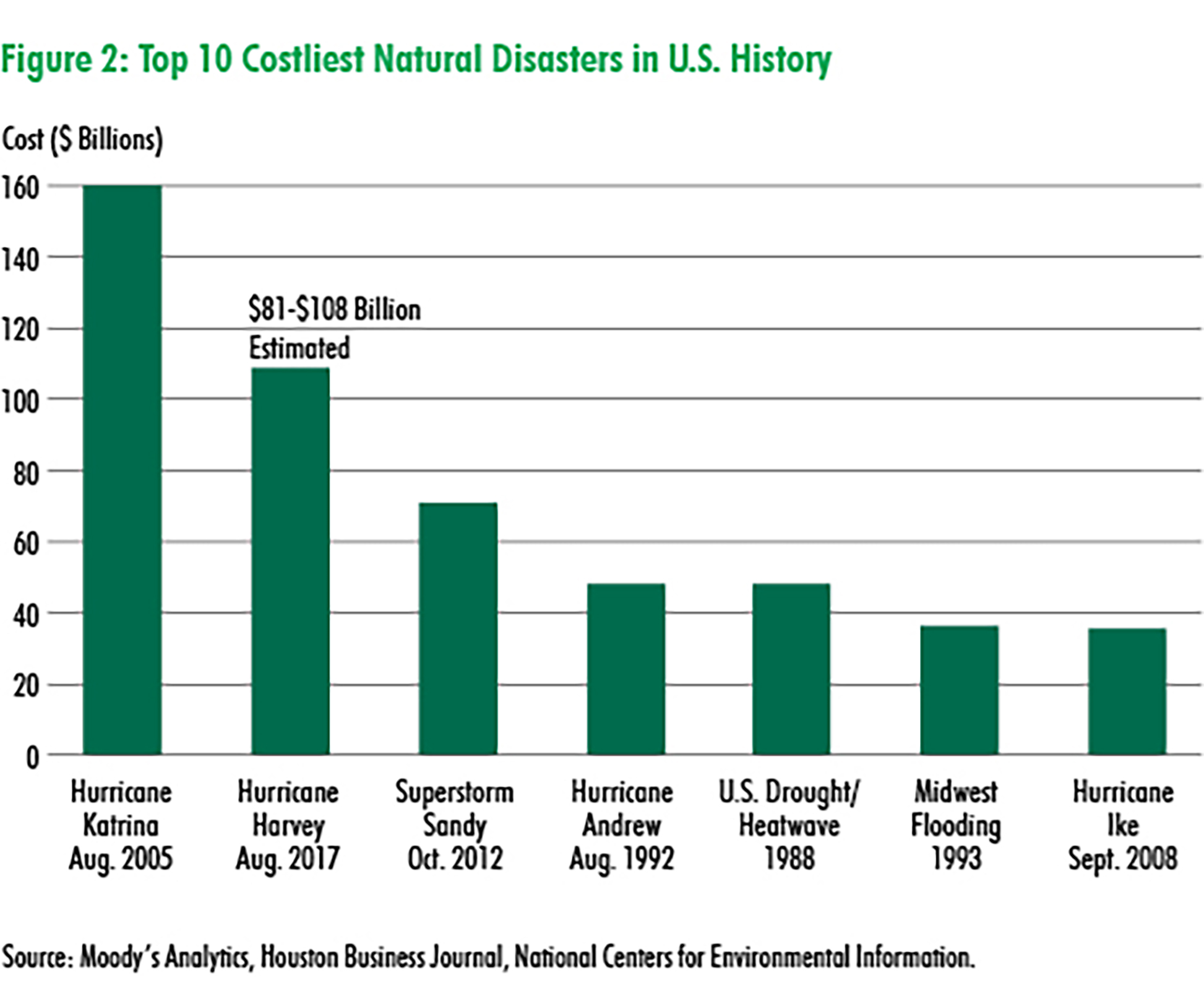

An extensive $100 billion+ rebuilding effort will take place over the next year, with several national building supply companies currently securing additional space. Many non-flood-related industrial requirements will probably go unfulfilled and industrial vacancy is expected to tighten, while occupancy is likely to increase.

Retail sales to increase

CBRE Research shows that prior to Harvey, the metro’s retail market was at a record high: 97 percent occupied in the second quarter. Retail properties weren’t widely affected by the hurricane, as the damage was mainly limited to strip centers and neighborhoods in the hardest hit areas, such as Kingwood to the northeast, Cypress in the northwest and to West Houston.

Tight market conditions are playing against displaced tenants looking for temporary space. Home improvement and related retailers are expediting their location decisions in order to make sure that they are prepared for the uptick in demand for housing repairs. Retail sales tax receipts are expected to spike mainly in Harris, Montgomery and Fort Bend counties. Local retail sales will increase, especially for durable goods such as furniture and appliances, home improvement and automotive.

FEMA is housing 53,000 people in government-funded hotel rooms and hotels throughout the region should see an increase in the number of people in search of accommodation. Initial reports show a relatively low number of closures among Houston’s 868 hotels totaling 85,615 rooms.

Assuming Hurricane Harvey has a similar impact as past major storms (Hurricane Katrina, Superstorm Sandy, Hurricane Ike and Hurricane Andrew), hotels in the five major Texas markets could generate an additional 3.4 million room nights of demand and roughly $430 million in additional revenue. More than 5,000 rooms are currently under construction in Houston, but many of the projects are expected to be delayed because of the storm, as construction supplies become scarce.

Multifamily development plans ahead

As many as 100,000 units were flooded, as residential properties were the most affected by Harvey. The bulk of these were single-family homes in suburban areas to the northeast, west and southwest of downtown Houston.

Some high-density submarkets sustained damage in approximately 30 percent of existing inventory, totaling roughly 22,300 occupied units and creating immediate leasing demand. The storm affected occupancy rates that will see sharp increases, while renters with leases expiring in the next six months should not anticipate any type of renewal incentives.

Houston’s office and multifamily sectors were oversupplied prior to Harvey, with retail, industrial and single-family development surging. However, multifamily developers may start looking for sites to construct sooner than anticipated, as displaced homeowners will likely lease Class A multifamily units. Additionally, new development requirements will most probably be imposed on new, large single-family land tracts.

Images courtesy of CBRE and via Google Maps

You must be logged in to post a comment.