Investor Interest Fuels Bay Area

Demand for office space is as strong as ever, prompting developers to roll out a steady stream of new product. The market’s total inventory encompasses 174 million square feet, with an additional 11 million square feet expected to come online by the end of 2017.

By Timea-Erika Papp

San Francisco’s well-known combination of soaring lease rates and limited availability has pushed office users to seek more affordable options beyond city limits. Demand is as strong as ever, prompting developers to roll out a steady stream of new product. The market’s total inventory encompasses 174 million square feet, with an additional 11 million square feet expected to come online by the end of 2017. All told, nearly 48 million square feet is in the planning and permitting stages.

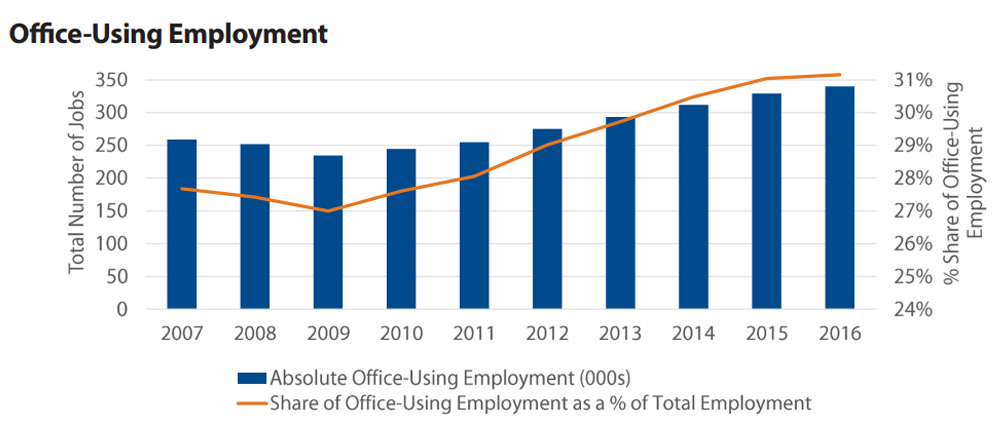

Roughly 31,000 jobs were added in the 12 months ending in July, a testament to the Bay Area’s reputation for developing talent. The presence of such worldclass institutions as Stanford, UC Berkeley and UC San Francisco appeals to employers in search of a well-educated, highly qualified workforce.

Silicon Valley continues to attract tenants along the Caltrain corridor. However, tech giants such as Google, Facebook and Apple are pushing smaller firms and startups to the East Bay, where smaller blocks of space are available. Oakland has been rapidly emerging as a growing tech market, while Richmond posted the metro’s highest lease rates at $84.77 per square foot.

Transaction volume reached $4.8 billion for the past four quarters, as both domestic and foreign investors showed strong interest in the metro’s office properties, especially 1980s-vintage assets. Sales volume in Palo Alto alone amounted to $632 million, an average of $908 per square foot.

You must be logged in to post a comment.