Top 10 Chicago Office Buyers

Since January, the city has seen several notable transactions despite a rather slow start into the year. Two deals closed at prices surpassing $300 million.

By Roxana Baiceanu

Despite an overall slow performance in 2017, the Chicago office market still attracted several notable investments, the sales volume surpassing $2.5 billion in November. Eight of the top 10 deals closed in the Windy City since the beginning of the year featured price tags over $100 million.

Buyers were particularly attracted by high-rises within the city’s West Loop and River North neighborhoods, most of the important transactions being closed in the second and third quarters. Until the year’s end, Sterling Bay is expected to complete the priciest deal, but until it officially appears in public records, HNA Group remains at the top of Chicago’s office buyer list.

Below you can find the entire top 10 list of buyers based on transactions closed during January to November 2017. The ranking is based on Yardi Matrix data.

10. The Besen Group

This year, the investors at The Besen Group made their first office purchase in Chicago. The group acquired the 322,000-square-foot building at 500 N. Michigan Ave. from Macerich Co. for $86.4 million, which propelled it to one of the top positions in our list of Chicago office buyers. The deal closed in November. The previous owner bought the property from Zeller Realty Group in 2012 for $70.9 million.

9. Retail Properties of America

In January, the Oak Brook, Ill.,-based company spent $88 million on acquiring the 230,000-square-foot Main Street Promenade building in Naperville, Ill. from BBM Inc. Located at 55 S. Main St., the property offers almost 100,000 square feet of retail space. It was 93 percent occupied at the time of the deal. RPAI’s office portfolio also includes The Schaumburg Towers in Schaumburg, Ill. and The Southlake Town Square in Southlake, Texas. Upcoming is One Loudoun, a 72,000-square-foot building in Washington, D.C.

8. Stonemont Financial Group

The Atlanta-based investment firm’s office portfolio comprises seven properties nationwide, the majority being located in the Midwest. In the Chicago area, Stonemont acquired three properties this year: the Bannockburn Centre at College Park, 177 S. Commons Drive and the Prairie Stone Corporate Center. They were part of a $1.1 billion portfolio transaction, which also included retail and industrial space. On the last two properties the buyer shed $108.4 million. The most expensive asset was Prairie Stone Corporate Center, which was purchased from Oak Street Real Estate Capital in August for $63 million. The 2007-built mixed-use property is located at 5450 Prairie Stone Parkway in Hoffman Estates, Ill. and includes almost 20,000 square feet of industrial space.

7. Ivanhoe Cambridge

The Canadian investor owns eight properties in the U.S., concentrated in three markets: Chicago, Manhattan and Seattle. The two Chicago office properties are recent additions to the company’s portfolio. The 180 N. LaSalle tower was acquired at the beginning of last year, while the 125 S. Wacker Drive deal closed in the summer. The 527,005-square-foot office building used to be one of MetLife Real Estate Investment’s assets and cost Invanhoe $145 million, almost $40 million more than what its previous owner paid for it back in 2012.

6. LaSalle Investment Management

LaSalle hasn’t expanded too much its Chicago footprint, having made a single purchase this year—the 536,650-square-foot tower at 123 N. Wacker Drive. The company now owns four office properties in the Windy City, all of them in the CBD area, having grown its portfolio to more than 2 million square feet. The 30-story tower was purchased from Wells Fargo for $146.5 million, after the property had gone into foreclosure in 2016. Its previous owner, Sovereign Capital, paid $175 million for it in 2005.

5. Golub & Co.

The company has more than 50 years of experience in acquiring, managing and leasing real estate. Its office portfolio encompasses five buildings, four in Chicago and one in Minneapolis, its most recent addition being the 36-story, Class A tower at 300 S. Wacker. Golub and its partner, Alcion Ventures, paid $155.3 million to Beacon Capital Partners in July for the 512,354-square-foot property, which they plan to revitalize.

4. Beacon Capital Partners

Approximately one year after having acquired the 1.2 million-square-foot AMA Plaza—Chicago’s 2016 “Building of the Year”—Beacon closed another large deal in the city. The iconic 231 S. LaSalle office property entered Beacon’s portfolio in October in exchange of $162 million. Built in 1922, it was completely renovated in 2015 by its previous owner, Berkley Properties. While on this list Beacon ranked fourth, it secured the top position among all San Francisco office buyers last month, as a result of purchasing 44 Montgomery.

3. CBRE Global Investors

CBRE acquired four office properties in Chicago this year, the largest number among all top 10 investors. The acquisitions’ price tag mounted to $202.1 million, the most expensive being Crain Communication Building at 150 N. Michigan Ave. ($120.6 million). CBRE bought the popular high-rise from John Hancock Real Estate in a deal which closed in September. The building encompasses more than 650,000 square feet. Built in 1984, it went through cosmetic renovations in 2015.

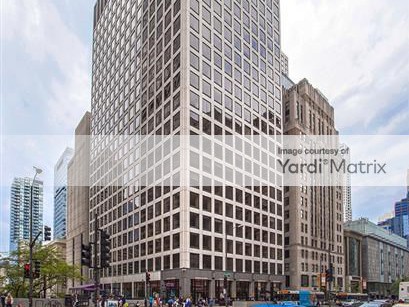

2. Walton Street Capital

The company’s Chicago office portfolio comprises more than 1.2 million square feet—almost one third of the office space Walton owns nationwide—the majority of the assets being located in the North Shore-North submarket. The only building located in the CBD is 401 N. Michigan, which Walton acquired this year from Zeller Realty Group in exchange of $350 million. The LEED Platinum-certified high-rise is home to Apple’s $27 million store.

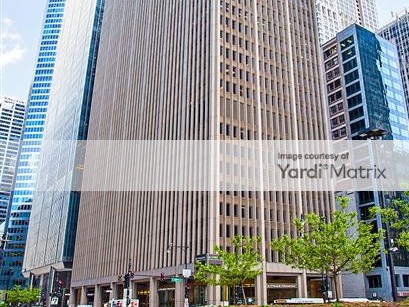

1. HNA Group

The Chinese investor paid $359 million for 181 W. Madison, which was previously owned by CBRE. While foreign investment has declined during the last two years in Chicago, HNA’s purchase may be a sign that activity might pick up. HNA also owns two other office buildings in Manhattan (245 Park Ave. and 1180 Ave. of Americas), one in Minneapolis-St. Paul (33 S. Sixth) and one in San Francisco (123 Mission St.).

Images courtesy of Yardi Matrix

You must be logged in to post a comment.