Current Charges: 2018 Electricity Price Outlook

Electric bills in the commercial sector are expected to remain relatively stable for the next few years, but property owners and managers should watch for weather-related shocks and other sources of volatility.

By Nancy Crotti

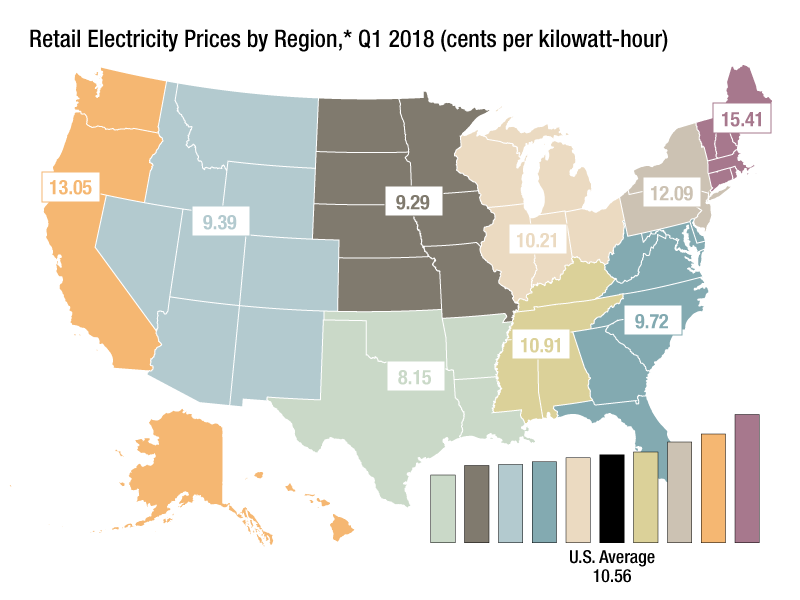

Electricity costs for the commercial sector are projected to vary widely across the country during the first quarter, according to the latest projections by the U.S. Energy Information Administration.

Electricity customers can look forward to relative pricing stability over the next few years. According to the latest projections from the U.S. Energy Information Administration (EIA), commercial electricity pricing will increase from 10.68 cents per kilowatt-hour in 2017 to an average of 10.92 cents this year and 10.97 cents in 2019.

On the consumption side, projected annual electricity sales to the commercial sector are up 0.6 percent this year, while industrial sector electricity sales are expected to grow by 0.4 percent.

While this stability is encouraging, operators should expect some uncertainty in that forecast, since procurement and pricing are subject to conditions that are beyond the control of conventional market forces. “The extreme cold weather in the Northeast at the end of 2017 and into early 2018 caused some initial price volatility and increased stress on the grid,” reported Daniel Rice, manager of client services for Yardi Energy.

During the summer of 2017, the U.S. Department of Energy contended that the reliability of the grid was at risk, especially when taxed by weather conditions. DOE attributed the warning to the limited number of power plants, primarily coal and nuclear, with at least 90 days of onsite fuel reserves. Fortunately, a fuel mix that relies more on natural gas delivered by pipeline has been able to meet demand without significant disruption.

All in all, property operators should keep an eye on the variety of moving parts that influence power pricing. “The complexity of government regulations, extreme weather events and international energy markets are challenging for a building owner to monitor,” observed Liz Majkowsi, senior vice president of operations for SL Green Realty Corp., the New York City-based office REIT.

Shifting Terms

One fallout from volatile weather, however, is that some providers are moving away from fixed-price contracts. These vendors now want property operators to pick up the tab for capacity costs, which are chiefly associated with hot summer days that place peak demand on the grid. Pricing varies among markets and properties, but capacity costs can still constitute 30 percent of the customer’s total rate.

Whether this practice represents the start of a longer-term trend remains unclear, Rice noted. In the meantime, operators have some tactics at their disposal to mitigate capacity costs. Responding quickly to providers’ warnings about high-demand periods can help cut costs, both in the moment and when it’s time to negotiate the next contract, Rice explained.

Some providers offer rebates or lower prices based on overall customer demand, noted Lori Aniti, an economist with EIA’s Office of Energy Analysis. “They might look at one of those programs to see if they can get rebates at certain times of day,” she said. “That might be helpful as well for them as a large customer.”

One factor helping to keep the lid on price increases is competition. Even in regulated markets, where about 65 percent of U.S. utilities are located, property owners have options for suppliers. For example, Ohio allows aggregated groups of customers to negotiate energy contracts with investor-owned utilities.

Locked In

Some retail suppliers in deregulated states are willing to secure prices for long terms, such as three, five or 10 years, reported Shannon McGriff, an energy broker and director of The Energy Professionals Association (TEPA). “There’s definitely potential to look forward and lock in your contract to take advantage of these prices,” McGriff said. She is already researching pricing for a client whose contract does not expire until 2020.

Unless a company employs a full-time procurement specialist, McGriff recommends working with a consultant to find the right provider, particularly in heavily price-driven markets. Building owners should focus on contract language, credit standing and customer service issues in addition to pricing. “You want to make sure the provider has good credit and can back up the language that’s in their contract,” she said.

For companies with high transaction volumes, poor credit can deter an electricity supplier from working with a buyer, added Rice.

Building owners and their representatives should also pay attention to changes in government requirements, and to mergers and acquisitions among suppliers. Customers usually won’t see changes overnight, but credit terms could differ if a large supplier acquires a smaller one, McGriff noted.

Other factors to consider include payment terms, bandwidth, material change, and access to billing portals. For example, if a major tenant moves out before an energy contract is up, that will create a material change in energy consumption that should be negotiated in the next contract. Access to a supplier’s billing portal can save time and money, according to Rice. “It’s just important to look at purchasing energy from a third-party supplier holistically, and not just going with who has the best rate,” he said.

You must be logged in to post a comment.