Metroplex Momentum in Dallas

The metro's office market is buzzing with activity, with a large influx of absorption as companies relocate to the region, attracted by one of the most active development pipelines in the U.S.

By Roxana Baiceanu

Dallas’ office market is buzzing with activity, with a large influx of absorption as companies relocate to the Metroplex, attracted by one of the most active development pipelines in the U.S. The metro’s already robust economy has continued to grow and diversify during the last four quarters, and the momentum is expected to last for at least the next two years. The recently passed tax reform could also encourage the trend of companies moving from Northern and Coastal states to the South and West.

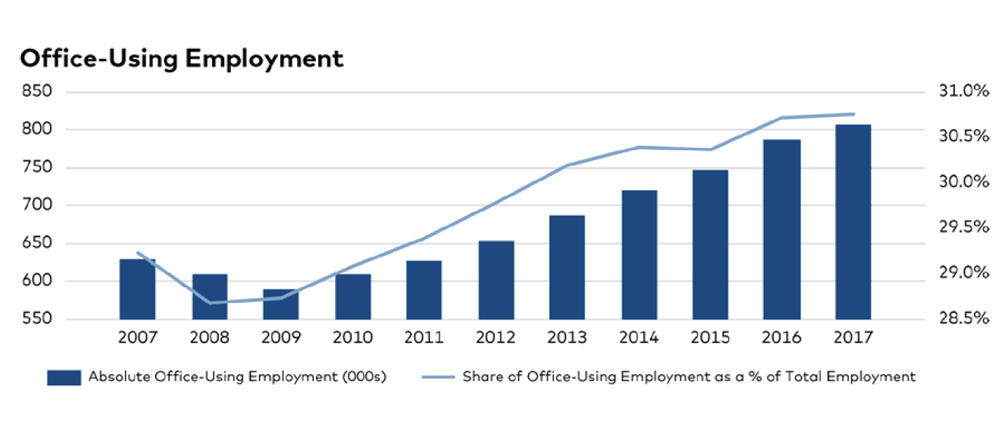

Some 60,000 new office-using jobs were added in the metro in 2017, bringing the employment pool to more than 800,000. The largest gains were in the professional and business services sector.

About 9 million square feet of office space was listed for lease as of January, while more than 7 million square feet is slated for completion this year. That could prove problematic in a market in which the overall vacancy rate rose to 19.3 percent after several projects came online at the end of 2017. In an effort to revive the dormant Central Business District (CBD), developers have embarked on several redevelopment projects—such as the Dallas County Records complex.

The suburbs continue to outperform the CBD. Major companies like JP Morgan Chase, State Farm and Liberty Mutual recently relocated to the Legacy West business district in Plano. Among the CBD’s downsides are scarce and expensive parking and congested highways that produce difficult commutes.

You must be logged in to post a comment.