Are Net-Leased Pharmacies Just What the Doctor Ordered?

While recent M&A activity has consolidated the players in the pharmacy space and created some unknowns, investors in the sector are still more surefooted than they've been in recent years, notes JLL Senior Vice President Peter Bauman.

By Peter Bauman, JLL Senior Vice President

The retail real estate landscape has become increasingly more challenging to navigate, as buyers become more selective and owners look for new ways to drive revenues. But pharmacies might be just what the doctor ordered—at least when it comes to net-leased assets.

The retail real estate landscape has become increasingly more challenging to navigate, as buyers become more selective and owners look for new ways to drive revenues. But pharmacies might be just what the doctor ordered—at least when it comes to net-leased assets.

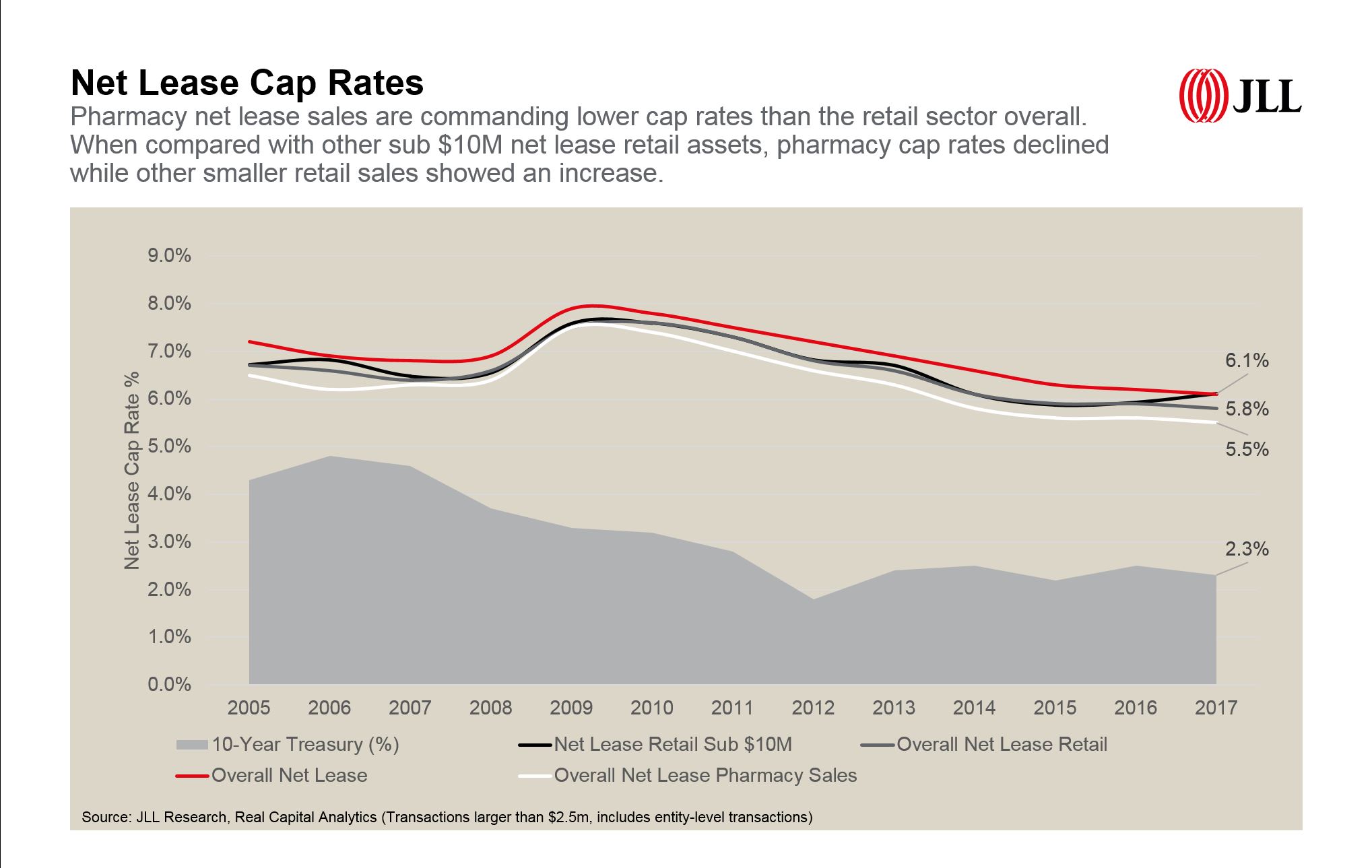

The numbers speak for themselves. According to JLL research, capitalization rates for net leased pharmacy transactions in 2017 averaged 5.5 percent nationally, representing the lowest annual level on record, and illustrating the strong level of investor demand. The picture for the broader net lease retail market is less positive. While pharmacy assets saw continued cap rate compression in 2017, the sub-$10 million retail market as a whole saw upward pressure on cap rates.

Combined with the fact that the average deal size for pharmacy transactions grew by 8 percent from 2016 to 2017, amid declines in U.S. commercial real estate transactions overall, these statistics are indicative of the robust investor demand for this asset type.

Demand highlights investor evolution

While recent merger and acquisition (M&A) activity has consolidated the players in the pharmacy space and created some unknowns, investors are still more surefooted in the space than in recent years.

But with thousands of chain store pharmacies located around the country, how are investors making their choices on which ones to look at? The fact is, investors are much savvier about their approach to buying pharmacies. While the basic metrics are still critical (cap rates, lease term, tenant credit rating, rent escalation, etc.) they are moving beyond these factors to predict the true value of the foot traffic in and out of the store and pharmacy sales.

Investors are also adding in the physical location of the store. Most pharmacies have adopted a convenience store model—think Walgreens, CVS and Rite Aid— and occupy prime retail corners and outparcels. The sales produced by the front-end store element and pharmacy sales are also a key factor in predicting a location’s health.

A changing landscape

There are still questions that remain, particularly when it comes to M&As. How will Albertsons buying the remaining Rite Aid locations raise the credit of those stores, and pique investor demand? What does Walgreens Boots Alliance’s acquisition of nearly 2,000 Rite Aid stores mean for its competition with CVS? Will the CVS and Aetna merger pressure pricing on other pharmacies, and increase their prescription revenue?

For now, CVS and Walgreens stores are some of the stronger bets investors can make in the pharmacy space, as their credit and leasing terms are typically often favorable. We don’t see that changing soon, but perhaps evolving as each company hones its strategy now that they have more brick-and-mortar locations.

What we do know is that consumers still love their corner pharmacy, and the demand for a brick-and-mortar location that provides their prescription medicine isn’t going away anytime soon. In 2016 (the latest year for which data is available) Americans used mail or online methods to obtain $106 billion of prescription drugs. While that is a large number, it represents less than a quarter of total the $465 billion in prescription sales that year, according to Morgan Stanley.

Another factor to watch in 2018 is what the Fed does with interest rates. It is likely interest rates will continue to go up, which will put pressure on cap rates and pricing as the market adjusts. Despite these unknowns, we expect to see cap rates remain strong and therefore continued investor demand for pharmacy assets, especially as some of the dust settles from M&A activity.

You must be logged in to post a comment.