Lincoln Equities Group Plans 1.6 MSF NJ Industrial Project

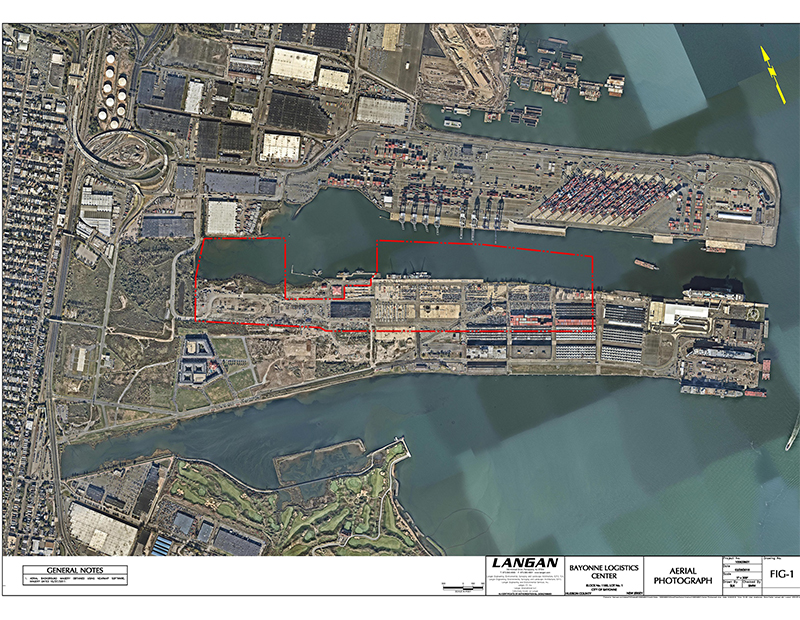

The company has agreed to acquire a 90-acre waterfront site near the Port of New York and New Jersey in Bayonne, where it plans to build a next-generation warehouse development.

By Barbra Murray

A project featuring 1.6 million square feet of industrial space near the Port of New York and New Jersey is in the works in Bayonne, N.J., courtesy of Lincoln Equities Group’s pending acquisition of a 90-acre site from Highstar Capital. LEG will erect a warehouse development on the land, which sits along the Hudson County waterfront and New York Harbor.

Located at the former Military Ocean Terminal at Bayonne, LEG’s project will give new life to a onetime military base that has been shuttered since 1999. Where a bevy of World War II-era buildings currently stand, next generation industrial warehouse space will sprout. It’s a timely undertaking. “As the e-commerce industry and same day-delivery services expand, the demand for industrial warehousing near ports and major metropolitan areas will rise,” Joel Bergstein, president of Lincoln Equities Group, said in a prepared statement.

LEG plans to transform the property into a premier industrial destination over the next three years, creating 750 temporary construction jobs in the process.

Tenants want it, investors crave it

Industrial digs near the Port are coveted all around. As PANYNJ continues to see record-breaking cargo volume, industrial property tenants are rushing to keep pace with the supply chain due to inventory growth, according to a fourth quarter 2017 report by commercial real estate services firm Transwestern.

Investors are also keen on space within close proximity of the Port. However, as Transwestern notes, the limited stock of product available for purchase has stymied sales activity. In July 2017, LEG and partner Real Capital Solutions sold a 228-acre industrial site in Piscataway, N.J., for $57 million, scrapping plans to develop the fully entitled land and choosing to capitalize on the strengthening investment sales market instead. LEG’s MOTBY property, well-located and primed for development, is quite a catch. Per the Transwestern report, “The shortage of land supply, especially near the ports, has remained an issue and is further complicated due to ongoing frustration over a permit process widely agreed to be too lengthy and laborious.”

LEG’s acquisition of the MOTBY site, currently managed by Ports America Group Inc., is scheduled to close in May 2018.

Image courtesy of Lincoln Equities Group

You must be logged in to post a comment.