Chicago’s Legal Sector Contracting Office Space

Since 2016, approximately 70 percent of the large Chicago law firms that completed lease transactions downsized, according to 2018 CBRE research. Senior Vice President David Mahoney talked with CPE about the impact of this trend on the metro’s office market.

By Laura Calugar

The Chicago Central Business District office market ended last year with 706,356 square feet of positive absorption, according to the latest CBRE report that analyzes legal sector trends. Approximately four million square feet of direct and sublease shadow space is expected to be delivered to Chicago’s CBD office market this year, with 68 percent of the space in the West Loop neighborhood. Most of that shadow space—86 percent—is Class A office space.

The Chicago Central Business District office market ended last year with 706,356 square feet of positive absorption, according to the latest CBRE report that analyzes legal sector trends. Approximately four million square feet of direct and sublease shadow space is expected to be delivered to Chicago’s CBD office market this year, with 68 percent of the space in the West Loop neighborhood. Most of that shadow space—86 percent—is Class A office space.

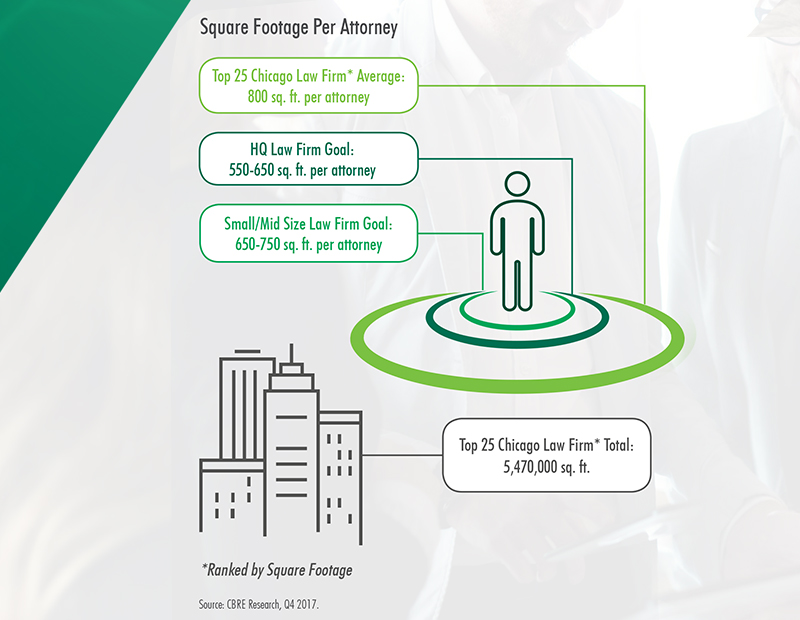

Almost three quarters of the large Chicago law firms that completed lease transactions in the past two years downsized, while medium and small firms primarily renewed their leases for the same square footage they currently occupy. In order to increase efficiency and reduce costs, law firms began to reduce their real estate footprint. For large Chicago law firms, the plan is to downsize from an average of 800 square feet per employee to 550-650 square feet. Small- and medium-sized firms are targeting footprints between 650 and 750 square feet per lawyer.

Since Chicago is home to the fourth largest number of law firm employees in the country, this downsizing trend is having an undeniable impact on the metro’s office market. David Mahoney, senior vice president with CBRE, spoke with Commercial Property Executive about the reasons law firms embrace this trend and what the next generation of attorneys is looking for in office space.

What is the main reason law firms in Chicago are reducing their office space?

Mahoney: Chicago law firms are taking a proactive approach to understanding their space requirements and the way in which their attorneys and staff currently work and will work moving forward. As firms move towards uniform office sizes, decrease support staff, create multi-use areas within their spaces and increase investment in technology, they become more efficient occupiers of office space.

How is this trend in Chicago’s legal sector impacting the metro’s office market?

Mahoney: Law firms make up 16 percent of the Chicago CBD market. As many firms reduce their footprints, we see negative absorption from the legal industry. However, there are new firms coming to the market and growth from existing firms and other industries to offset that dynamic.

Demand from law firms for new space in trophy buildings with cutting edge technology, efficient floor plates and first class amenities have also contributed to the new development surge we’re seeing.

What kind of space does the next generation of attorneys in Chicago prefer?

Mahoney: The next generation of office space users in Chicago embrace technology and collaboration, seek energetic spaces with natural light, efficient buildings with first class amenities and convenience. The legal sector follows many of the same patterns, but requires a different functionality within the space. We will see more and more firms convert to uniform office sizes with glass fronts, create multipurpose spaces such a cafes that are not only used for a few hours a day during lunch hours and invest in technology.

How much is this trend influenced by the increasing rents in the metro’s high-priced business centers and trophy office buildings?

Mahoney: Economics always play a role and reducing one’s footprint is a way to reduce costs. With that said, Chicago is still an affordable market on a rental rate basis relative to many other major markets throughout the U.S. and globally. So while economics certainly contribute to this trend, it is also driven by changing workplaces preferences, new technologies and new developments with more efficient floor plates.

Is this encouraging office owners to upgrade their properties or rethink the layout of their office space in order to attract other clients?

Mahoney: Landlords throughout Chicago constantly compete for tenants and invest capital to upgrade amenity packages, base building systems and other common areas—ultimately trying to gain an edge over their competitors by providing current and prospective tenants with a higher quality experience. Many of the buildings that have lost large tenants to the new developments have made such investments and other landlords have taken a proactive approach. Regardless, the competition certainly benefits tenants and makes assets within the Chicago market a good value for tenants when you look at the quality of our buildings relative to rents.

How long has this been going on and what is your prediction about its evolution?

Mahoney: Law firms have been increasing real estate efficiencies for upwards of a decade. Law libraries went first, then file storage space and now we are starting to more and more firms embrace uniform size offices and many of the other elements that contribute to a more modern and vibrant workplace and a more efficient footprint. We anticipate this trend continuing to evolve with technology and as some of the firms that have not yet embarked on a full real estate and workplace process doing so when the opportunity arises.

Image courtesy of Nicole Thomas Photography via CBRE

You must be logged in to post a comment.