“Non-Traditional” Lenders

Between 2016 and 2017, the dollar volume of loans reported intermediated for REITs, mortgage REITS and specialty finance companies; for credit companies; and for other “non-traditional” lenders grew by 56 percent.

by Jamie Woodwell and Reggie Booker

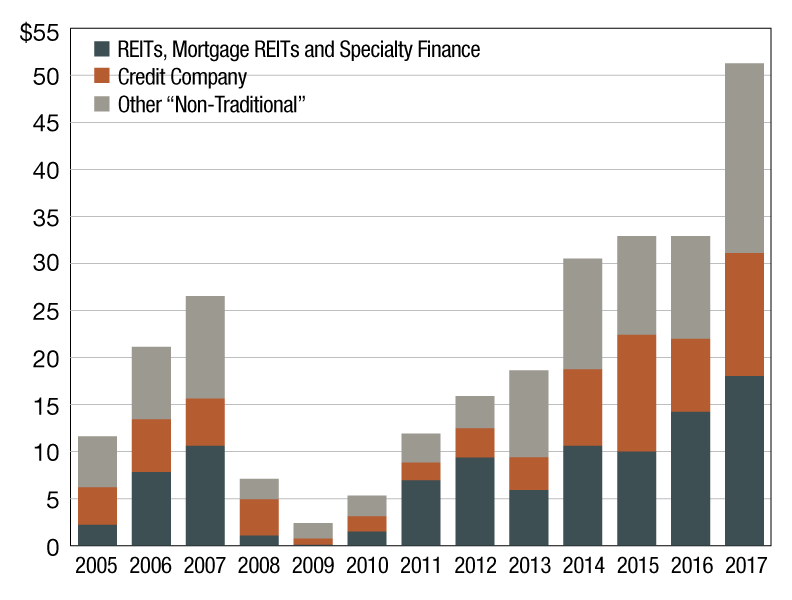

Commercial/multifamily mortgages intermediated to “non-traditional” lenders; $ in billions

The role of “non-traditional” lenders in commercial real estate finance increased significantly in 2017, but there is far more discussion about this than there is actual data. To date, MBA’s origination surveys have not fully captured the sector, and the Federal Reserve’s Z1 and other data sources also appear to be missing a full and accurate picture of their activities. One glimpse into the changing role of debt funds and other “non-traditional” commercial real estate lenders comes through the dollar volume of loans being sourced for them by intermediaries. MBA’s annual origination survey asks originators to break their volume out between loans that they close in their own name (in which they act as the lender) and loans that they originate that are closed in someone else’s name (in which they act as an intermediary). Between 2016 and 2017, the dollar volume of loans reported intermediated for REITs, mortgage REITS and specialty finance companies; for credit companies; and for other “non-traditional” lenders (i.e., not for banks, life companies, CMBS, GSEs or FHA) grew by 56 percent—from $33 billion to $51 billion. These numbers could include some double-counting and do not include any direct originations by debt funds, but they do give one of the clearest pictures to date of the increasing role of “non-traditional” lenders.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

Reggie Booker is the Mortgage Bankers Association’s associate director of commercial real estate research.

You must be logged in to post a comment.