Crossborder Capital Flows in US Real Estate Markets

Chris Nebenzahl of Yardi Matrix offers an analysis of what's driving increased competition for deals among offshore capital providers.

Chris Nebenzahl

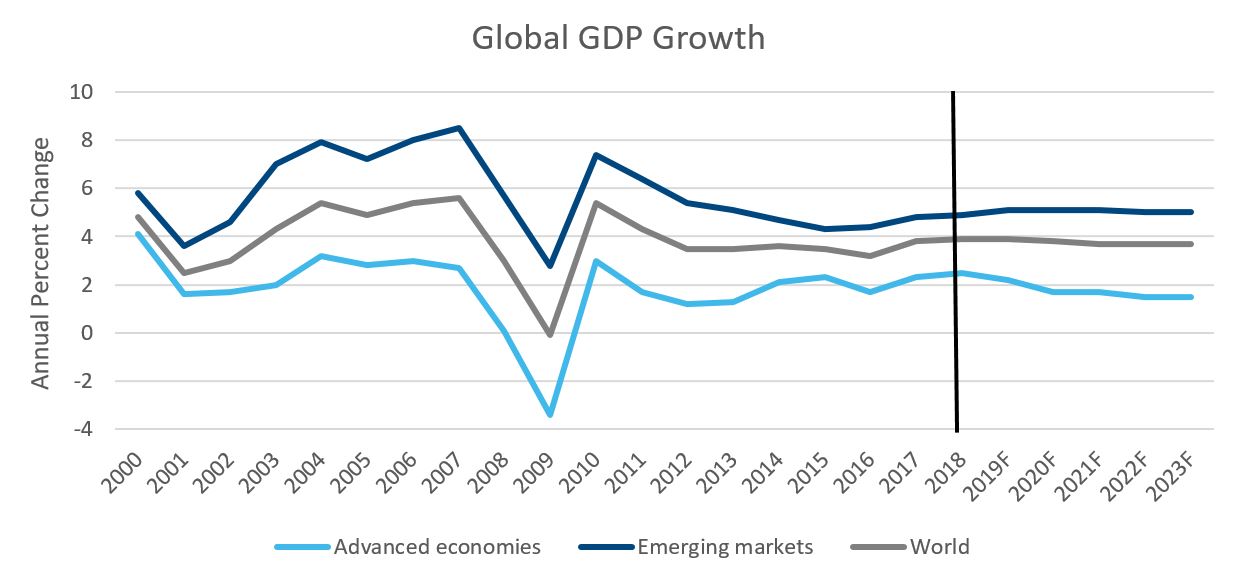

While many investors and economists scratch their heads and debate how long the recovery and expansion can last in the U.S., global economic growth has accelerated after slowing from 2010-2016, according to the International Monetary Fund. As the U.S. commercial real estate market maintains strong fundamentals and solid returns, foreign capital continues to flow from many parts of the globe including Canada, Europe and Asia.

Power players

Canadian investors have been active in U.S. markets, most notably with the Brookfield Asset Management acquisition of Forest City, a diversified REIT with more than 10 million square feet of high quality office, life science and retail property, as well as 18,500 multifamily units. The Toronto-based asset management firm continues to add to its international portfolio that includes more than $160 billion in assets under management and more than 450 million square feet of commercial real estate. On aggregate, Canadian investors have allocated close to $20 billion in U.S. real estate in the 12 months ending in June 2018, according to Real Capital Analytics.

Source: International Monetary Fund

Brookfield wasn’t the only foreign investor to lock down a recent mega-deal however, as Unibail-Rodamco, the Paris-based retail REIT, purchased Westfield. The merged company now known as Unibail-Rodamco-Westfield owns and operates more than 100 shopping centers across 13 countries. The acquisition included flagship shopping centers in the most populated markets in the U.S., including New York, Washington, D.C., Los Angeles, Chicago, Seattle and the Bay Area.

Following 2017 government regulation intended to curtail foreign investment, Chinese fund flows have slowed beginning in the second half of last year and continuing through 2018. Chinese investors including Anbang, the insurance company now under government control, and HNA Group have significantly pulled back their U.S. investments and have become net sellers this year, according to Real Capital Analytics. While the pullback from Chinese players has impacted numerous domestic markets, Chinese capital has not completely dried up, and certain investors are still active in the U.S.

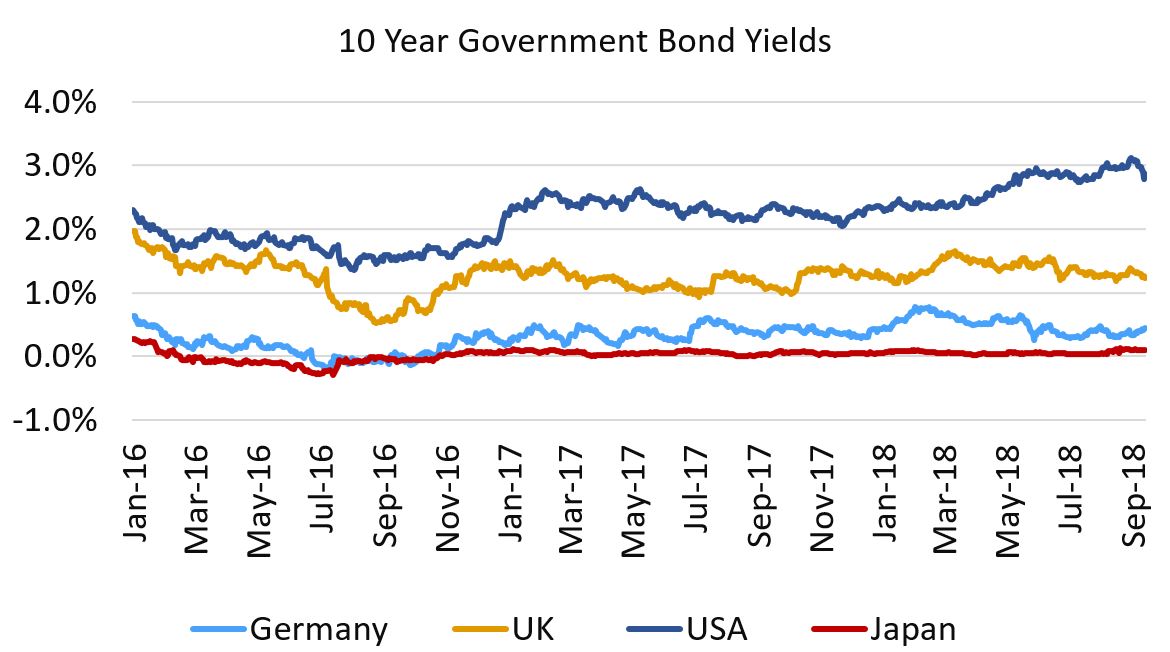

Rising interest rates continue to be a key focus for domestic investors as they work to make deals pencil. Increased domestic inflation and tightening monetary policy from the Federal Reserve have pushed both long and short term interest rates upward in the United States. Cap rates have remained relatively steady near historic lows, and the increase in Treasury rates has squeezed the spread between bond yields and property yields. However, interest rates remain incredibly low and in some cases negative in most developed countries. As the spread between U.S. Treasuries and foreign bond yields widens, foreign investors that can borrow at lower rates in their home country suddenly see greater potential returns than domestic investors borrowing in the U.S.

Source: Moody’s Analytics, Investing.com

A wider net

Foreign investors are beginning to look further afield for quality real estate development and acquisition opportunities, as secondary markets have experienced significant employment and population growth. Gateway markets continue to see the lion’s share of foreign investment, however cities including Dallas, Houston, Seattle, Raleigh, Denver and Atlanta are catching the eye of foreign investors looking for higher yields than what is available in the primary coastal markets. As demographic shifts and fiscal policy changes continue to promote growth in secondary markets, expect foreign investors to grow their portfolios in new and emerging cities.

In addition to secondary markets, international capital has gone beyond core asset types such as office and multifamily. China Life recently partnered with ElmTree funds on a $950 million deal focused on net-lease properties, citing the sector’s yield stability. Other sectors including self storage and life sciences are attracting international interest as well.

Despite growing concerns over protectionist trade policy, the global economy and commercial real estate markets remain strong. Expect crossborder capital flows to continue to grow, and don’t be surprised by increased competition for deals from international investors.

You must be logged in to post a comment.