Demand Response Programs Expand the Menu

Utilities offer commercial customers new ways to cut consumption and costs.

By Gail Kalinoski

A solar array installed at Marcus Garvey Village in Brooklyn, N.Y., part of the affordable housing community’s demand-response strategy. (Photo courtesy of Con Edison)

The commercial and industrial sectors provided more than half of the enrolled demand response (DR) capacity last year—12 gigawatts, or 65.5 percent—as DR continues to grow and increasingly become more integrated as a resource for the U.S. energy market.

A new report from Smart Electric Power Alliance (SEPA), produced in partnership with Navigant and the Peak Load Management Alliance, found that a broad range of DR programs dispatched 10.7 gigawatts of energy savings to the grid from a potential 18.3 gigawatts available.

“DR is not just an emergency resource any more, but can be used for purposes like renewable integration, customer engagement and offsetting constraints in natural gas supply,” Brett Feldman, associate director at Navigant and a contributing analyst on the 50-page report, said in a prepared statement. “New technologies, program designs and use cases will expand DR for both residential and (commercial and industrial) customers.”

SEPA analyst Brenda Chew, the study’s lead author, agreed. “One of the big discussion points is demand response is converging with other distributed energy resources,” she told Commercial Property Executive. “Commercial and industrial is a very large chunk of what is accounted for across the United States so far.”

New Models

Chew noted that new business and regulatory models, along with technology advances and customer interest, are driving changes and integrating DR with the other energy resources “making it increasingly dispatchable and providing benefits for customers and the grid.”

The study examined data from 155 utilities across the U.S., both regulated and deregulated markets and including large investor-owned utilities, small cooperatives and municipal utilities. Chew said it covered about 62 percent of the electric customers in the U.S., or about 89.9 million people.

This year’s report touches on key takeaways, including:

- DR is helping utilities and grid operators absorb excess solar generation and adjust loads through reverse demand and load shifting.

- Non-wire alternatives are also growing and a number of utilities are leveraging DR to offset peak load growth and defer investments in distribution systems.

- Small to medium businesses, along with residential customers, are now able to take advantage of time-of-use rates, often in combination with DR programs, to help utilities better manage load curves.

- Opportunities for demand response expansion include continuing participation in wholesale power markets, and the peak load standards being proposed in Arizona, Massachusetts and other states. The standards would aim to increase the share of clean energy deployed during peak load periods.

- Storage is also playing a growing role, particularly behind-the-meter batteries that are being aggregated to participate in DR events. When STEM deployed 85 megawatts of aggregated capacity at multiple commercial and industrial sites in 2016, it became the first storage provider to meet reliability and performance requirements.

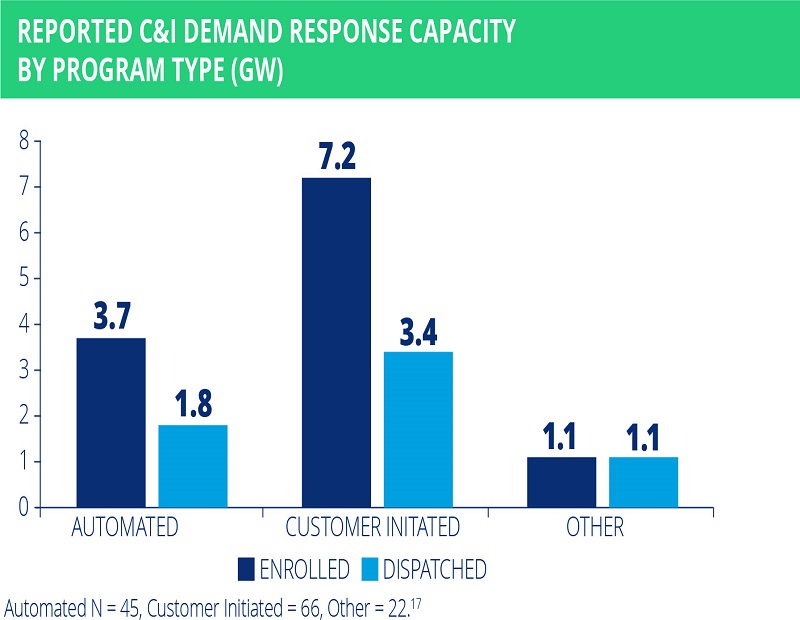

Among commercial and industrial users, customer-initiated programs lead demand-response capacity, according to the Smart Energy Power Alliance. (Chart courtesy of SEPA)

While residential demand response programs—aided by the increasing number of smart home devices and thermostats—are growing, commercial and industrial customers still have the highest DR participation, Chew said. Customer-initiated DR programs accounted for about two thirds of the commercial and industrial enrolled capacity, with one third participating in automated or other programs. Listed under “other” are ice thermal storage, electric storage, heat pumps, pool pumps, irrigation control, emergency dispatch and electric vehicle smart charging programs, which Chew and Feldman say will have more DR impact in the future.

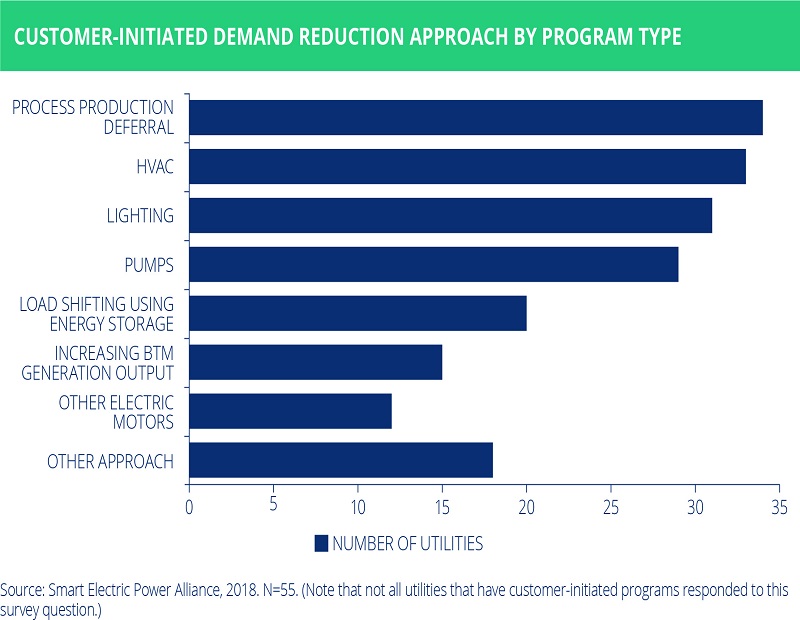

In the customer-initiated programs, process production deferral was the top DR used, followed by HVAC, lighting, pumps and load shifting using energy storage. The automated DR customers used HVAC most frequently to reduce demand, followed by pumps, lighting, energy storage and process production deferral.

Feldman said that about 90 percent of the customer-initiated DR customers comply when an event is called, but 10 percent decline to participate and take a penalty. This happens most often by industrial users for whom “the value of product outweighs the payment of the penalty,” he explained. He noted that the number of commercial and industrial customers choosing automated participation is likely to remain smaller.

“The total automated DR hasn’t taken off to a large extent because the [commercial and industrial] customers don’t want to give that control over to the utility or their provider,” Feldman said.

States of Commitment

Participation varies from state to state. In 2017, the Tennessee Valley Authority dispatched a total of 665 megawatts of commercial and industrial demand reduction across its six-state territory. A study of Hawaiian Electric’s fast demand response program noted that it allowed commercial and industrial customers to participate with as little as 10 minutes’ notice and included semi-automated and automated activation. Participants must commit at least 50 kilowatts for load reduction. Companies receive financial benefits for committing load and actual load reduced during an event.

Process production deferral tops the list of customer-initiated demand reduction strategies. (Chart courtesy of SEPA)

Benefits and incentives can be substantial. Chew described how one Midwest industrial owner said his company had received $1.4 million for participating in a demand response program.

Feldman pointed out that value stacking is common among commercial and industrial users who participate in utility and wholesale programs.

“They are thinking about how to get the additional value from using the same assets,” he said. “It’s not a lot of incremental cost to get that additional value.”

A growing number of utilities are leveraging DR programs to meet grid needs and avoid making costly infrastructure upgrades. Half of the SEPA utility participants said that they were interested in using DR as part of non-wire alternatives. Con Edison in New York City has been using its Brooklyn Queens Demand Management Program for several years as an alternative to spending an estimated $1.2 billion on a substation upgrade.

As of its most recent quarterly report, Con Ed had achieved load relief from energy efficiency and demand management at 6,700 small businesses, 1,600 multifamily residential buildings and 21,500 one-to-four family residences, a spokesperson said. The utility also achieved 40 megawatts of peak hour non-traditional utility side and customer-side solutions, and obtained commitments for 33.6 megawatts on the customer side, including 24.8 megawatts in the peak hour between 9 p.m. and 10 p.m.

In addition, Con Ed uses other energy sources to generate and manage electricity in that area including solar panels installed at a Brooklyn affordable housing complex, as well as 300 kilowatts/1,200 kilowatt-hours of battery storage and a 400-kilowatt fuel cell.

You must be logged in to post a comment.