Southern Markets Drive Deal Flow in Q3

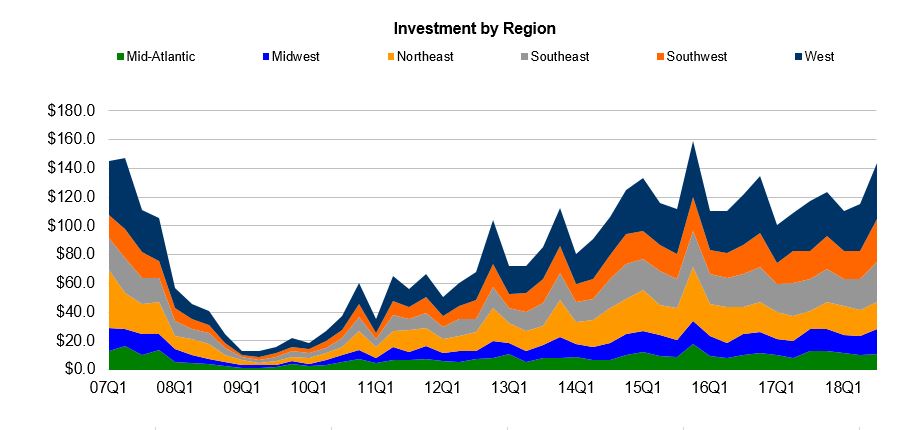

Real Capital Analytics data shows that transaction volume in the third quarter jumped almost 25 percent to $143.5 billion over the previous quarter.

Note: Data current through Nov. 19, 2018. Analysis through Sep. 30, 2018. Based on independent reports of properties and portfolios $2.5 million and greater. Data believed to be accurate but not guaranteed. (Source: Real Capital Analytics Inc.)

Investment volume in the third quarter of 2018 increased to $143.5 billion as of September 30, 2018, marking a 24.8 percent rise over the previous quarter, reported Real Capital Analytics. Since midyear, deal flow has picked up in all major regions, led by the South: The Southeast region saw a 48.1 percent increase to $29.6 million, while the Southwest experienced a 29.7 percent uptick to $27.7 million.

As compared to the same period last year, deal flow picked up in every major region except the Mid-Atlantic, which posted a 16.1 percent dip in the third quarter of 2018, dropping from $12.8 billion to $10.8 billion in transactions. The Southwest saw the greatest uptick in investment volume—a 50.1 percent year-over-year increase to $29.6 billion—followed closely by the Northeast (up 44.6 percent to $19 billion), Southeast (up 27 percent to $27.7 billion), Midwest (up 14.6 percent to $17.3 billion) and West (up 12.4 percent to $39.1 billion).

You must be logged in to post a comment.