How Climate Change Is Affecting Real Estate Values

Three major storms exacted a $200 million economic toll in 2017 alone. What are the best strategies to protect investments?

The impacts of climate change on communities alter businesses and real estate investors alike. Factors such as flooded or damaged public infrastructure—which hinders employee and customer commutes—or competition for water resources threatening business operations and urban heat reducing public health, should all be taken into consideration when pondering new investments.

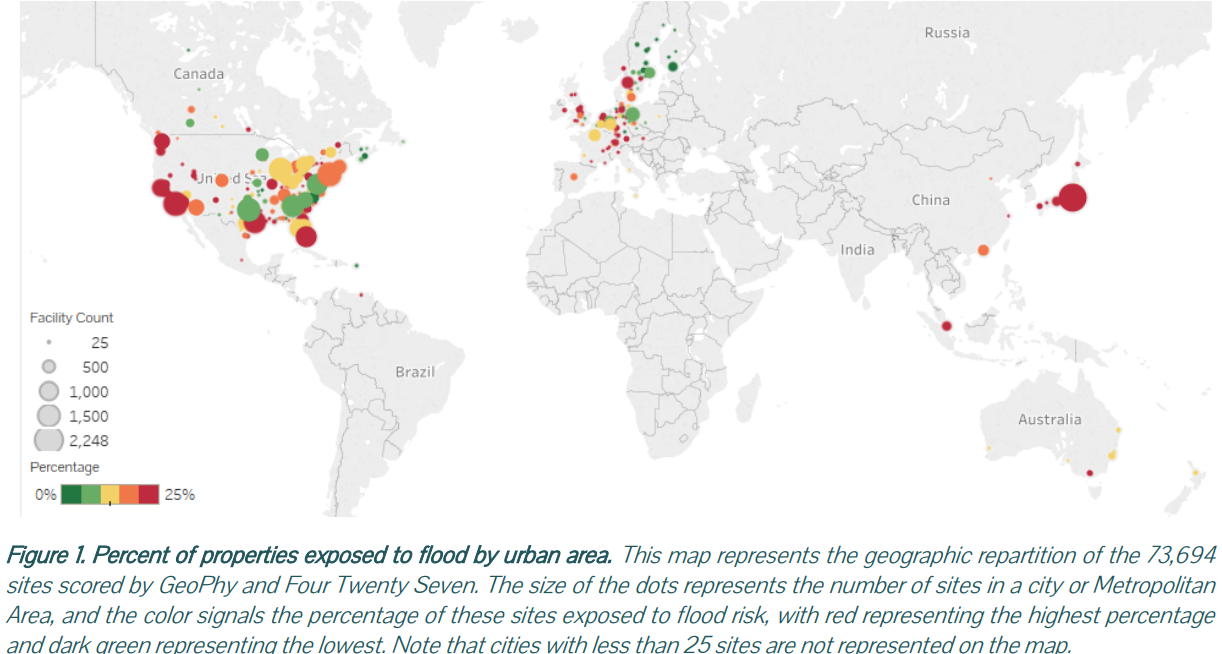

Provider of market intelligence on the economic risk of climate change Four Twenty Seven, in collaboration with GeoPhy, have released a report that includes scientific- and data-based facts on the relation between climate change and real estate. The analysis—which comprised 73,694 properties owned by 321 listed REITs as of the second quarter of 2018—revealed that 17 percent of those properties were exposed to flood risk, six percent to sea level rise and 12 percent to cyclones.

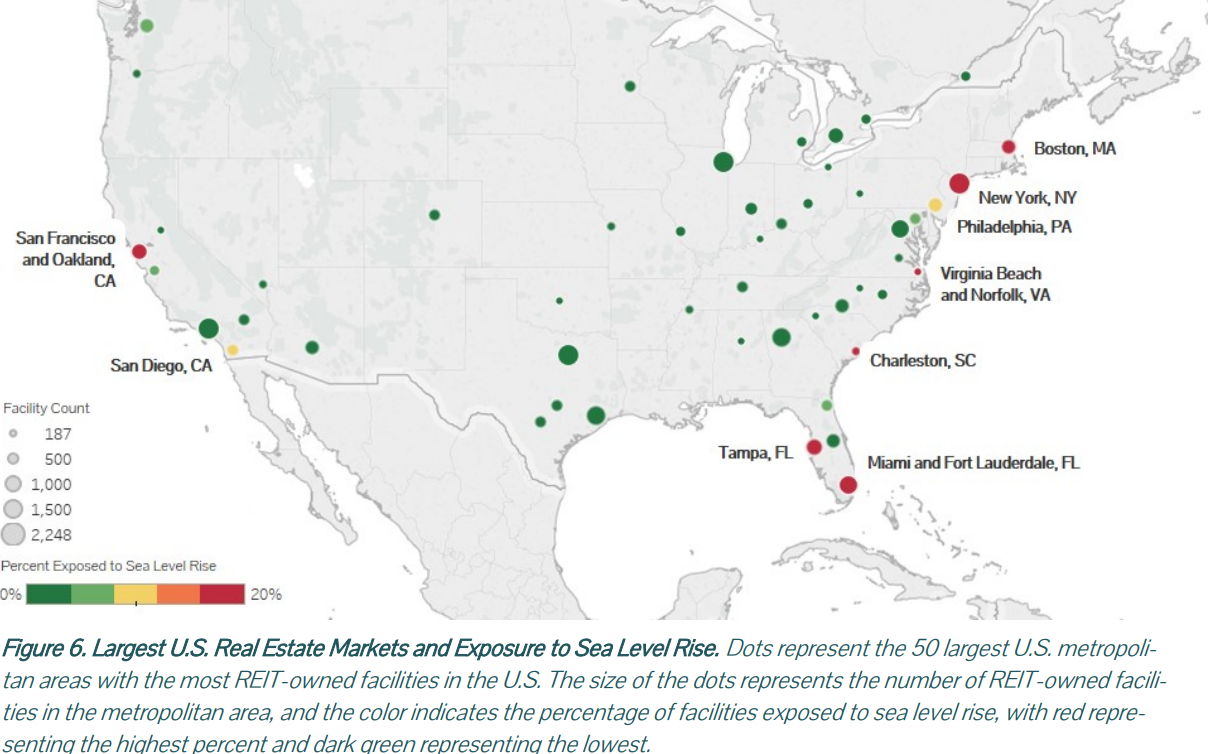

The study found that the most exposed REITs are concentrated in Asia—Japan, Hong Kong and Singapore, in particular. In the U.S., the markets most exposed to sea level rise include New York City, San Francisco, Miami, Fort Lauderdale, Fla., and Boston. Vornado Realty Trust stands out with 76 out of 78 properties exposed to sea level rise, primarily in the New York City area.

Hurricanes Harvey, Irma and Maria caused an estimated $220 billion in economic damage in 2017. Extreme weather events affect properties that depend on water supply, drainage and sewage structure, which translates into a high impact on utility costs, operating expenses, market values and the protection of public health. The University of Colorado at Boulder and Pennsylvania State University found that properties exposed to sea level rise are now selling at a seven percent discount relative to comparable, but less exposed properties across the nation.

To get a closer look at the relation between climate change and real estate, we talked to Turnkey Property Pro’s Principal Oliver Somoza about the issue. His real estate development company specializes in identifying, renovating and managing different types of properties.

To what degree has the real estate industry acknowledged the relation between climate change and property values?

Somoza: The real estate industry has begun to acknowledge climate change as a real issue as it relates to property values, I’d say just in the past five years. Investors are becoming more aware of the devastating effects of flooding and hurricanes in tropical climates and are looking for solutions and the most suitable ways to implement them. However, climate change will be a serious threat to properties in the years to come. That’s why we need to act fast. Climate change is going to kill values for investors who are caught off guard, without a plan in place.

What resources do investors, developers and property owners have in addressing climate-related physical risks?

Somoza: Property owners can purchase additional insurance to mitigate these risks, but there are also a multitude of construction-related improvement options depending on the area and the type of inclement weather associated with that region.

What measures are being considered by both owners and local governments?

Somoza: Property owners are starting to consider buying in areas that are not prone to severe weather. They’re also considering renovating their properties to combat climate change. Other measures include building houses on stilts, making buildings greener and energy efficient, building strong homes that can withstand hurricane force wind etc.

Local governments have also started building infrastructure designed to offer protection from damaging climate events. As an example, after much of downtown Manhattan was flooded during Hurricane Sandy, New York City built a barrier system. Major climate events like Hurricane Katrina in 2005, which caused catastrophic damage especially in Florida and Louisiana, and more recently, Hurricane Maria that devastated Puerto Rico, forced governments to act quickly. Still, despite these measures, the government needs to take the threat of global warming much more seriously than it does now. Property owners will certainly face increased taxes in the years to come to mitigate the cost of these improvements.

Has the risk associated with climate change impacted renters’ and buyers’ interest in properties?

Somoza: Climate change has certainly affected buyers’ and renters’ decisions. As an example, Lake Havasu City, Ariz., registered a temperature of 128 degrees last year, the highest temperature ever recorded in Arizona. Climate change is forcing temps to soar, making certain areas flat-out unlivable. In addition, I am also noticing buyers steer clear of beach houses that aren’t built significantly above water level.

How will ROI be impacted by these hazards? What about taxes?

Somoza: ROI will be hit by a wave of increased insurance and maintenance costs on damaged homes. Taxes will skyrocket. Local communities and the government will need to pay significantly more to address these problems.

Assessing adaptive capacity

In a follow-up report issued earlier this year, Four Twenty Seven released a framework to analyze a community’s adaptive capacity. It comprises three main components: awareness, economic and financial characteristics, and the quality of adaptation planning and implementation.

Adaptive capacity—also known as the ability to prepare for possible change and leverage opportunities—can help businesses determine how local risk exposure is likely to impact its assets and what the most strategic responses should be. The process is not limited to businesses. Cities are also likely to find that their resilience to climate impacts is an increasing factor in attracting businesses and financing.

Credit rating agencies, the report reminds, are also actively considering the most effective ways to incorporate such process into their ratings. S&P Global Ratings already integrates climate considerations into its standard framework for municipal ratings. Moody’s also lists economic disruption, physical damage, health and public safety and population displacement as climate-driven risks for public sector issuers.

Awareness

While this first step is not essential for having a resilient economy, it is an important indication of how likely a city or business is to implement climate change adaptation policies and strategies, allocate budgets and staff hours as well as leverage resources for resilience building. The example in the report puts Miami in the spotlight, the second-most exposed city to sea level rise in the U.S., but also highly exposed to hurricanes and heat stress. The city is part of several climate initiatives—from commitments to act on climate to Rockefeller’s 100 Resilient Cities—showing that the metro has taken risks seriously. Another important element of awareness pointed out by the analysis is the communication of climate impacts to the public. The more residents understand their climate risks, the greater the likelihood for them to provide an enabling environment for climate adaptation.

Economic, funding characteristics

This step focuses on the long-term economic consequences of climate-driven weather events. While they won’t necessarily occur in the short term, there are various ways in which extreme weather events can damage a city’s tax base, affecting its ability to repay debt and attract financing. Thus, a diversified economy that relies on several industries with different sensitivities to climate hazards is likely to be more resilient and less likely to be demolished by a single disaster. The same goes for investors: A diverse portfolio that also devotes to sustainability features could prove to be a safer strategy.

Adaptation planning, action

Understanding an area’s awareness, funding and adaptation efforts directed at the climate impacts it faces is critical in assessing a jurisdiction’s adaptive capacity. The authors of the reports exemplify using simple formulas: If a community has low awareness, but has implemented adaptation for several climate hazards, that may indicate that it is overcoming political barriers to adaptation. Likewise, if a city has high awareness, but limited access to funding, or has not yet implemented adaptation measures, that is a valuable entry point for investors and businesses striving to engage to build local resilience.

The general example used by Four Twenty Seven showcases a city in the Midwest area—Columbus, Ohio. Although the metro is not exposed to sea level rise, investors may look for an indication of robust adaptation to drought and heat stress since these are pertinent hazards for cities in that region. The metro reported three adaptation actions to CDP in 2017 and all focus on storm or surface flooding, including maintaining water infrastructure to minimize leaks and preparing a watershed management plan and an updated emergency response plan. These actions indicate that Columbus is actively building its resilience to mitigate its risk to rainfall-induced flooding and brings some degree of comfort for corporations and investors with assets in the city or looking to invest in the area.

You must be logged in to post a comment.