Why This Rate Cycle Is Right for REITs

During the global financial crisis, REITs did not achieve their objective as a defensive ballast for portfolios; however, conditions are very different today, notes CenterSquare's Scott Crowe.

Scott Crowe Image courtesy of CenterSquare

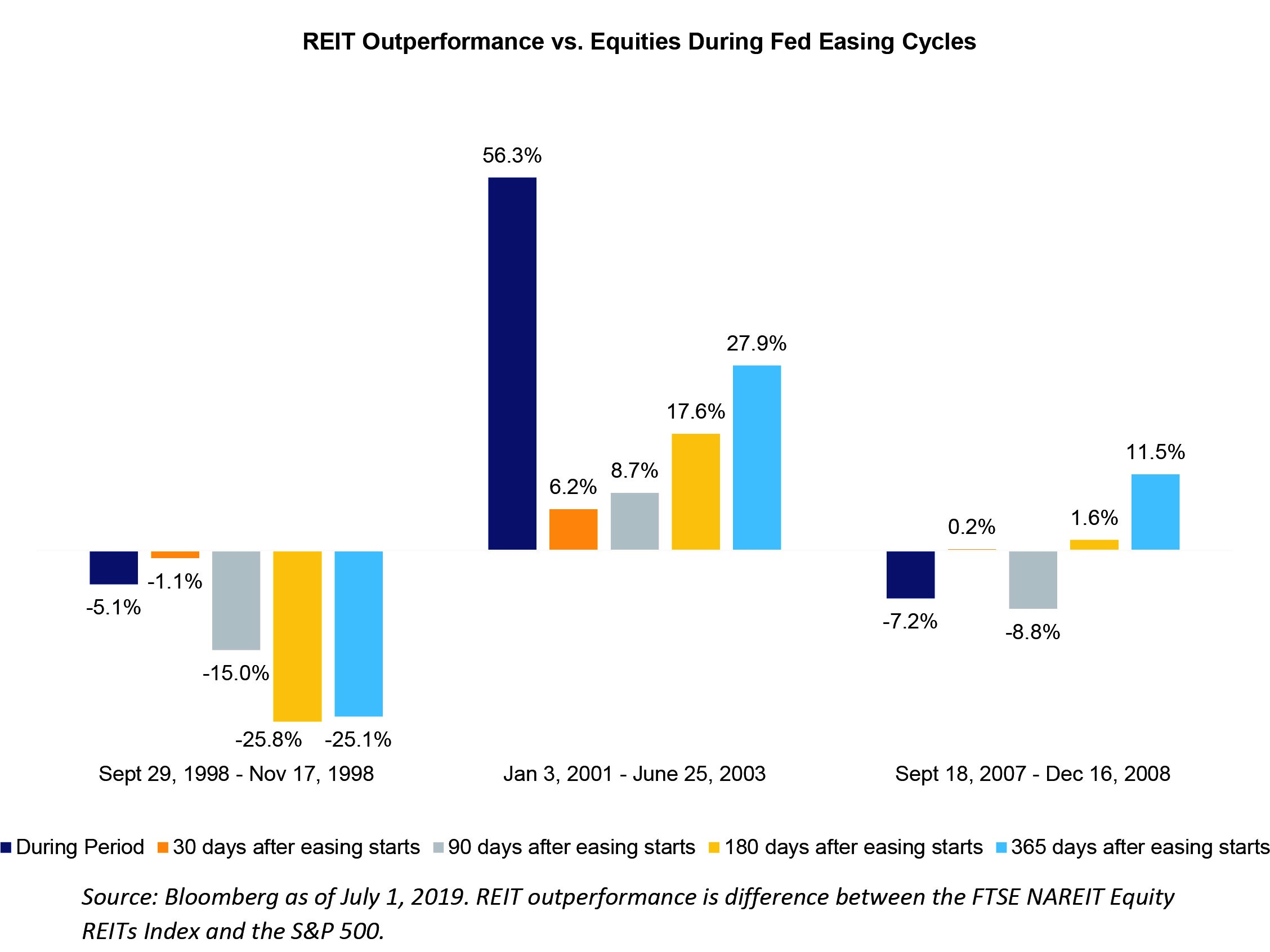

We believe that conditions are ripe for continued outperformance from the REIT sector, as a period of slowing economic growth shifts the Fed from a three-year tightening cycle to the cusp of an easing cycle. At first glance, history tells a mixed picture of REIT performance during easing cycles―with examples of both outperformance and underperformance over the last 20 years. However, a closer look suggests that today’s investment back drop has a lot of the same ingredients as past cycles that demonstrated solid REIT performance.

Figure 1:

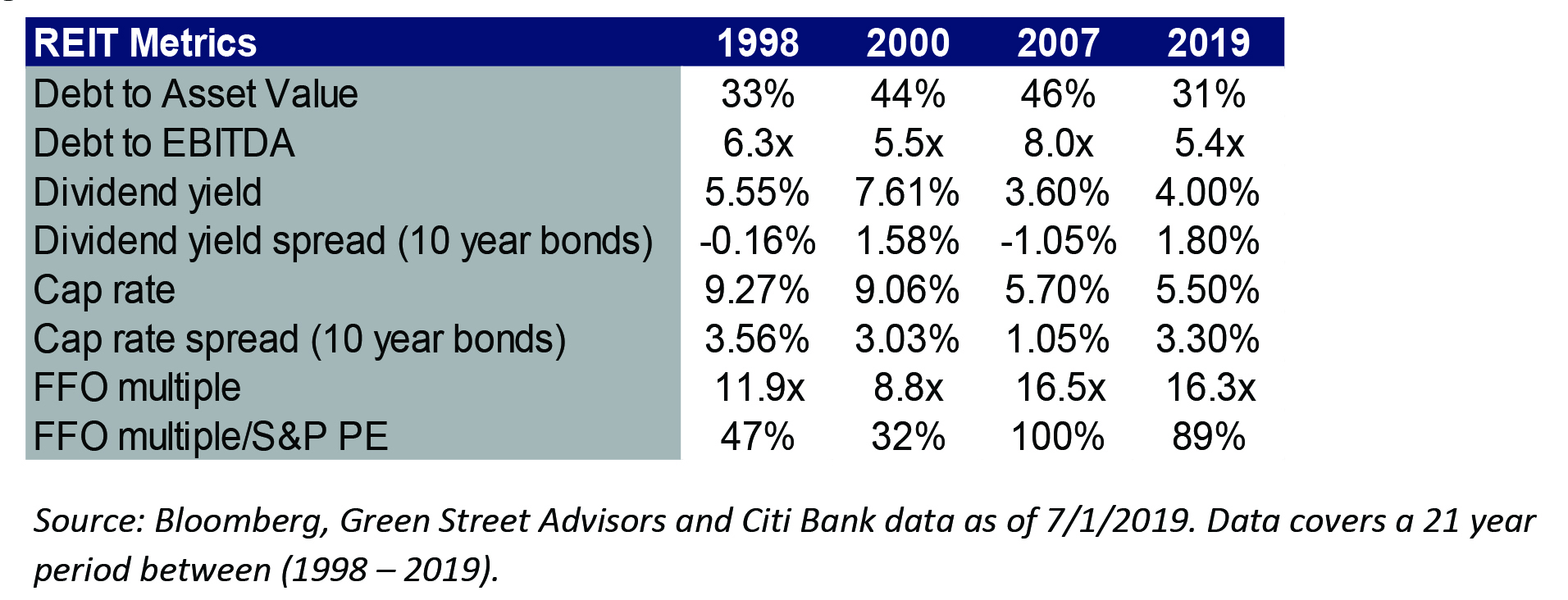

During the global financial crisis, REITs did not achieve their objective as a defensive ballast for portfolios, however conditions are very different today. Firstly, the Crisis was a housing-led slowdown, which spilled over to the commercial real estate market, and the housing market is on firmer footing today. Secondly, real estate pricing in 2007 was irrational, with cap rates nearly in line with debt costs and REIT balance sheets vulnerable to any correction in values. Today, however, the spread between the 10-year bond yields and cap rates is approximately 330 bps, which is one of the highest spreads in recent history, and REIT leverage levels are conservative (see Figure 2).

In fact, we believe the current investment context bears many similarities to business-led slowdown of 2001, with the subsequent easing cycle leading to significant REIT outperformance against an equity market that had experienced a multi-year late cycle bull run. REIT balance sheets were in a good position then and cap rates spreads to debt costs were high, much like today. While valuation discounts vs. equities were more attractive in the early 2000s, today the relative multiple between REITs and equities is also toward the cheap end of where this metric has traded this cycle.

The other easing cycle we examine in Figure 1 is that of the late 1990s, which saw the Fed start cutting rates to sustain the economic cycle. This is also not a good reference point for today’s situation and in fact, we believe a similar dynamic already happened this cycle, with the Fed pause followed by fiscal stimulus over 2016 -2018 having already driven equity prices into the last stage of the bull market this cycle.

Figure 2:

The cusp of a rate easing cycle can create an uncertain investment environment given it is usually correlated with a slowdown in growth, which in a late cycle environment can expose weaknesses in the economy. This cycle, however, we believe there is good reason to expect that the strength of the underlying fundamentals for REITs positions them for continued outperformance.

Scott Crowe is chief investment strategist for CenterSquare.

You must be logged in to post a comment.