2019 National Industrial Occupancy

Year-over-year industrial vacancy rates compared nationally and by region, updated quarterly.

Vacancy rate

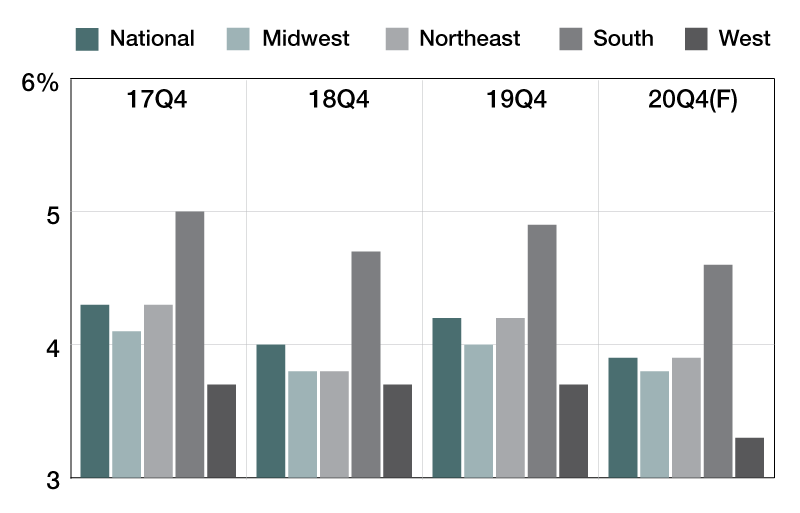

On a national level, vacancy rates for industrial markets increased by 20 basis points year-over-year in the fourth quarter, reaching 4.2 percent. Compared to 2017, vacancy rates decreased by 10 basis points. Regionwide, the most notable gains came from the Northeast, where rates were up by 40 basis points compared to the same interval in 2018. Vacancy rates increased by 20 basis points in the Midwest and in the South. The West is the only region where industrial vacancy rates remained unaltered year-over-year, at 3.7 percent.

Prior to the outbreak, industrial vacancy rates for the fourth quarter of 2020 were forecasted to decrease by 30 basis points on a national level. Vacancy rates in the West were expected to register the most notable drop, down by 40 basis points, followed by the Northeast and the South (both down by 30 basis points). Vacancy in the Midwest was forecasted to drop by 20 basis points, the smallest change regionwide.

—Posted on April 27, 2020

Vacancy rate

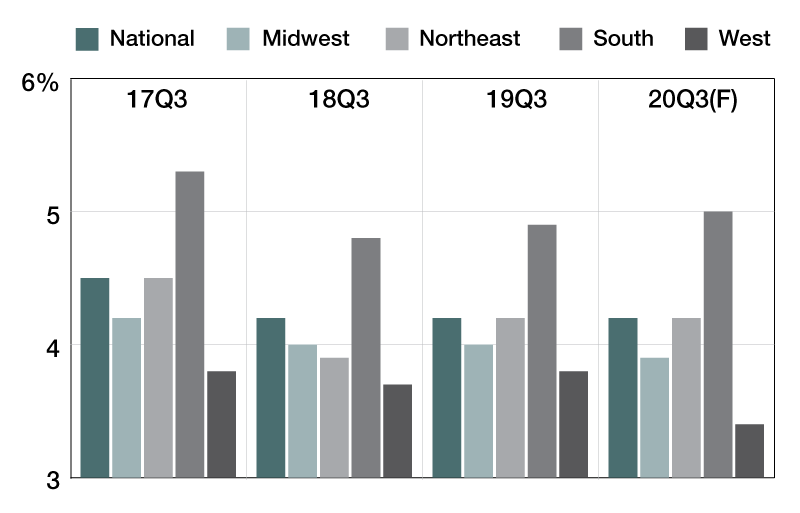

On a national level, vacancy rates for industrial markets in the third quarter remained unchanged year-over-year, at 4.2 percent. Compared to 2017, vacancy rates contracted by 30 basis points. Regionwide, the Northeast recorded the most notable gains, up by 30 basis points compared to the same interval last year. Vacancy rates increased slightly in the South and West—up 10 basis points in each region. Vacancy rates remained at the same level in the Midwest, at 4.2 percent. Industrial vacancy rates for the third quarter of 2020 are forecasted to remain unchanged on a national level and decrease in some regions. Vacancy rates in the West are expected to register the most notable drop (40-basis-point decrease), while the Midwest is expected to register a decrease of 10 basis points. Vacancy in the South is projected to inch up slightly (up 10 basis points).

—Posted on Jan. 24, 2020

Vacancy rate

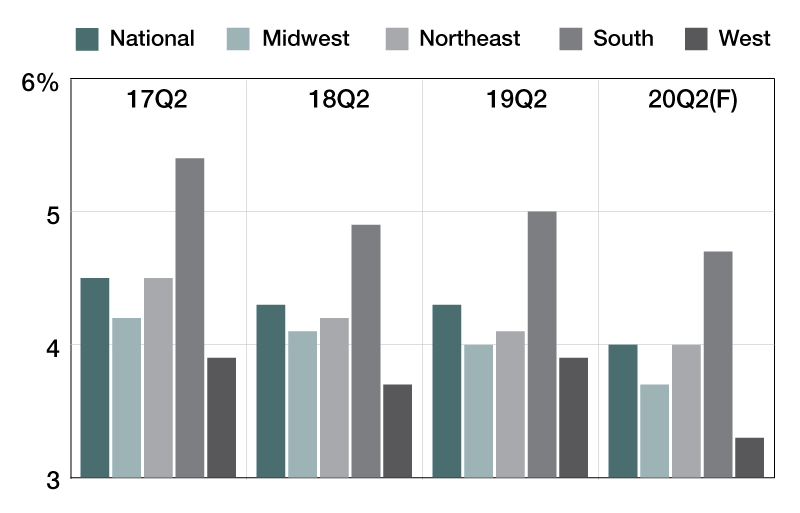

On a national level, vacancy rates for industrial markets in the second quarter held steady year-over-year, at 4.3 percent. Compared to 2017, vacancy dropped by 20 basis points. Regionwide, the West posted the most significant growth, up by 20 basis points compared to the same interval last year. The South also saw a slight surge in vacancy, up 10 basis points, while the Northeast and the Midwest recorded a 10-basis-point drop in vacancy. Vacancy rates for the second quarter of 2020 are forecasted to drop in every region in the industrial sector, decreasing by 30 basis points on a national level. Rates in the West are expected to register the most notable drop, down by 60 basis points, followed by the Midwest and the South (both down by 30 basis points). In the Northeast, vacancy rates are expected to post the smallest change, down by 10 basis points.

—Posted on Oct. 25, 2019

Vacancy rate

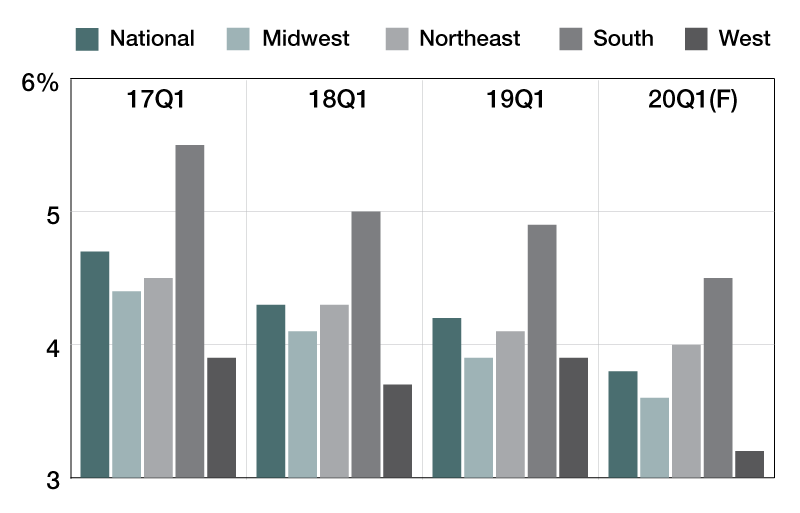

Vacancy rates for industrial markets decreased in almost every region in the first quarter of 2019. Vacancy was down 20 basis points in the Midwest and also by 20 basis points in the Northeast, followed by a 10-basis point drop in the South. The only positive change came from the West (up 20 basis points). On a national level, vacancy rates decreased by 10 basis points compared to the first quarter of 2018 and recorded a notable drop of 50 basis points compared to the same interval in 2017. Vacancy rates are expected to decrease in almost every region in the first quarter of 2020, dropping 40 basis points on a national level. Vacancy in the West is projected to decrease the most (70-basis-point decline), followed by the South (down 40 basis points) and the Midwest (down 30 basis points). Vacancy rates in the Northeast are expected to fall only by 10 basis points.

—Posted on July 23, 2019

You must be logged in to post a comment.