Self Storage Rents Continue Descent

Street-rate rates have dropped 1.7 percent across the U.S. Select metros in the west, however, continued to experience some improvement.

Heavy incoming supply continued to burden self storage rent growth in the month of August. On a year-over-year basis, street-rate rents fell 1.7 percent for the average 10×10 non-climate-controlled and 2.9 percent for climate-controlled units of similar size. Overall, rent rates declined in approximately 75 percent of the top metros tracked by Yardi Matrix.

The flood of newly completed projects impacted Charleston the most, where rent rates fell by 11.3 percent over the past 12 months. Substantial new supply also put pressure on Portland (down 5 percent) and Atlanta (down 3 percent). Western markets, such as Las Vegas (4 percent) and the Inland Empire (2 percent) showed the strongest growth year-over-year. In San Jose rent rates were still down 6 percent, yet it represents a recovery of nearly 100 basis points month-over-month. Other Californian markets experienced little to no improvement.

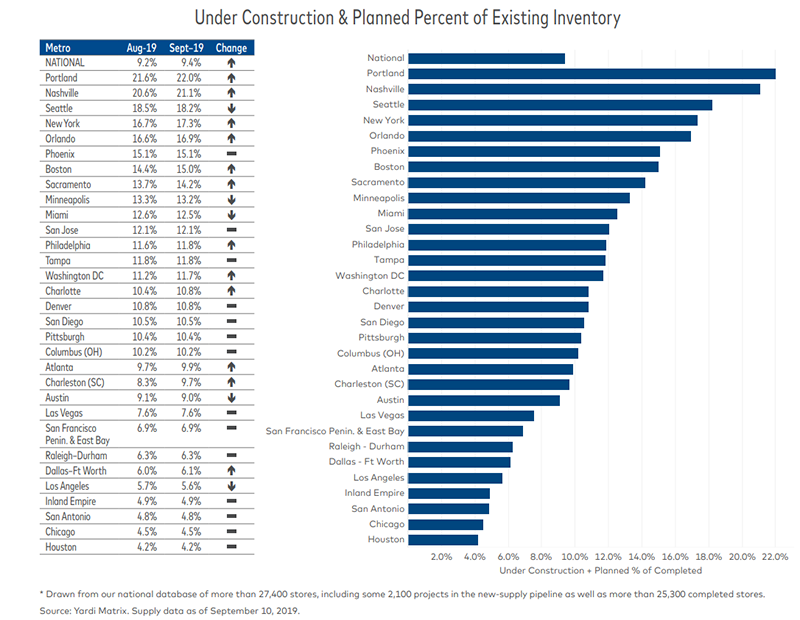

Across the country, projects planned or in the construction stages account for 9.4 percent of total inventory, representing a 20-basis-point increase over the previous month. Metros with notable development activity include Nashville (21.1 percent), where demand for new storage space is driven by substantial population growth. Although the new development pipeline has become slightly smaller in Miami (down 10 basis points to 12.5 percent), low taxes and the favorable climate continue to draw retirees and high-net-worth individuals to the city.

Read the full Yardi Matrix report

You must be logged in to post a comment.