Where Climate Risk is the Highest for Real Estate

A wide-ranging report from MSCI dives into the threat to commercial real estate investment posed by climate change.

In commercial real estate, as in society at large, climate change is the subject of much attention and research, especially in the wake of several natural disasters that have caused billions of dollars in property damage. For property owners worldwide, climate-related issues carry unprecedented urgency. In its latest study, global equity index MSCI assessed climate risk in private real estate portfolios worldwide, asking the question: What’s the exposure?

READ ALSO: How Climate Change is Affecting Real Estate Values

Since the early 1980s, extreme weather events and natural disasters have become both more frequent and intense. In 2017 alone, natural disasters in the U.S. cost more than $300 billion in damages, primarily to residential and commercial real estate, according to the National Oceanic and Atmospheric Administration (NOAA).

For investors, the impact of climate-related events can range from increased operational expenses—like damage to a property and repair costs—to higher insurance premiums, decreased asset values and in some cases, total loss of a property.

A closer look

To analyze the impact of climate change, MSCI’s Gilliam Mollod and Will Robson teamed up for a deep dive into the risk posed by climate change to private real estate portfolios in major cities worldwide. Mollod is a senior associate on the ESG Models and Research team at MSCI, while Robson is the firm’s executive director and head of real estate solutions research. The result of their analysis is a white paper entitled, “Climate Risk in Private Real Estate Portfolios: What’s the Exposure?”

“Because private real estate is such a large asset class and potential exposure to climate change risk is so large, we’ve seen that demand,” said Robson. “I think clients were looking to leverage that expertise into the private real estate arena, given the insight they’ve seen in other asset classes. The private classes started to stand out as a sort of gap in the ESG analytics across the whole portfolio.”

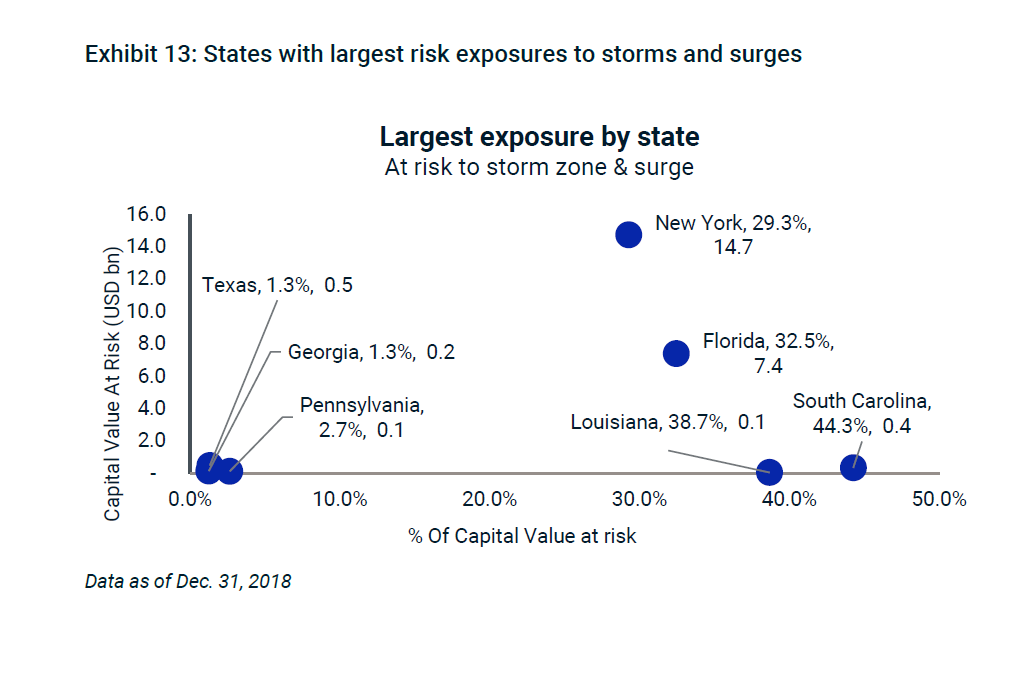

Regarding hurricanes, for example, the authors found that nearly 60 percent of the total 1,558 real estate assets—which have been valued at $93 billion—in the U.S. that were at any risk were in storm intensity zone 1. The properties facing potentially severe damage (defined as Category 3 areas or higher) accounted for one-fifth of the U.S. assets at risk to hurricanes, valued at $16.6 billion.

A tale of two cities

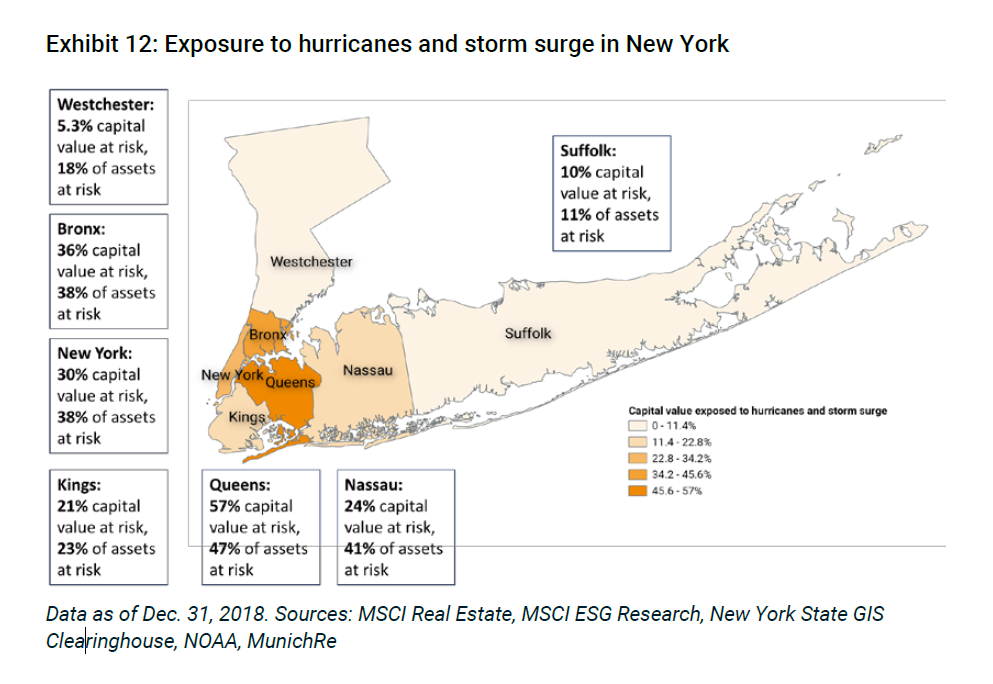

Among the most vulnerable, unsurprisingly, was New York City, which is surrounded by multiple waterways. The state of New York has the largest absolute capital value exposure of any state, most of it in New York City and especially Queens.

“New York (City) isn’t one of those areas that is super-prone to large hurricanes, but there’s a lot of storm surge risk and understanding that assets are exposed is an important thing for real estate investors … to remain aware of,” said Mollod.

In Queens County, 47 percent of assets are deemed at risk, followed by Nassau County with (41 percent) and Manhattan and the Bronx (38 percent each).

Like many other major global metropolises, New York City is situated along major rivers and oceans. But there’s a major contrast to a city like London. Unlike New York City, London has a barrier on the Thames River that provides a significant amount of protection from flooding.

“One of the biggest surprises was seeing how many of the properties in London were protected by the Thames Barrier,” said Mollod. “It made us realize how important climate measures affect properties, the importance of investors in being aware of hazards, and what kinds of resiliency measures are already in place.”

Depending on the level of risk, owners may want to consider selling a property or transferring the risk to an insurer. Investors looking at buying assets in coastal cities prone to flooding or other natural disasters may want to avoid such high-risk areas altogether. On the other hand, investors could consider only investing in buildings that meet higher standards of ESG resilience or work with local policymakers on resiliency strategies.

You must be logged in to post a comment.