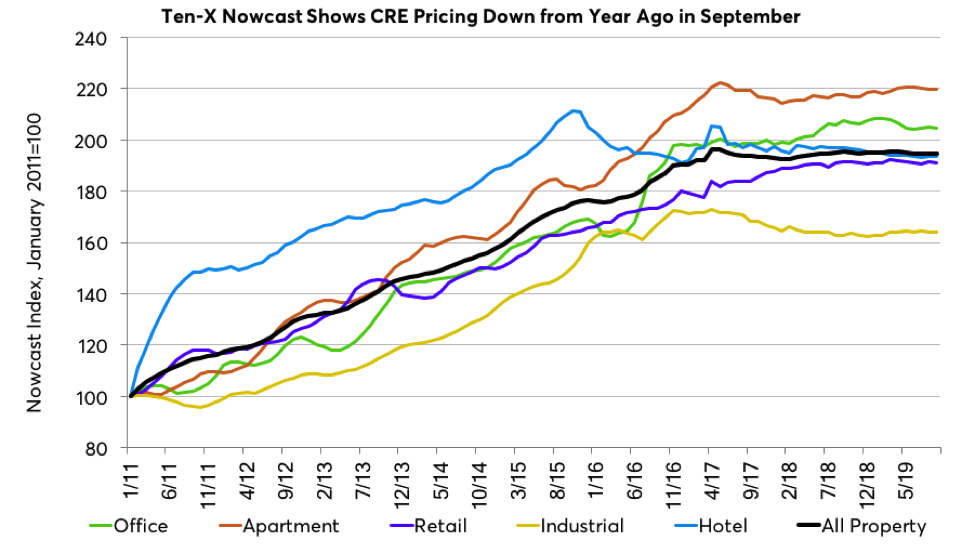

CRE Prices Flatline in September

CRE prices have flatlined across the board, with all five major property segments remaining listless in September.

US commercial real estate prices were down from their year-ago level in September, according to the Ten-X Commercial Real Estate Nowcast, the second consecutive month showing an annual decline in aggregate pricing. The Ten-X All Property Nowcast was down 0.4 percent from September 2018 on a 0.1 percent month-over-month decline. CRE prices have flat lined across the board, with all five major property segments remaining listless in September. The apartment segment eked out a 0.1 percent monthly increase in September, with the other four segments either flat or down from the previous month.

Apartment property pricing remains the relative strongest of the five major property segments. September’s 0.1 percent increase in the Ten-X Apartment Nowcast was the first monthly gain since June and left the pricing index up 1.1 percent from a year ago. The only other property segment still showing a year-on-year gain is the industrial segment. Apartment pricing is strong in the Southeast, which showed a 5.3 percent year-over-year increase helped by a 1.1 percent gain in September. The Midwest and the Southwest matched the national 1.1 percent annual increase, though the Southwest posted a monthly decline. Multifamily pricing is down year-over-year in the Northeast and West.

While the Ten-X Industrial Nowcast is up 0.6 percent in September, the broader picture indicated basically flat pricing. The industrial nowcast was flat in September from August.

The other three property segments—office, retail and hotel—are all down year-over-year, according to the Ten-X Nowcasts. Hotel property prices are showing the steepest decline of the three, down 1.8 percent year-over-year in September, matching the previous month’s annual decline. Hotel prices have been down on an annual basis for most of the time since early 2018. Hotel property pricing is down across all the regions, though the Southeast and the Southwest posted modest monthly gain in September.

Ten-X Office Nowcast pricing declined 0.2 percent in September and 1.4 percent from a year ago, worst among the five major property segments. Office pricing trends were weak in all regions except the Southwest in September.

The Ten-X Retail Nowcast declined for the fifth time in the last six months, and its 0.2 percent September decline matched the similarly struggling office segment. Retail property pricing is down a matching 0.2 percent year-over-year, though there remains much regional disparity in retail pricing; while the Southeast, with its strong demographic support is up a solid 7.3 percent year-over-year, the Northeast is down 4 percent.

Peter Muoio is the chief economist at Ten-X.

You must be logged in to post a comment.