Real Estate ETFs to be Tested by Market Turbulence

Passive investment vehicles have gained significant market share, but volatile times lie ahead. What will it take to navigate risks successfully?

Exchange-traded funds have been shaping the asset management industry for nearly three decades and the appeal of this passive investment, or index-based, vehicle has only grown stronger during the past decade. In the next few years, financial advisers will likely allocate more capital to ETFs than to actively managed mutual funds, a 2020 outlook report from Broadridge predicts. What led to this increase?

Chris Burbach is the co-founder of Fundamental Income, sponsor of the NETLease Corporate Real Estate ETF. The company launched the net lease ETF in March 2019 to offer investors direct access to the net lease real estate sector, which tracks REITs that invest in properties leased to single tenants. Image courtesy of Fundamental Income

“The rising popularity of ETFs has largely been driven by lower costs and the tax efficiency of these vehicles relative to mutual funds and other non-traded products,” said Chris Burbach, co-founder of Fundamental Income, sponsor of the NETLease Corporate Real Estate ETF. “Mutual funds, particularly those focused on real estate, have struggled to justify the higher fees they are charging.”

Transparency and easy access to various markets, including real estate, have also helped fuel the increase. Investors can use ETFs as a way to rapidly shift their portfolios in a volatile environment—a useful tactic in such a prolonged economic cycle filled with unpredictable challenges, like the coronavirus pandemic. The liquidity of sector REITs, depending on the ETF, makes the shift possible, but it also poses the risk of a whipsaw effect due to the unpredictable nature of such a volatile market, according to Lowell Bolken, vice president & portfolio manager within Securian Asset Management’s real asset income team.

Buying the Basket

Lowell Bolken is a vice president & portfolio manager within Securian Asset Management’s real asset income team. He believes the growing interest in ETFs comes down to low fees in a relatively steady, upward trending REIT market. Image courtesy of Securian Asset Management

Put simply, investing in an ETF is similar to investing in stock. “You are buying a basket of stocks that are bought in proportion to the index that the ETF tracks rather than an interest in a single company,” Burback added. “Investors can buy and sell shares of an ETF that trade on an exchange in the same way that they buy shares of a public company.”

Real estate ETFs represent a relatively low share of assets under management—less than three percent. “The low AUM in real estate ETFs may be a function of rates in recent years as REITs tend to follow interest rates,” said Matthew Schiffman, principal of distribution insights at Broadridge. “A low rate environment is a negative.”

Investors in a real estate ETF buy a diversified grouping of public companies, each of which own multiple properties, trade at various yields and offer different potential for growth, Burbach noted. As with active real estate investment, ETF investors should consider both the yield and the growth prospects of the underlying company or companies. “Given that most real estate ETFs are broad-based and market cap-weighted, investors would be wise to be more targeted in how they invest,” he said.

Another similarity to active investment is that skills and market knowledge are needed to make the right decisions at the right time and avoid what can be just another “field bet,” Bolken advises. “For every dollar that an investor places in a passive investment, they are literally buying a portion of an underperforming mall company or a struggling shopping center owner,” he said. “They’re also investing in a health-care owner whose operating earnings don’t cover the company’s dividend. They’re also unwittingly paying a substantial premium for many companies whose underlying properties do not warrant the current share price.”

READ ALSO: After Historic Low, What’s Next for Net Lease Cap Rates?

Net lease REITs benefit from a growing cash flow stream due to solid leases, diverse tenant bases and rent increases. These REITs manage to pay an above-average dividend yield and retain approximately 20 percent of their income to reinvest in new assets, explained Burbach, who specializes in net lease ETF investing. “Investors often make the mistake of viewing these companies as a bond alternative due to the long-term contracts and above-average dividend yield and miss the attractive cash growth these companies generate,” he said.

The 2020 Outlook

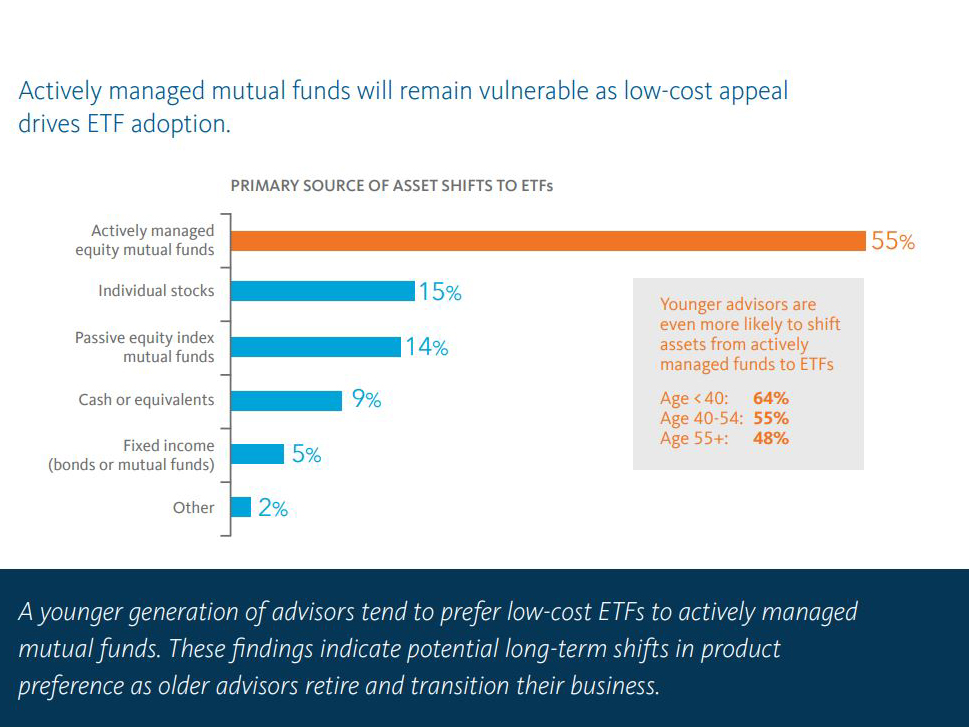

Amid global uncertainty and an economic slowdown, experts predict solid growth of ETF investment volume, mainly as a result of lower costs, transparency, diversification and flexibility for intraday trading. Currently, actively managed funds represent the largest part of AUM with 29 percent, followed by ETFs with 27 percent, according to Broadridge research. The report also predicts that AUM allocations to ETFs will increase by 73 percent in the next two years.

“Growing investor awareness of the benefits of ETFs combined with financial advisers ramping up their ETF asset allocations point to a continued shift away from higher-cost investments to lower-fee ETFs, and it’s likely to become more pronounced over time,” Schiffman said.

Matthew Schiffman, principal of distribution insights at Broadridge, says that ETF demand will be influenced by how well active managers do in this volatile environment. Image courtesy of Broadridge

The next down-cycle, the future generation of investors and active management discipline are the three factors that will define ETF investing in 2020, according to Bolken. Securian’s vice president believes that “ETF investors acting rationally in a global period of stress becomes more critical as their respective asset sizes in the system has ballooned.” He hopes that the new generation of investors will resist the temptation to over-leverage, given the unlimited menu of ETFs. “Active managers’ relative performance in 2020 and beyond will be key in establishing their position within a well-diversified portfolio,” he added.

In the end, the recipe for long-term success in real estate investing is strongly linked to liquidity and diversification, which encourages expanding portfolios through ETFs. The anticipated continued pressure on margins is another aspect that is likely to support this passive investment tool.

“Buying a property often leaves the investor with overconcentration risk in the tenant and surrounding area. Buying real estate through ownership of public REITs gives investors the same type of exposure diversified across thousands of properties and the ability to sell your investment with the click of a button,” Burbach explained.

Read the April 2020 issue of CPE.

You must be logged in to post a comment.