Performance Spread in Australian Retail Property Widened

Australian retail property registered an all-time low total return of -2.7 percent for the quarter ending March 31, 2020.

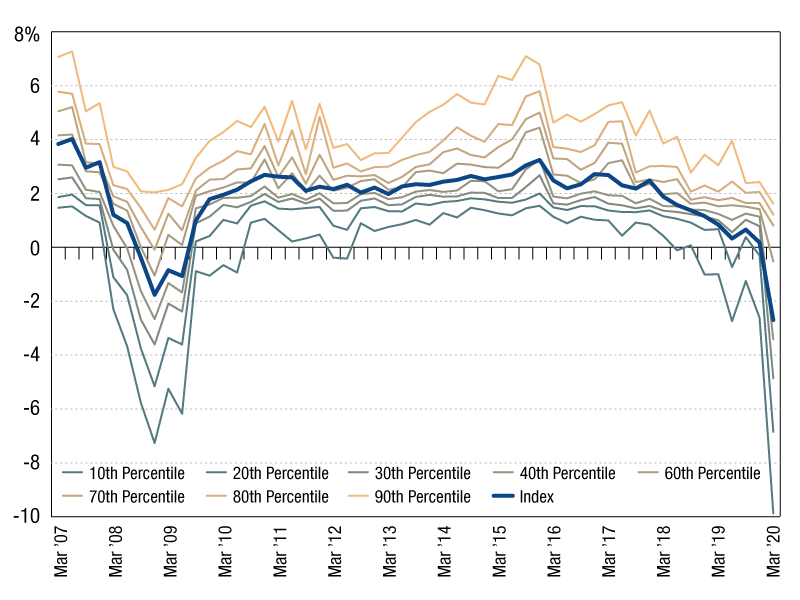

Retail; quarterly total return

This analysis, using data from The Property Council of Australia/MSCI Australia Annual Property Index shows how quality has been a key differentiating factor in retail performance. This is especially true in times of slowing returns when performance spreads have tended to widen.

Australian retail property registered an all-time low total return of -2.7 percent for the quarter ending March 31, 2020. The previous low water mark for the Australian retail sector was in the fourth quarter of 2008 when a total return of -1.8 percent was recorded.

While the overall return slowed, the spread of returns also widened during the period. In the first quarter of 2020, the spread between the 10th and 90th percentiles of total return was 11.5 percent. This spread more than doubled from the previous quarter when the spread was 5.0 percent.

MSCI Research found that quality proved a differentiating factor in the sector’s performance as the value of prime retail assets was more resilient. Poorer quality assets recorded relatively lower capital growth, especially in the tails of the distribution. In the first quarter of 2020, the 10th percentile of capital growth for secondary retail was -14.5 percent compared to -8.8 percent for prime retail.

Insights and data provided by MSCI Real Estate, a leading provider of real estate investment tools. A Vice President in MSCI’s global real estate research team, Reid focuses on performance measurement, portfolio management and risk related research for asset owners and investment managers. Based in Sydney, he covers APAC as well as global markets.

You must be logged in to post a comment.