CRE Transaction Activity Returning, CBRE Reports

CBRE's new Deal Flow Indicator suggests a recovery from the low point of the pandemic as the number of signed confidentiality agreements increases.

Even with the pandemic still underway, CBRE’s latest Deal Flow Indicator signifies that commercial real estate investor sentiment and transaction activity have both begun to recover.

The report, which relies on data from the firm’s digital listings platform for property sales, assesses the number of confidentiality agreements signed since the nadir of the COVID-19 crisis.

READ ALSO: Scouting Post-Pandemic Potential

Investors are not staying on the sidelines. “There is a huge amount of capital to deploy, interest rates are ultralow, and people are learning to live with the pandemic,” Richard Barkham, global chief economist & head of Americas Research with CBRE, told Commercial Property Executive. “There is good news on the vaccine as well, which is boosting confidence.”

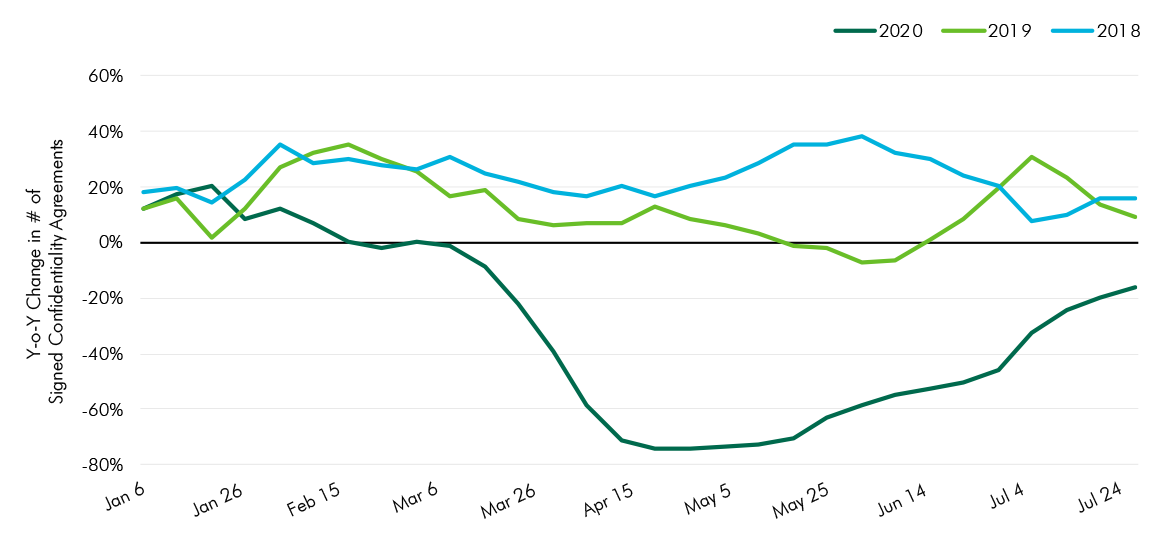

Toward the end of July, the number of signed confidentiality agreements had declined 17 percent year-over-year, marking a dramatic upturn from the 74 percent year-over-year decline recorded in April and May. “Having been an economist for 30 years, I am rarely surprised by data, but this bounce in signed confidentiality agreements from April to July caused me to look twice,” Barkham said. “That is a big positive bounce.”

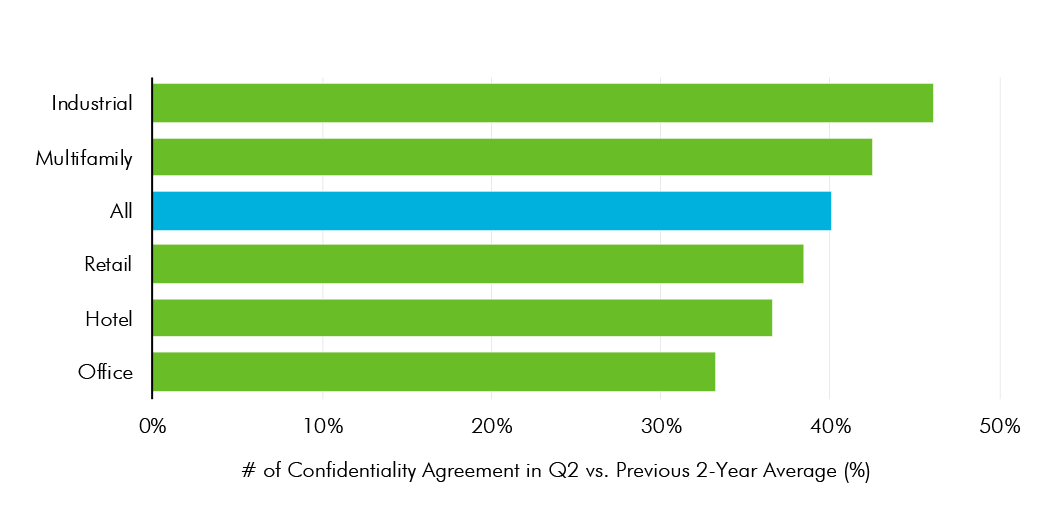

The industrial and multifamily sectors were at the forefront of the rebound in the second quarter. In the industrial sector, buoyed by the pandemic-induced increase in e-commerce growth, property offerings reached 46 percent of the previous two-year average, while the multifamily sector reached 42 percent. Signed confidentiality agreements for retail and hotel assets were in the upper-30s and mid-30s percent range, respectively, of the past two years’ average second-quarter level.

At the lower end of the spectrum, the office sector’s signed confidentiality agreements reached the low-30s percent range, hampered by a weakened rental outlook due to coronavirus-related health concerns and the proliferation of remote-working arrangements. However, operational office assets—including life sciences facilities, data centers and single-tenant buildings—increased in popularity given that the properties provide income stability and have a relatively higher resistance to downturn risks. As a result, operational office transactions kept the overall office sector afloat and yielded a rise in the average sale price per square foot.

CRE’s pandemic-era future

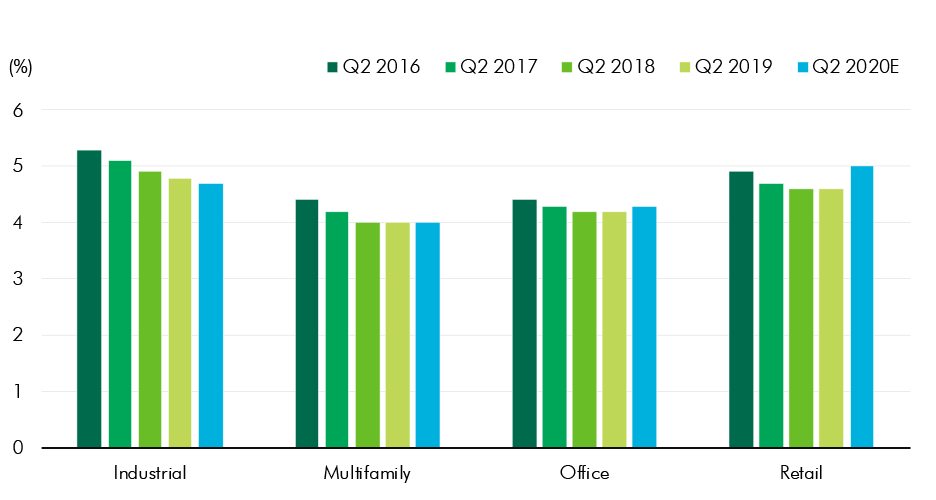

CBRE forecasts that while investor confidence is on the rise, overall property values will likely go on the downswing. Asset values will drop 10 percent to 20 percent by the end of 2020, which will result in an increase in cap rates. Down the road, the ultimate recovery of commercial real estate transaction activity will be spearheaded by capital-heavy, value-add investors and risk-averse investors pursuing options aside from low-yielding bonds. CBRE expects that within three years, cap rates will have returned to levels seen before the pandemic took hold. “Bringing the CBRE Deal Flow platform together with our data science capabilities is allowing us to see changes in the real estate market in real time. That is a major step forward in an industry which has traditionally used only quarterly data,” Barkham concluded.

You must be logged in to post a comment.