CMBS Delinquency Rate Declines Again, Trepp Finds

The Trepp CMBS delinquency rate for August dropped to 9.08 percent from 9.6 percent in July.

Image by Oleg Gamulinskiy via Pixabay

The overall U.S. commercial mortgage-backed securities delinquency rate continued to drop in August, reaching 9.02 percent—a decline of 58 basis points from July, according to Trepp LLC’s newly released monthly report.

Trepp found the July delinquency rate was 9.6, dropping from 10.32 percent in June, which had just missed the all-time record of 10.34 percent reached in July 2012. To date, the June rate was the highest of this crisis, jumping from 7.15 percent in May. In December 2019, the Trepp overall CMBS delinquency rate was 2.3 percent.

READ ALSO: CMBS Resilience Faces a Big Test

According to the report prepared by Manus Clancy, senior managing director of applied data & research with Trepp LLC, about $6.5 billion in loans were “cured” in August, also assisting in the decline. Clancy explained that to cure a loan means it was delinquent the previous month but reverted to current, or beyond grace period status. Forbearances led to some cures, as well as borrowers being allowed to use reserves to make the loan current, among other reasons.

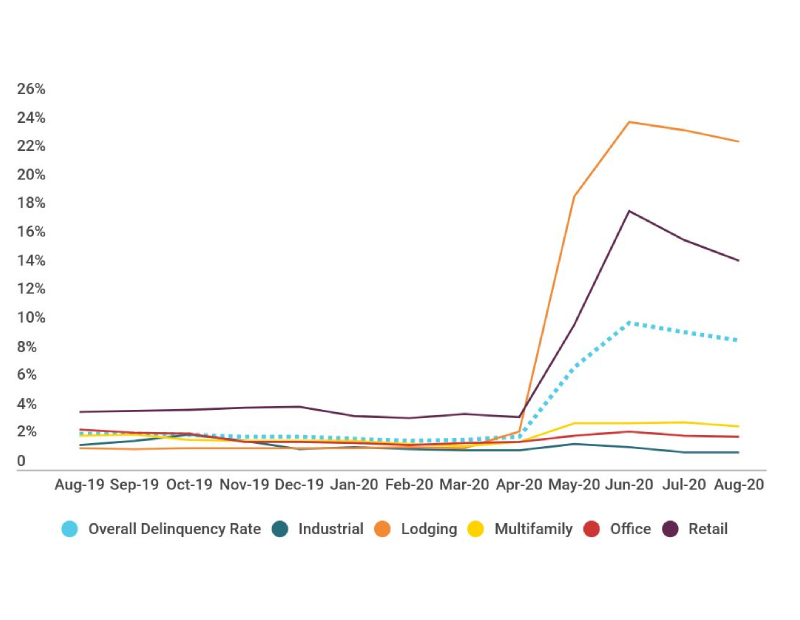

Month-over-month delinquency rates by major property type. Chart courtesy of Trepp LLC

The overall number of loans 30 days delinquent was 1.21 percent and the number of loans 60 days delinquent was 1.04 percent, both improvements over July. On the flip side, the percentage of loans 90 days or more delinquent jumped from 2.65 percent in July to 4.02 percent in August.

Clancy had noted earlier in the summer that the delinquency rate could be hitting what he called “terminal delinquency velocity,” meaning most borrowers who would be seeking debt service relief due to coronavirus impacts had probably already requested it. While Clancy stated an uptick in future delinquencies is still possible due to a surge in COVID-19 cases as well as relief windows ending for some loans, he does expect future increases in the delinquency rate would be more modest than what occurred in the spring at the height of the crisis.

Special servicing statistics

While the overall delinquency rate is improving, the percentage of loans with the special servicers continues to increase, going from 9.49 percent in July to 10.04 percent in August.

Not surprisingly, loans in the lodging and retail sector are being hit hard. Trepp stated 25.0 percent of all lodging loans in August were in special servicing, up from 24.3 percent in July. Retail loans also rose, going from 16.0 percent in July in special servicing to 17.3 percent by August.

The percentage on the special servicer watchlist also bumped up, though slightly, reaching 19.9 percent in August versus 19.7 percent in July.

Numbers by property type

According to Trepp’s overall property type analysis, all the CMBS 1.0 and 2.0-plus delinquency rates by property type decreased in August:

- Industrial delinquency rate dropped 4 basis points to 1.20 percent.

- Lodging delinquency rate dropped 83 basis points to 22.96 percent.

- Multifamily delinquency rate dropped 31 basis points to 3.02 percent.

- Office delinquency rate dropped 8 basis points to 2.32 percent.

- Retail delinquency rate dropped 122 basis points to 14.88 percent.

Read the full report on Trepp’s website.

You must be logged in to post a comment.