Commercial Construction Planning Proceeds: Dodge

The Dodge construction momentum index rose to its highest level since the pandemic began.

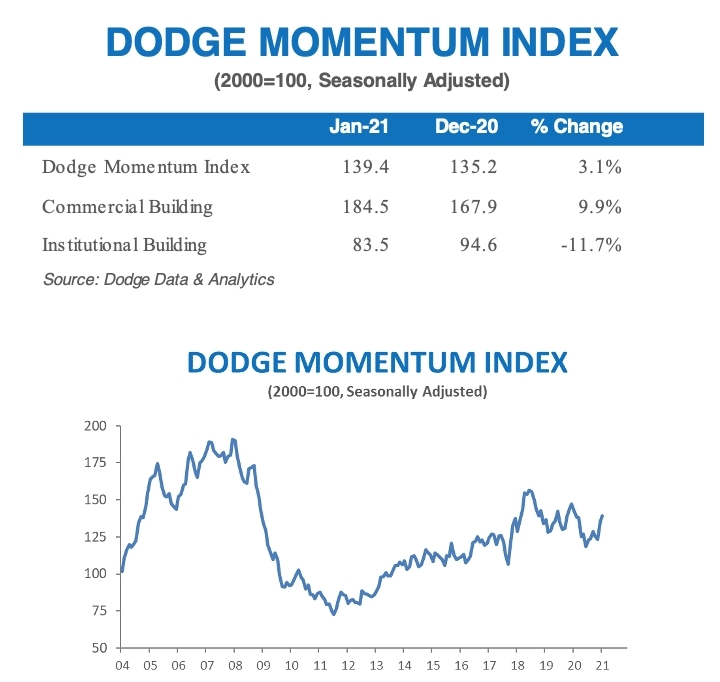

The commercial component of the Dodge Momentum Index increased 9.9 percent in January, offsetting the 11.7 percent decrease in the institutional construction sector.

READ ALSO: Net Lease Market Beats Expectations

Overall, the Dodge Momentum Index saw a 3.1 percent month-over-month increase to 139.4 in January, hitting its highest point since the onset of the COVID-19 pandemic. According to the latest Dodge Data & Analytics study, the momentum of projects going into planning increased from the December reading of 135.2 but remains 2.2 percent below the January 2020 level.

Looking only at the commercial component, the construction momentum is up 12.3 percent year-over-year. The Dodge report noted that commercial planning is at its highest level since before the Great Recession, which is likely caused by the increasing number of warehouse projects, and, to a lesser degree, office projects.

Richard Branch, Dodge’s chief economist, told Commercial Property Executive that the company expects warehouse construction to continue to grow through 2022. This is the main reason for the overall commercial sector’s rebound.

“As growth in (the warehouse) sector eases, it will be difficult for the overall commercial sector to sustain positive momentum,” Branch also told CPE. “Office construction will recover to some degree over the next several years, however, the growing share of employees working from home will likely keep office construction below the levels seen in previous cycles.”

Two of the year’s major commercial projects that moved into the planning stage include the $420 million Walmart distribution center in Lancaster, Texas, and the $355 million Amazon warehouse in Arlington, Wash.

Institutional planning sees major drop

With the disparity in commercial and institutional construction momentum, the report concluded that the construction sector’s recovery could be very uneven in the coming months.

On the other side, institutional planning hit its lowest level since Dodge began its Momentum Index in 2002, dropping 27.7 percent year-over-year. According to Dodge, the plummet in institutional construction activity is caused by local and state governments suffering budget deficits, leading to delayed building plans. Dodge’s previous report in July 2020 saw a similar decline in public works projects, which dropped 31 percent in a month’s time.

However, Branch told CPE that Dodge expects institutional construction to start recovering by mid-2022, following the overall U.S. economy’s climb back to its pre-pandemic levels.

“In our current forecast, this growth is supported by the assumption of additional federal stimulus dollars approved in the first quarter of this year directed towards shoring up state and local budgets,” Branch explained to CPE. “Should that funding not be forthcoming, planning for schools and other public buildings will need to wait for more organic growth in state and local tax revenues to occur, which may delay the recovery in institutional construction by another year.”

Despite its drop in construction activity, the institutional sector saw the $175 million Norman Regional Healthplex expansion in Norman, Okla., and the $156 Mercy Health Hospital in Kings Mills, Ohio, projects go into planning. January saw a total 13 projects, each with a value of $100 million or more, enter the planning stage.

Read the full report by Dodge Data & Analytics.

You must be logged in to post a comment.