GSA Inks $80M Lease With Parallel Capital in Long Beach

The renewal includes more than 140,000 square feet at a LEED Gold-certified property.

The U.S. General Services Administration has signed a lease renewal at Parallel Capital Partners’ Shoreline Square office building in Long Beach, Calif. The GSA’s lease, valued at $80 million, encompasses more than 140,000 square feet. The deal keeps the property’s occupancy at 87 percent.

Shoreline Square is a Class A, 410,114-square-foot office building at 301 E. Ocean Blvd., less than a mile from Long Beach’s waterfront. Parallel Capital Partners acquired the 20-story asset for $101.7 million in 2014, according to CommercialEdge data.

Shoreline Square has received several upgrades since its construction in 1987, including a cosmetic renovation in 2008. The LEED Gold-certified building includes approximately 17,000 square feet of ground-floor retail and floorplates ranging from 18,500 to 29,837 square feet. Parking is available at a ratio of 3.5 spaces per 1,000 square feet. Downtown Long Beach offers a variety of shopping, dining and entertainment locations, as well as access to main transit routes and the ports of Long Beach and Los Angeles.

CommercialEdge shows the building’s existing tenant roster includes U.S. Customs and Border Protection as well as the Bureau of Alcohol, Tobacco, Firearms and Explosives, along with a mix of non-governmental firms, including Comerica Bank and Tesoro Refining & Marketing Co.

Senior Vice President Brian Saal of CBRE represented Parallel Capital Partners, while Senior Director John Winnek of Cushman & Wakefield negotiated the leasing on behalf of the tenant.

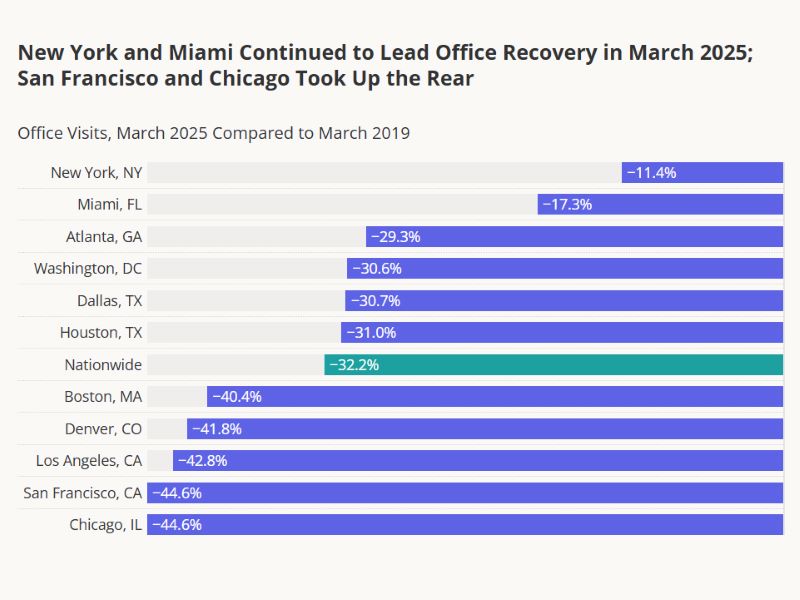

Uncertainty continues for office market

As we enter the second year of the global health crisis, office vacancies across the U.S. remain elevated, according to the latest CommercialEdge report. As of February, the national rate was at 15 percent, while Los Angeles remained slightly lower, at 13.8 percent. It is unclear how the office landscape will look in the coming years, as shifts toward remote work could endure.

Some metros are poised to recover faster, however, due to more affordable lease rates and ongoing corporate relocations. Dallas is one such example, where listing rates averaged slightly more than $28 in February. In January, Parallel Capital Partners signed two new tenants for $17 million at its Urban Towers property in Irving, Texas.

You must be logged in to post a comment.