Ares Management Closes $1.7B CRE Fund

The global alternative investment manager's third U.S. investment vehicle focuses on selective distressed, repositioning and development opportunities.

David Roth, head of U.S. Real Estate Private Equity at Ares Management Corp. Image courtesy of Ares Management Corp.

Nearly 18 months after launching Ares U.S. Real Estate Opportunity Fund III LP, Ares Management Corp. has completed the final closing of the fund with approximately $1.7 billion of commitments. The investment vehicle closed oversubscribed, having exceeded its $1.5 billion target.

Like its two predecessor funds, AREOF III focuses on selective distressed, repositioning and development opportunities.

“This fund series has historically delivered attractive returns and we believe that fact is evident by the support from new and existing investors in our third U.S. opportunistic fund,” David Roth, head of U.S. Real Estate Private Equity at Ares Management Corp., told Commercial Property Executive.

READ ALSO: Report: Global Institutions Spend More on Real Estate

The varied lineup of investors in AREOF III consists of sovereign wealth funds, public pensions, insurance companies, foundations, family offices and private banks. Among the list of public pension contributors is Fresno County Employees’ Retirement Association, whose Board of Trustees approved a $75 million commitment to the Fund in September 2020. And the contributions to AREOF III came from around the world, including the Americas, the Middle East, Asia and Europe. Spearheaded by Ares’ team of experts in investing across market cycles and sectors, AREOF III attracted $600 million in capital commitments during the pandemic between May 2020 and the Fund’s final closing.

Opportunity amid disruption

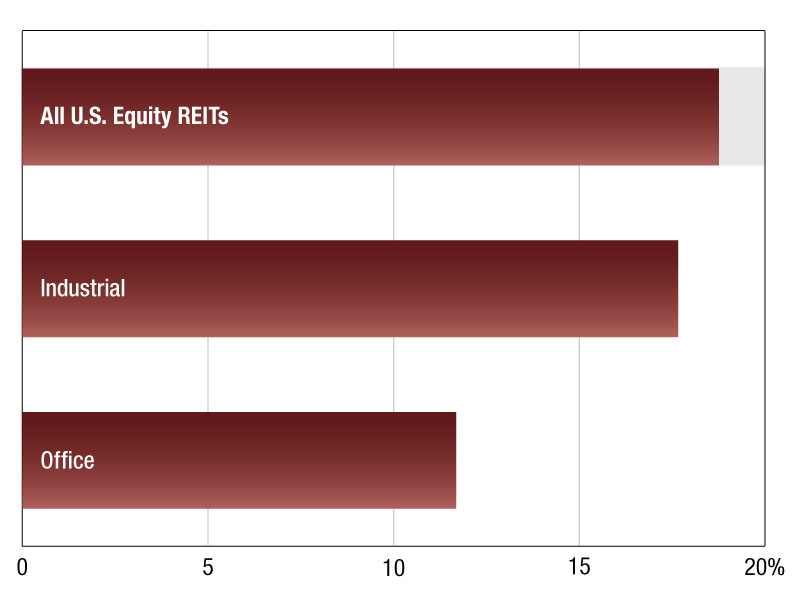

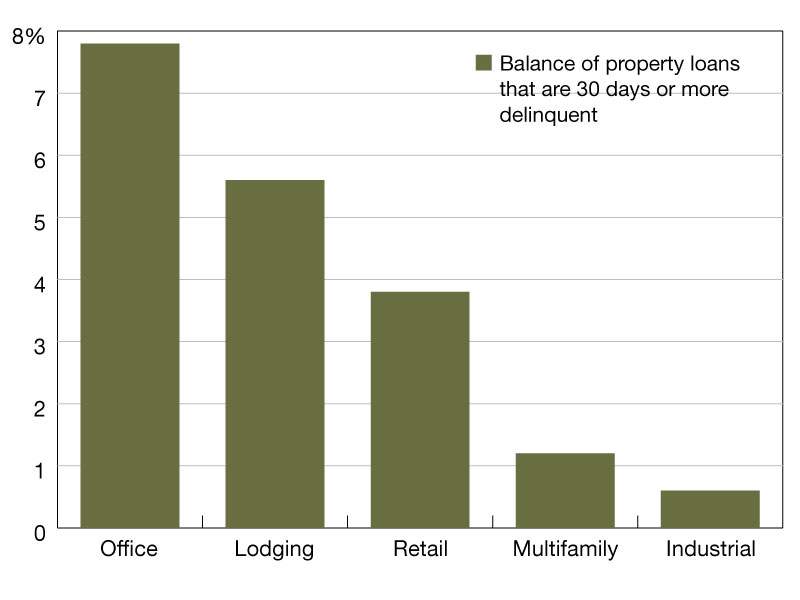

In its investment activity, AREOF III is capitalizing on the current period of volatility, which Ares sees as an attractive period of opportunity.

“We believe that an evolving set of demand tailwinds will define the real estate recovery, which Ares believes is likely to be differentiated by asset class and geography,” Roth said. “COVID-19 is amplifying demographic and industry shifts influencing occupier preferences that began well before 2020.”

To date, AREOF III has made nine investment commitments, including the acquisition of a total of more than 14,000 single-family rental units, two industrial programmatic investments, one student housing asset and two office buildings in a historically resilient market. And there’s much more activity on AREOF III’s agenda. “The Fund is positioned with ample dry powder to deploy over our multi-year investment period towards forthcoming opportunities as they arise,” Roth noted.

You must be logged in to post a comment.