Promising CRE Trends From Nuveen: Report

With slower long-term economic growth expected in the post-pandemic world, investors will increasingly find opportunities tied to demographic shifts rather than business cycles, according to Nuveen Real Estate's latest study.

More than a year into the pandemic, with vaccines rolling out and the U.S. economy aided by the injection of $1.9 trillion, outlooks show signs of overall stabilization, albeit at a slow pace. Nuveen Real Estate, a TIAA company, has released its second issue of RealAccess, a study on the impacts of the health crisis on real estate investment, in which it explores several trends profoundly impacting the built environment.

“Megatrends related to demographics, technology and sustainability will continue to drive demand as generations age and relocate, and as growth continues in sectors like e-commerce and health care,” Nuveen Real Estate Global Chief Investment Officer Carly Tripp told Commercial Property Executive.

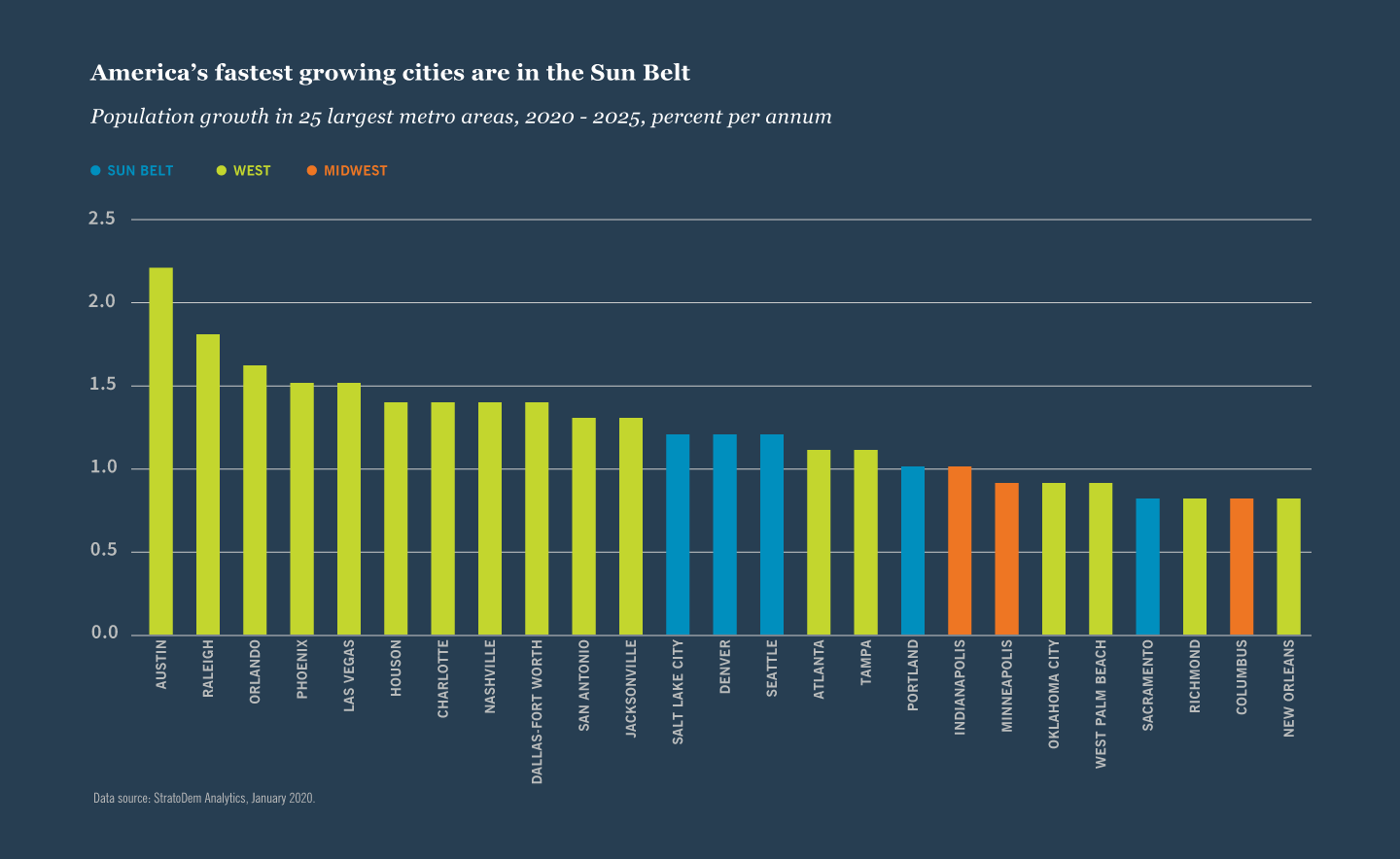

Accelerated migration to Sun Belt cities

While the trend is not new, COVID-19 has clearly accelerated it. High-density cities are losing ground in the face of those with more space availability, and the top preferred destinations are Arizona, Texas and Florida.

Similarly, suburban areas are more appealing to the aging Millennial generation, which is now having children and looking for residential options that include more bedrooms, privacy and a yard. Moreover, the report’s authors project that the growth of this demographic will be more than twice the rate of the general U.S. population over the next decade.

Meanwhile, the Baby Boomer generation is also aging, which will likely fuel demand for senior housing—more than 65 percent of the current stock is 17 years or older, adding to the opportunity for development.

These migration patterns extend beyond housing as the substantial population growth in particular cities and puts pressure on demand for industrial fulfillment centers, health-care offices, grocery-anchored retail and others.

Unsurprisingly, major employers are relocating their headquarters from higher-priced cities to these areas, with Oracle, Hewlett Packard and CBRE among them. Additionally, with more people and businesses growing roots across Sun Belt metros, the softer factors in these cities will also gain importance, and well-being, culture and leisure will play an essential role in real estate demand.

Health-care real estate responds to health-care system transformation

Another aspect the report touches on is the growth of health care. Even before the pandemic, the sector was already the fastest growing in the U.S. economy and accounted for almost one-fifth of GDP, according to OECD Health Statistics 2019.

The global health crisis has not just amplified its performance but also placed into the spotlight some subsectors, such as medical offices and life sciences centers. While the latter are essential for drug development, medical offices will remain in high demand as, the authors believe, more care will be delivered outside of hospitals, and these facilities provide cost-effective settings.

READ ALSO: Where Are the Next Life Sciences Hubs?

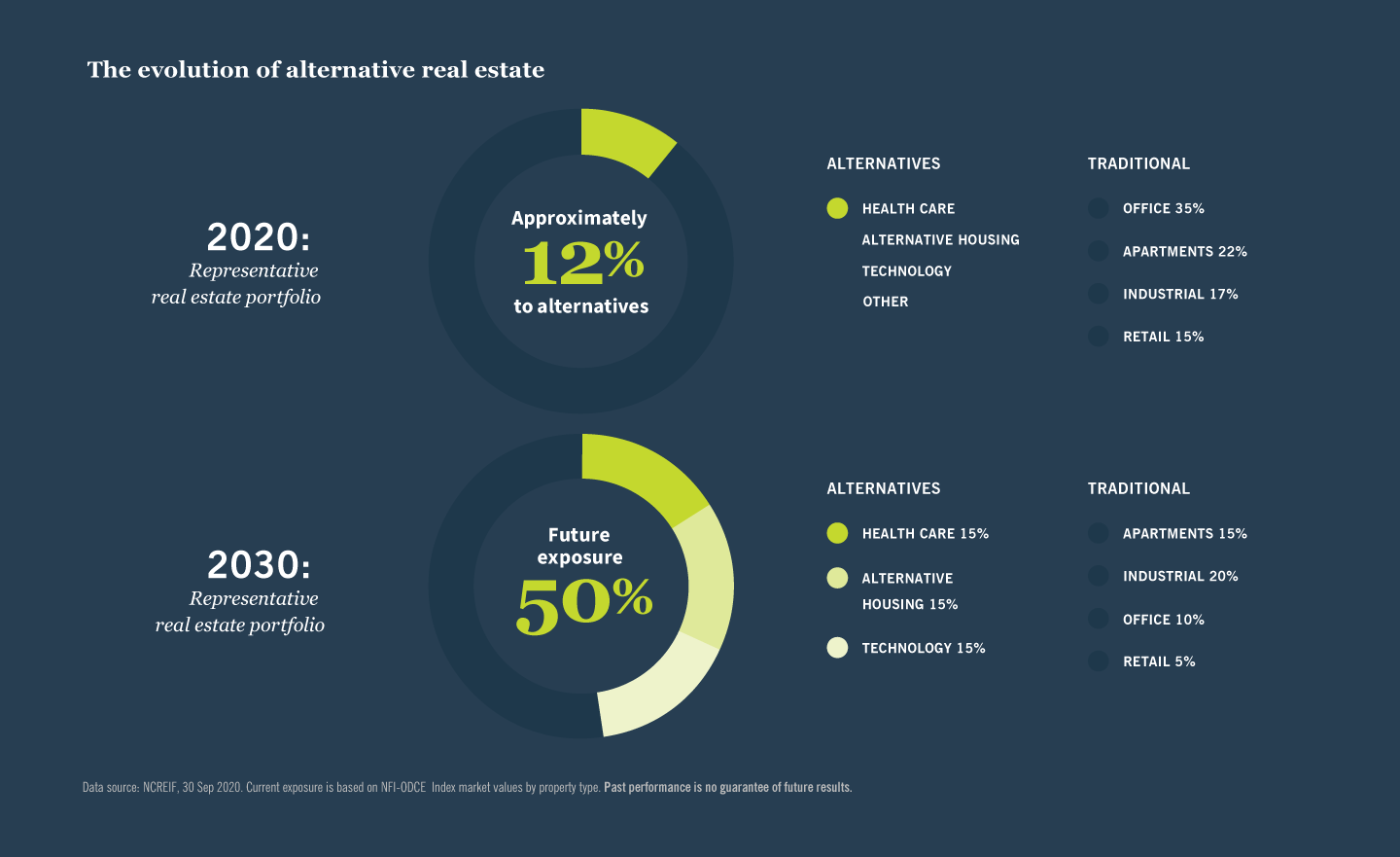

With slower economic growth expected after the pandemic, the focus is expected to shift to real estate property types that can generate superior growth, despite a weaker economic environment.

“According to NCREIF, alternatives currently make up 12 percent of the average real estate portfolio. In 2030, we expect it to hit 50 percent as the definition of real estate changes and megatrends continue to create opportunities for investors,” Tripp told CPE. This change also translates into increased demand for alternative housing, such as single-family properties and manufactured housing.

Two sectors are emerging: alternative housing options for aging Millennials and Baby Boomers, and data centers, cell towers and their associated real estate components that support the sustained growth of internet traffic, mobile-to-mobile connections, and next-generation technology such as artificial intelligence and the Internet of Things.

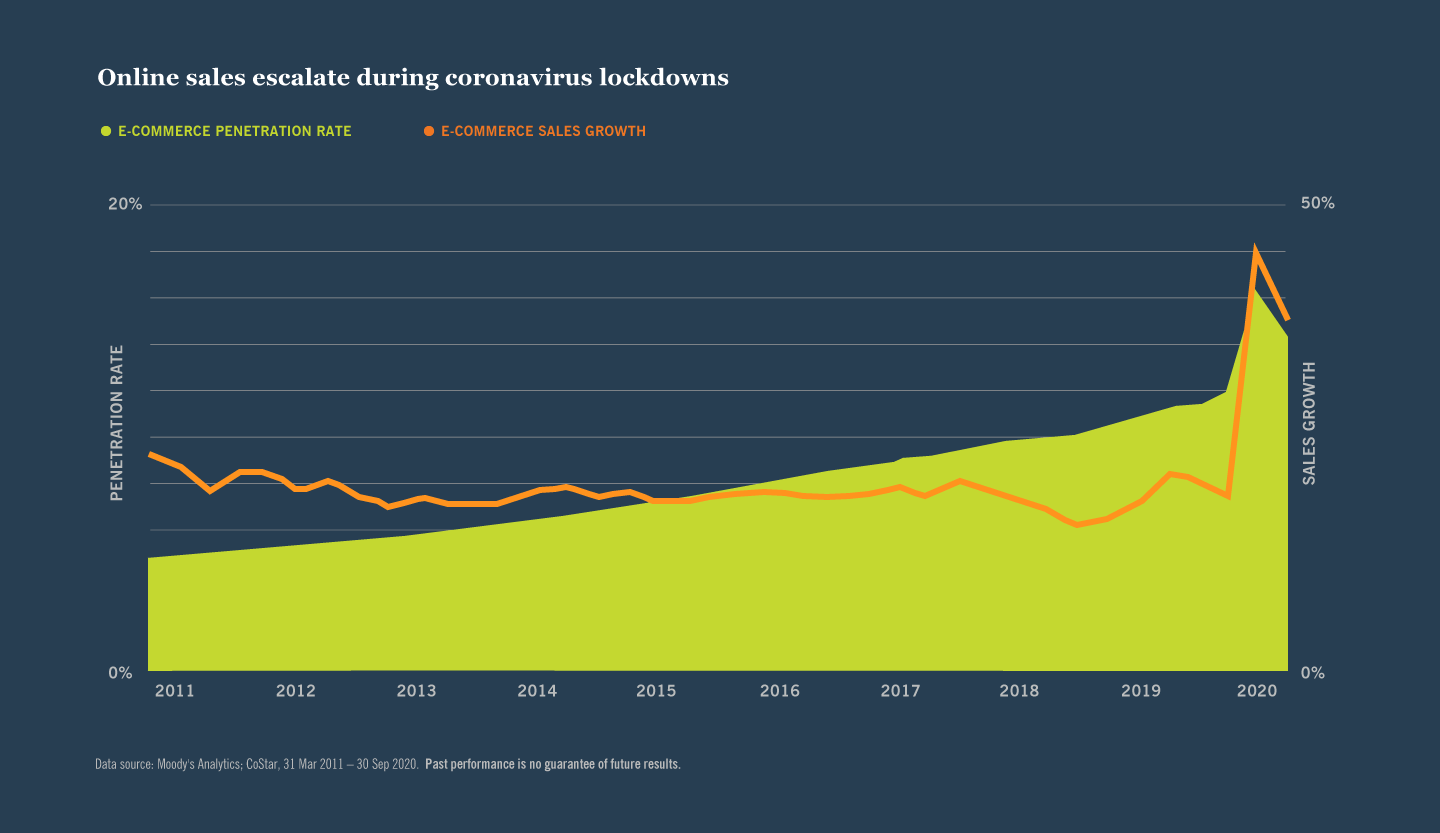

The rise of the industrial sector and digitalization

Coronavirus lockdowns have pushed technology advancements. “Real estate plays an integral role in the continued digitalization of the world economy. How we continue to utilize and depend on the built world is evolving and technology has enabled investors to look beyond the traditional commercial and housing sectors, and expand the definition of what real estate investing is today,” explained Tripp.

E-commerce sales saw remarkable performance, with consumers ordering goods and services online. “E-commerce’s penetration rate grew from 11.2 percent in the third quarter of 2019 to 14.3 percent year-over-year in 2020 as a result of the pandemic, and we expect it to increase another 5 to 10 percent by 2025. This could lead to heightened demand for warehouse space from a larger variety of tenants,” according to Tripp.

Supply management strategies shifted from “just-in-time” to “just-in-case” practices following unforeseen increases in customer demand, which last year, led to supply chain failures. Consequently, the new supply management tactics require larger inventories, and thus more warehouse space, which is anticipated to further elevate demand for industrial real estate space going forward.

Similarly, to manage risk and be prepared for the changes in global economics, major corporations have been diversifying their supply chains. Specifically, India, Malaysia, Pakistan and Vietnam became more attractive than China, thanks to their affordable labor costs and large workforce pools.

READ ALSO: Cities Weathering the COVID-19 Storm

Extrapolating, this transition will likely increase demand on the East Coast relative to West Coast ports. More so, to reduce supply chain risks, companies are beginning to relocate mission-critical supply chain activities to geographic regions closer to the end consumer. As such, some corporations will choose to place these activities in the U.S., Mexico and Canada.

Raleigh, N.C., Austin, Texas, and Nashville, Tenn., are among the markets expected to display the greatest surge in warehouses, relative to their population. With strong migration to these cities, especially among higher-income workers, e-commerce is anticipated to expand in a disproportionate manner.

The report also found that single-family home permit performance marked an exceptional increase at the end of 2020, up to 14.4 percent from -0.6 percent at the close of 2019. Typically, single-family home demand has been a primary driver of light industrial and warehouse demand, as construction companies and vendors need space to store building materials and equipment. Nuveen also expects demand from home construction and related activities to support warehouse growth as a complementary demand driver to e-commerce.

Read the full report here.

You must be logged in to post a comment.