Brighter Outlook for Solar Installations

New capacity picked up during the second half of 2020, and a big year could be ahead in key user segments.

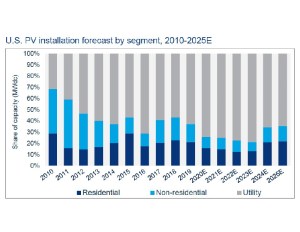

The initial months of the pandemic saw a slowdown in the U.S. solar projects, but the sector started gaining back its power over the summer. Solar accounted for 43 percent of all new electric generating capacity additions through the third quarter of 2020, more than any other electricity source. The utility-scale market was the primary driver of installations in the third quarter, with 2.7 gigawatts of new capacity, or 70 percent of all solar capacity brought online that quarter.

Wood Mackenzie, which prepared the U.S. Market Insight Q4 2020 report with the Solar Energy Industries Association, projected a record 19 GW of new solar capacity installations in 2020, up 43 percent from 2019. Wood Mackenzie and SEIA are forecasting total solar installations for 2021-2025 above 107 GW—a 10 GW increase from the second-quarter estimate, driven primarily by solid increases in the utility-scale pipeline.

READ ALSO: Energy-Saving Efforts Continue, Albeit at a Slower Pace

“The broad message was definitely the comeback of the solar industry to more levels of growth in that (third quarter) time frame,” Michelle Davis, a Wood Mackenzie senior solar analyst and an author of the report, told Commercial Property Executive. “However, the report does try to provide nuance. Not everything and every sector are completely back to normal.”

Still, third-quarter volumes increased faster than expected, enabling Wood Mackenzie to boost its yearly outlook from the previous quarter. In the third quarter, the U.S. solar market installed 3.8 GW of solar photovoltaics, up 9 percent from the second quarter as the industry began recovering from the worst impacts of the pandemic.

Residential installations recovered the fastest, increasing 14 percent from the second quarter with 738 MW installed.

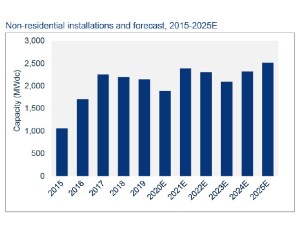

The non-residential segment, which includes commercial, government, nonprofit and community solar, increased 8 percent from the second quarter with 429 MW installed, in line with first-quarter volumes. Growth was seen in key markets such as California, Massachusetts and New Jersey. Project development and construction activity in the non-residential segment picked up in late summer through fall, with pipelines increasing in growing markets like Maine, Virginia and Illinois, the report noted. While that was good news, the non-residential segment was down 13 percent year-over-year for the third quarter.

According to Davis, the commercial segment has been slower to restart depending on how state markets and local jurisdictions were impacted by the pandemic. “There is permitting and other processes that you have to go through to get a solar project off the ground and approvals you need. A lot of places shifted to doing things virtually and online,” she said, with some jurisdictions moving more slowly than others.

The report notes that some businesses also cut capital expenses because of economic concerns.

Utility Sector Drives Gains

The utility segment was the least impacted because it undertakes large construction projects that are vetted in advance, Davis noted. Some projects may be delayed for a quarter but overall the utility market was resilient. The third quarter of 2020 was the largest third quarter in history for utility PV with 2.7 GW deployed, bringing total capacity to 7.6 GW.

With an additional 7 GW in projects slated for completion by the end of the year, 2020 was expected to be the largest year ever for utility PV. Some of those planned projects may not be finished until 2021 but Wood Mackenzie and SEIA expect 2020 installations to exceed 14 GW.

The utility solar segment is benefiting from continued expansion of state-level renewable energy targets to achieve 100 percent carbon-free energy, as well as from utilities’ own goals to provide more renewable power . Corporate buyers purchasing renewable power is also a “fairly significant driver,” Davis said. “All of those combined really add to the procurement pipeline.”

READ ALSO: Peak Carbon Emissions Fall, But Faster Decline Needed

In 2020, there were 25.9 GW of new utility-scale projects contracted. According to the report, developers will push to complete projects qualified to receive solar investment tax credits over the next few years. At least 12.8 GW of projects have 2023 completion dates and the 2023 development pipeline is expected to grow as more PPAs are signed. To that extent, developers will seek to build as many projects as possible before the ITC drops to 10 percent.

Tax-Credit Issues

With some 2020 projects delayed and demand driven by developers who want to take advantage of the ITC, 2021 should be a record-breaking year for the non-residential segment with nearly 2.4 GW in new installations anticipated. Much of that growth (42 percent) is expected to come from community solar. Davis pointed out that ITCs provide boosts to all three solar segments but are particularly important to the commercial sector. “Anything that boosts economics will help with deployment,” she noted.

There was good news in late December, when Congress passed the omnibus spending bill that included a two-year extension of the solar ITC. According to Davis, the tax credits were supposed to shift down to 22 percent in 2022 but will remain at the 26 percent level this year and 2022. With that legislation, the solar ITC will drop to 10 percent in 2024 for commercial projects.

Despite the appetite for solar projects, labor shortages and tax equity finance capacity continue to be a concern. Competition for tax equity financing has increased at the same time that financing partners are becoming more cautious about who they work with and what projects they will fund, Davis said. Smaller projects are particularly at risk, since projects that will generate more than 1 megawatt with investment-grade off-takers won’t have difficulty getting funded.

“Investment tax credits are so lucrative it’s crucial for developers to get a financing partner on board to take advantage of these tax credits,” Davis added.

You must be logged in to post a comment.