Where New Office Projects Get Funded

Lenders are still looking for construction financing deals, and it can get competitive.

With the office sector taking a hit last year, financing for new projects has been sporadic and selective, as lenders increasingly focus on preleasing, sponsors and location. That, however, does not mean there is no heat in the market.

“Whether it’s money center banks like ourselves, regional banks, life companies or debt funds, it’s extremely competitive. There is a lot of what I like to call competitive quotes among us,” said Nipul Patel, head of real estate banking with Wells Fargo. “It’s a good time to be a borrower. Spreads have come back down again and have tightened tremendously over the last 60 to 90 days.”

Developer Savanna secured $264 million in construction financing for 141 Willoughby Street in Brooklyn, a 24-story speculative office building, in May. JLL Capital Markets arranged the financing months after Savanna pulled back the project during the early part of the pandemic to include post-pandemic wellness features. Image courtesy of JLL Capital Markets and Savanna.

Brad Zampa, executive vice president of debt and structured finance with CBRE, said all types of lenders will chase well-leased office opportunities, particularly larger deals with institutional sponsors.

“In some primary markets, both banks and debt funds will provide spec construction financings. Banks are asking for partial recourse, but debt funds are not. In several instances, we will pair a bank with a debt fund where the bank takes the senior mortgage and the debt fund holds the mezzanine position,” Zampa said.

Shlomi Ronen, managing partner of Dekel Capital, said bank financing is generally in the 55 to 65 percent of cost with pricing spreads starting at mid-2s to mid-3s over LIBOR or SOFR. Debt funds will often offer non-recourse loans in the 60 to 70 percent cost range with higher spreads.

Tommy Lee, head of capital markets at Trammell Crow Co., which opened an office in Raleigh, N.C., to expand its presence in the area, said debt funds are active and banks are interested if there’s preleasing and investment-grade tenants involved.

“On projects that we’re doing now that would clear the prelease hurdle, yes, traditional banks are showing up and being competitive on that deal. Prelease is everything,” said Lee.

Lee said TCC, which delivered 33 office buildings around the U.S. since 2015 and has 15 more in progress, is betting on Raleigh with a new mixed-use development featuring 150,000 square feet of speculative Class A office space. Dubbed 400H, the project calls for a 365,000 square-foot high-rise with 242 units of luxury housing topping the office and 16,000 square feet of retail.

TCC traditionally secures equity partners for up to 95 percent of the equity requirement in a development before seeking construction financing. “We can turn to a lender and say here’s the sponsorship you’re lending to,” he said.

The team making 400H happen includes AECOM-Canyon Partners as equity partners, as well as High Street Residential and HM Partners. QuadReal Property Group provided funding for the project.

Deals still closing

After holding back early in the pandemic, Savanna, a New York-based real estate investment management firm, secured $264 million in a senior loan from PIMCO and mezzanine financing from funds managed by CarVal Investors in May for its 400,000-square-foot, 24-story speculative office and retail project in Brooklyn. JLL Capital Markets Senior Managing Directors Kellogg Gaines and Aaron Niedermayer said they first sought financing for 141 Willoughby Street in February 2020.

“When COVID-19 hit, we took a pause,” Niedermayer said. “(Savanna) went back and worked with their development and design teams and made changes to address some of the COVID-19 realities of the world.”

In the fall, Gaines and Niedermayer began seeking financing again. Commercial banks were still being conservative on speculative office construction lending, they said.

“There were a number of debt funds that took a good charge at this,” Gaines said. “We just worked the market and found the right player for the senior and the right player for the mezzanine,” Gaines said.

Daniel Tanner, director at CarVal Investors, said the loan was well structured to mitigate any risks associated with a spec project.

READ ALSO: Opportunities, Risks in Today’s Commercial Mortgage Financing

For larger deals, multiple players are generally involved. One example is Manhattan’s One Madison, which in November received a nearly $1.3 billion construction loan from a consortium of lenders including Wells Fargo, TD Bank and Goldman Sachs for the 1.4 million-square-foot office redevelopment planned by SL Green, Hines and National Pension Service of Korea. The deal—the largest office construction facility in New York City in 2020 —included Bank of America, Deutsche Bank and Axos Bank. The loan has a term of up to six years with a floating interest rate of 3.35 percent over LIBOR, with ability to reduce the spread to 2.50 percent if leasing and completion milestones are met.

“Sometimes there will be a bank in there for the senior portion. They’re allowing the private capital to effectively leverage off of that. That could top out at 50 to 55 percent of cost and then the balance gets funded by private capital,” said Joseph Iacono, CEO & managing principal at Crescit Capital Strategies.

While not a new ground-up project, L&L Holding Co. and Columbia Property Trust are redeveloping the historic Terminal Warehouse in Manhattan into Class A office and retail space. In July, the developers announced a $1.25 billion construction financing package. Vehicles managed by Blackstone Real Estate Debt Strategies led the $974 million senior loan and senior mezzanine financing, with Goldman Sachs and KKR participating. Funds managed by Oaktree Capital Management led the $274 million junior mezzanine financing with Paramount Group.

“You have multiple players there playing in different portions of the stack,” said Iacono, who was not involved in the financing. “In a large deal like this it’s understood by the borrowers that there are going to be multiple participants because of the size and because of the efficiency.”

For middle-market deals, borrowers will often go with a one-stop shop to reduce transaction costs and execution risk, Iacono said. In some cases, you will see a junior lender and bank.

The Raleigh, N.C, mixed-use project dubbed 400H is being developed by a team including Trammell Crow Co., High Street Residential, AECOM-Canyon Partners and HM Partners. Image courtesy of Trammell Crow Co.

Tracking office construction

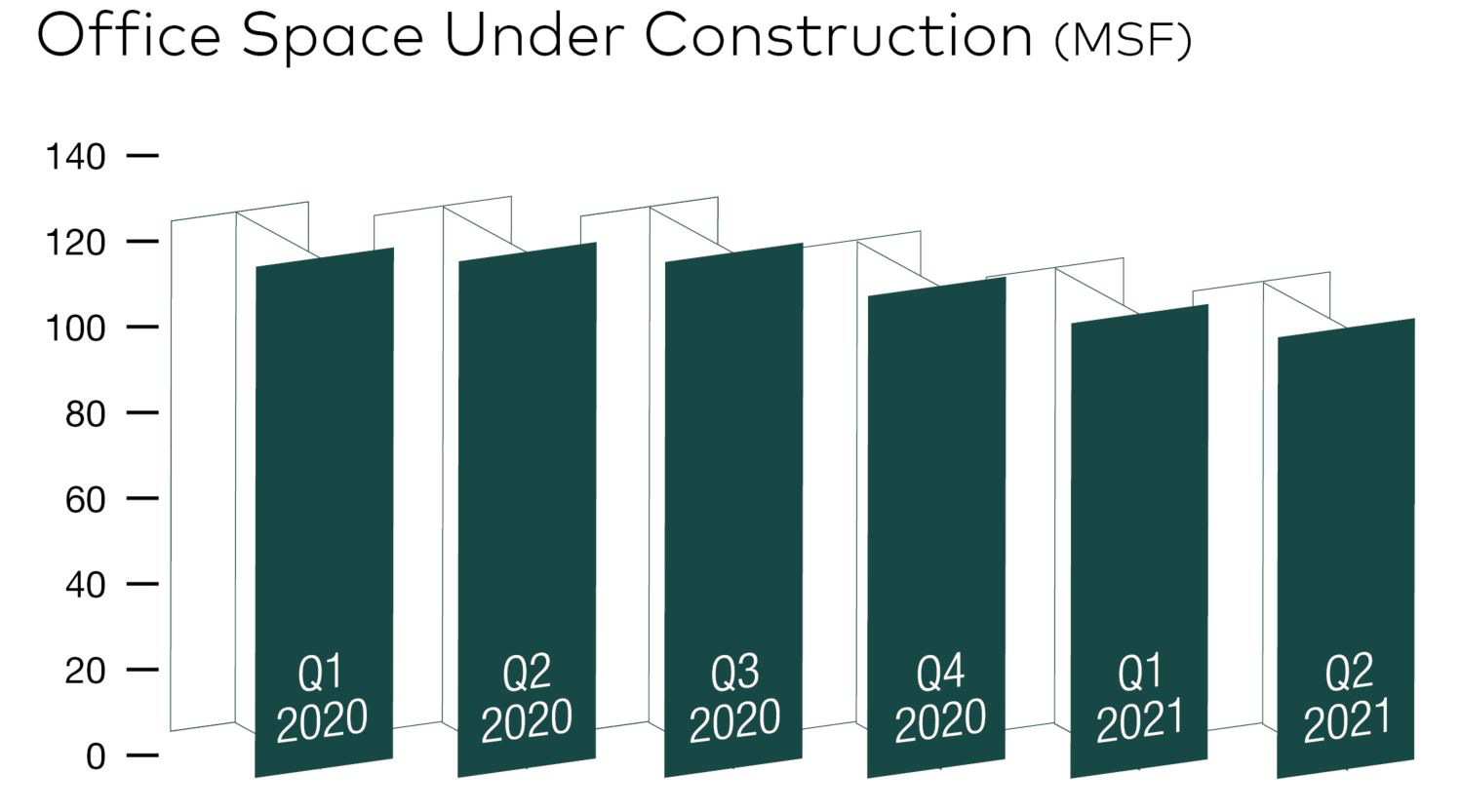

Manhattan led U.S. markets in new office construction during the second quarter, with 13.2 million square feet under development, up 600,000 square feet from the first quarter, according to CBRE. Several other metros such as Los Angeles (9.4 million square feet), Boston (9.2 million square feet) and Seattle (7.4 million) topped the list. Charlotte had the highest amount as a percentage of its existing inventory, at 9.8 percent, followed by San Jose, Calif., at 9.6 percent and Austin, Texas, at 8.2 percent. Overall, there was 107 million square feet of office space under construction in the second quarter, down 3 percent from the first and 14.4 percent from the same time last year.

READ ALSO: Demand for Specialty Product Boosts Office Sector

CBRE Chief Global Economist Richard Barkham said new completions will peak this year, at 60 million square feet. In 2022, they’re expected to drop to 49 million square feet. By 2023 and 2024, the numbers will be 15 and 13 million square feet, respectively, representing developments approved during the pandemic. Barkham expects office construction to bounce back to 48 million square feet in 2028 and 46 million in 2029.

Looking across the map, much of Boston’s office pipeline is in the life science segment. Patel said both San Diego and Boston have also seen repurposing of traditional office space for life science companies. Some markets seeing new office development include Sun Belt cities such as Miami, Austin and Nashville, Tenn., said Iacono, who noted large corporations will commit to large blocks of space in new buildings.

The Sun Belt “is the one place where we are seeing new construction, outside of renovation of buildings, especially in Southern markets where there’s an increase in employment and in-migration,” said Gregg Gerken, head of U.S. commercial real estate lending at TD Bank.

Hines, which launched a new open-ended, commingled fund in August with more than $1.2 billion in immediate investment capacity, is known for developing high-rise office towers in major U.S. cities. Approximately 20 percent of the new Hines U.S. Property Partners fund will go toward office development but Alfonso Munk, chief investment officer for the Americas, said much of that will be office in special asset classes like life science and it will come later in the fund cycle. The fund expects to invest across residential, industrial, office and mixed-use sectors and niches like life science and self storage.

Munk said Hines believes there will be great opportunities to develop “the next generation of office assets that take into account the needs of tenants coming out of the pandemic” and likes high-growth areas including Denver, Seattle, Austin, Nashville, The Carolinas, Atlanta and South Florida.

You must be logged in to post a comment.