PIMCO to Buy Columbia Property Trust in $3.9B Deal

The acquisition would take the New York City-based office REIT private.

In a deal valued at $3.9 billion, Columbia Property Trust has agreed to be taken private by Pacific Investment Management Co. (PIMCO), the companies announced on Tuesday morning.

PIMCO will acquire the outstanding shares of the New York City-based office REIT for $19.30 per share, a 27 percent premium over Columbia’s share price on March 12. The deal also includes the assumption of Columbia’s consolidated and unconsolidated debt, the companies said in a statement. Closing is expected by the end of the year.

The deal is the culmination of a strategic review process undertaken this spring by Columbia. In March, Columbia was the target of an unsolicited proposal from a group led by The Sapir Organization. That deal would have paid $19.50 for each share of Columbia stock.

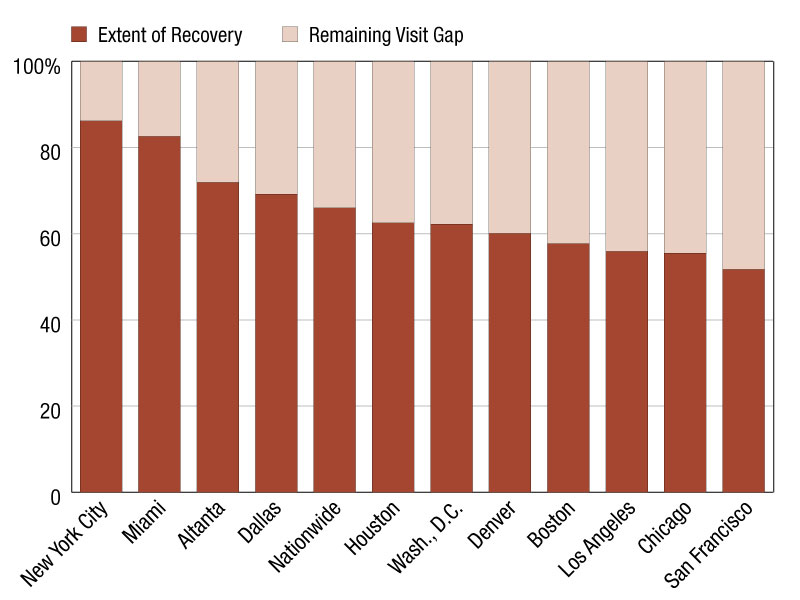

Columbia owns 6 million rentable square feet of office space in New York City, Washington, D.C., Boston and San Francisco. Another four properties are under development. Columbia also manages 8 million square feet for third-party clients.

Notable Columbia projects include 80 M St. in Washington, D.C. As part of a 105,000-square-foot vertical expansion, the property is the first commercial building in the capital to use mass timber.

Another Columbia project, 799 Broadway in Manhattan, earned a bronze award the 2020 CPE Distinguished Achievement Awards for its design by Perkins&Will.

Last October, Columbia recapitalized 221 Main St., an office tower in San Francisco’s South Financial District, with a $180 million investment from Allianz Real Estate.

Newport Beach, Calif.-based PIMCO manages $180 million real estate assets worldwide. The company, which is owned by Allianz S.E., combined its real estate platform last year with that of Allianz Real Estate.

You must be logged in to post a comment.