UK Industrial Property Surged in 2021 as Median Total Return Topped 30%

Quarter four of 2021 saw commercial property in the United Kingdom record its best single-quarter total return since the fourth quarter of 200

Standing Investment; Range of Returns

Quarter four of 2021 saw commercial property in the United Kingdom record its best single-quarter total return since the fourth quarter of 2009. A quarterly return of 6.3 percent drove the rolling annual total return of the MSCI UK Quarterly Property Index to 16.5 percent, a six year high.

However, while previous cyclical upswings saw the main property sectors move in relative unison, the current cycle is largely driven by the strength of the industrial property. Of the 16.5 percent annual index return, 12.9 percent could be attributed to the industrial sector courtesy of a 36.4 percent total return.

By contrast, the office sector recorded a respective annual return of 15.3 percent. Yield compression was the main driver of industrial outperformance as its equivalent yield effectively halved in 10 years as it strengthened to 4.2 percent at the end of 2021 from 8.4 percent in quarter four of 2011.

The combined impact of a strengthening yield and rental growth saw industrial become the largest sector by value in the Index at 35 percent, up 2.3x over 10 years.

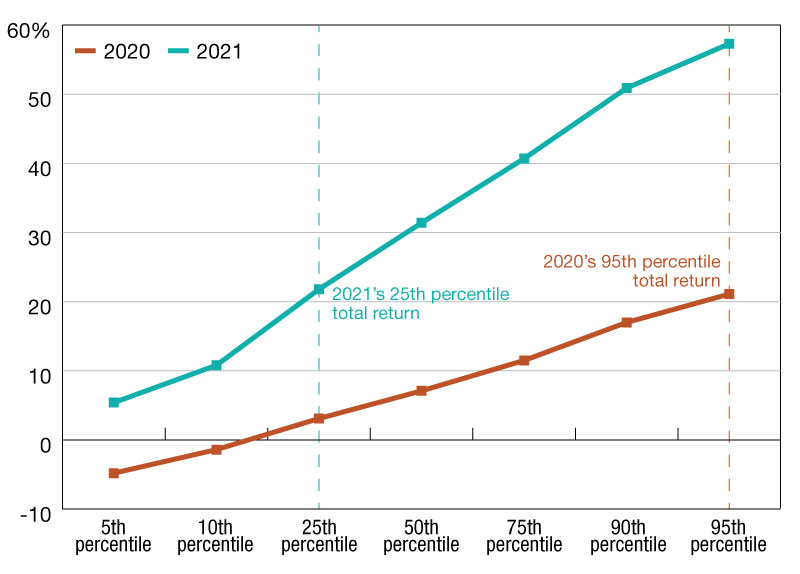

While industrial was also the top performing sector at the end of 2020, 2021 turned out to be a watershed year for the sector as the median industrial return rocketed from 7.1 percent in 2020 to 31.4 percent in 2021.

Strong rental growth, low vacancy and record low yields combined for a step change in performance as the sector’s entire returns distribution shifted to the right. So much so that 2021’s 25th percentile of UK industrial return (21.8%) exceeded 2020’s 95th percentile (21.1%).

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.