CRE Executives Are Asking Which Way Is Up

Jay Maddox of Avison Young on today’s mixed signals and the industry’s prospects.

Jay Maddox Image courtesy of Avison Young

Commercial real estate lenders and investors are confronted by a puzzling array of seemingly contradictory economic signals. Interest rates have skyrocketed since Russia’s invasion of Ukraine and price inflation, initially thought to be a temporary consequence of supply chain issues, has metastasized into a potentially systemic problem. At the same time, the U.S. stock market continues to rally to historic heights.

Capital flows for most types of commercial real estate have remained very strong, especially for multifamily and industrial properties. Apartment rents have been rising faster than wages and underlying price inflation across many markets, with low single-digit vacancy rates in many markets. The market appetite for industrial properties, particularly distribution and warehouse facilities, has been insatiable. The question becomes whether this environment is sustainable.

Interest Rate Pressures

In these uncertain times, there are two important factors that CRE lenders and investors should be wary of. First, despite any wishful thinking, the Fed has no choice but to continue to “hike until it hurts” in order to combat inflation. The Fed has ceased its asset purchase programs that flooded the market with liquidity helping to keep rates artificially low during the pandemic, while at the same time pushing interest rates higher. As with most such initiatives, the tendency is to over-correct. So, we can expect rising interest rates for the foreseeable future. The good news is that despite the run up, interest rates remain at historic lows, at least for the time being.

The Risk of a “Yield Curve Inversion”

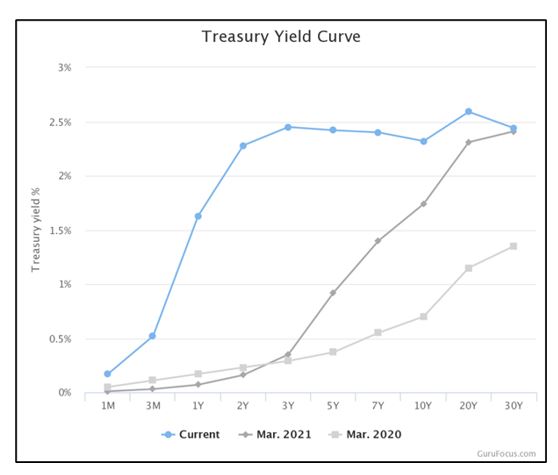

Another potential concern is the recent flattening and slight inversion of the Treasury yield curve. In normal times, long-term interest rates are higher than short-term rates thereby compensating investors for the increased risk. When the yield curve “inverts,” short-term rates exceed long-term rates. You can see a comparison of the yield curve over the past three years in the chart below. It was normal in 2020 and 2021 but is now flattening.

Interestingly, the yield curve was inverted in late summer of 2019, so one might have expected a future recession. However, it’s safe to say that no one could have predicted the depths of the pandemic-induced recession in 2020. Having said that, it’s certainly possible that the markets have returned to the 2019 scenario.

What this Means for CRE Investors and Borrowers

In conclusion, the era of “free money” appears to be over, however, capital flows remain robust and interest rates remain historically low. Borrowers may want to lock in today’s rates rather than hoping for a potential market correction. Investors may want to consider harvesting some gains and should be cautious in relying on overly aggressive underwriting metrics that may not be sustainable. Lenders have already increased their risk spreads due primarily to market volatility. One cannot predict when the inflection point will occur, but all signs point to a market adjustment down the road. Careful risk management and thoughtful decision-making are a must.

You must be logged in to post a comment.