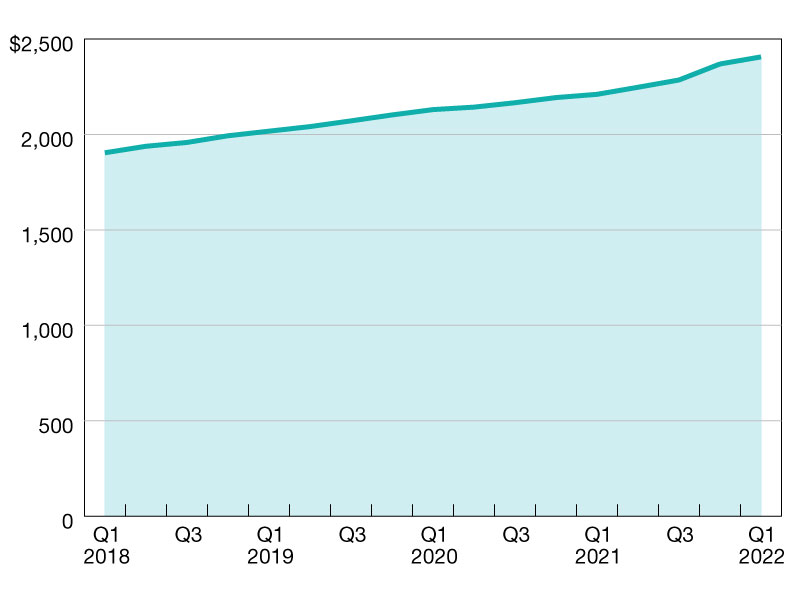

Commercial Mortgage Debt Outstanding Rises to New Record in Q1 2022

Total mortgage debt outstanding rose to $4.25 trillion, according to MBA's latest report.

$ in billions

Driven by record-high originations for a first quarter, the amount of mortgage debt outstanding climbed to a new high at the end of March 2022.

This is according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report, which found that the level of mortgage debt outstanding increased by $74.2 billion (1.8 percent) in the first quarter of 2022. Total mortgage debt outstanding rose to $4.25 trillion at the end of the first quarter.

Depositories and life insurance companies were behind the majority of the growth. Commercial banks continue to hold the largest share (38 percent) of mortgages at $1.6 trillion. Agency and GSE portfolios and MBS are the second-largest holders of mortgages (21 percent) at $911 billion. Life insurance companies hold $635 billion (15 percent), and CMBS, CDO and other ABS issues hold $612 billion (14 percent). Many life insurance companies, banks and the GSEs purchase and hold CMBS, CDO and other ABS issues. These loans appear in the report in the “CMBS, CDO and other ABS” category.

The recent run-up in interest rates and drop in broader equity values will without a doubt affect commercial and multifamily markets in the coming quarters, but the relatively strong market fundamentals for most property classes should serve as a stabilizing force.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.