How Data Can Boost Decarbonization

Cutting the carbon footprint is a widely held corporate goal—but is energy data being put to good use? Cleartrace CEO Lincoln Payton weighs in.

Talking about sustainability and energy efficiency and worrying about carbon emissions doesn’t put an end to climate change. Building some solar farms and wind parks and upgrading buildings in some parts of the world helps, but it’s far from enough. In today’s world, we have the knowledge and the abilities to fight climate change and win.

Decarbonization goals have increasingly become part of the ESG commitments of many companies, but the data collected is not always put to good use. “Renewable energy buyers and suppliers need to understand the carbon intensity of the electricity they consume or produce—on an hourly basis—in order to advance their decarbonization strategies,” said Lincoln Payton, CEO of Cleartrace, a carbon and energy management software company based in Austin, Texas. His company is working with large renewable energy buyers committed to decarbonizing their operations, such as JPMorgan Chase, Brookfield Properties and Iron Mountain.

In the interview below, Payton discusses the role of data in reducing carbon emissions, greenwashing and the markets with the cleanest energy capacity in development.

Tell us about the Cleartrace system. How does it work?

Payton: Cleartrace’s carbon accounting platform unites a range of energy and carbon data for commercial and industrial energy consumers and energy asset owners, and delivers both a dashboard and data warehouse that can serve as a single source of truth for proof of decarbonization.

Our product is unique in that we primarily take granular, hourly data from the meter level and other streaming data sources to ensure it’s 100 percent accurate. Unlike using monthly or annual averages, granular data gives companies mathematically verifiable data on their carbon impact that can protect their reputation from claims of greenwashing.

Our platform then organizes this meter-level data on an hourly basis, then enhances this data by layering on other relevant attributes to calculate each hour’s percentage renewable match and corresponding carbon impact. Further, by leveraging blockchain technology, we ensure customers have a data trail that is immutable, offering traceable records of carbon, both emitted and avoided.

What have you learned so far from the data you’ve been collecting?

Payton: We’ve learned that while many companies aren’t ready to commit to 24/7 renewable energy yet, there is a range of ways we can work with companies to access data and gain insights that will help inform their decarbonization journey and prove their impact.

How effective are the current sustainability targets?

Payton: Every company is different—some are setting and hitting ambitious targets and work with us to prove that impact. Others are lagging, making goals that they aren’t hitting or making claims that they cannot prove.

We know that as policymakers, investors and consumers get savvier and the effects of climate change continue to appear in everyday life, companies will be held increasingly accountable for action on climate. We exist to help companies decarbonize with high integrity and transparency.

Various rating programs certify buildings’ features that pertain to sustainability. Why isn’t carbon tracking and reporting a standard requirement yet? Any signs it will become mandatory any time soon?

Payton: New city laws including New York City’s Local Law 97, Boston’s Building Energy Reporting and Disclosure Ordinance (BERDO) and Maryland’s new Climate Solutions Now Act are starting to create requirements for reporting on and eventually reducing buildings’ carbon footprints. The U.S. Securities & Exchange Commission has proposed new rules requiring climate-related disclosures from publicly traded companies. So, we are confident that several jurisdictions will require carbon tracking and reporting in the near term and we’ve been working with different industry bodies on universal accounting standards.

READ ALSO: Building Performance Policies Across the US

How prevalent is greenwashing in the renewable energy market? How can it be discouraged?

Payton: Consumers, investors, policymakers and prospective employees are all powerful stakeholders that can and are holding companies accountable for greenwashing. I believe ensuring access to data is critical to provide companies with true proof of decarbonization and enable them to share confidently with the public and stakeholders about their impacts.

How clean is renewable energy from a carbon impact perspective? Are all megawatts-hour identical from a carbon impact standpoint?

Payton: We treat all renewable energy sources that don’t burn any fossil fuels as 100 percent renewable and clean. However, those sources’ impact on decarbonization will vary depending on how dirty the incumbent grid is. Adding more solar in an area swimming in large solar and wind farms has less overall impact than adding a large solar farm in an area largely served by coal or natural gas. For example, a company matching their hourly consumption with 100 percent renewable energy on a 0 percent renewable grid will actually reduce greater carbon dioxide emissions than if they are on a grid that’s already 25 percent renewable.

Another factor is matching when energy is generated to when it’s consumed. Power generated under power purchase agreements may be sent to the grid but not be used by the intended recipient when they actually need energy. Load-matching takes place when a company not only procures the output of carbon-free energy sources but tracks its consumption using sophisticated software tools like Cleartrace’s platform, to make them align as closely as possible.

Cleartrace’s initial set of customers is already using the platform to load-match renewable energy procurement and consumption in both single buildings like One Manhattan West in New York City’s Hudson Yards and large distributed real estate portfolios (e.g. more than 1500 properties in JPMorgan Chase’s footprint).

Which markets in the U.S. show better performance from a carbon emissions reduction standpoint? What pushes them forward?

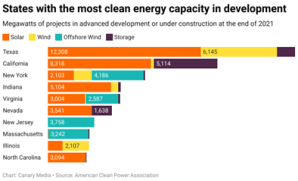

Payton: Texas, California and New York are the states with the cleanest energy capacity in development. This is in large part due to state policies and incentives to promote renewable energy development.

Some companies updated their goals to run their entire business on clean energy 24/7 by a certain year. Why should this corporate performance threshold become the norm for a company’s ESG strategy?

Payton: At the moment, 24/7 carbon-free energy is seen as a bold goal—with the likes of Google, Microsoft, Iron Mountain and others leading the charge—but we see it as one that more and more companies will be working towards to ensure they are minimizing their carbon emissions and, by extension, their liabilities.

Electricity is our most perishable commodity, produced and used within seconds. Annual or even monthly energy data can’t tell you if the energy you’re using is being supplied in the same moment with clean energy you’re procuring. Only through load-matching can companies be sure of their decarbonization impacts. But moving from early goals to this kind of strategy is a journey and one we’re helping companies accelerate with the power of data.

You must be logged in to post a comment.