What’s Ahead for Retail This Holiday Season: JLL

Consumers will visit stores in larger numbers this year to experience the holiday ambience and other benefits, a new survey indicates.

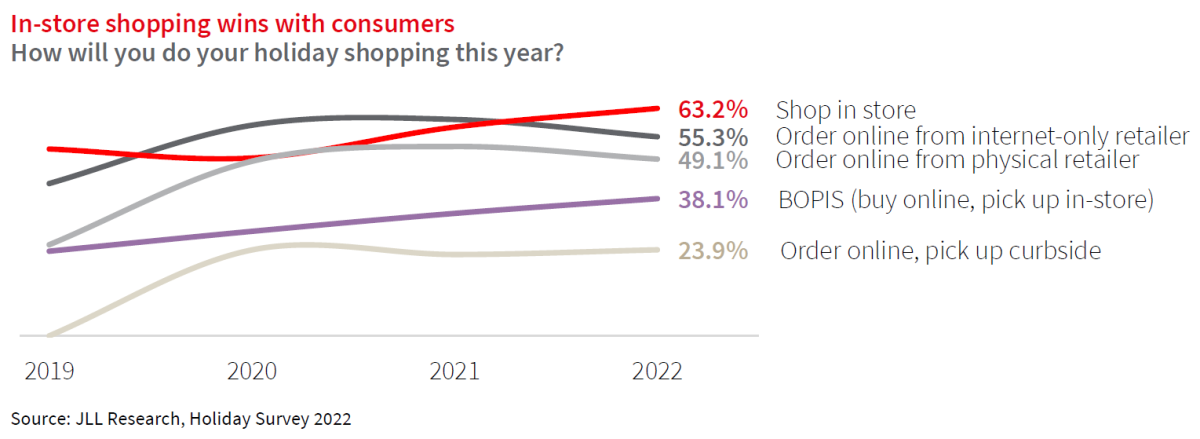

Just when it seemed that the pandemic-induced surge in online shopping would keep the majority of U.S. consumers out of the stores during the holidays for good, the tide has turned.

According to JLL’s Retail Holiday Survey 2022, most consumers are more eager to venture out beyond their laptops to do holiday shopping in 2022 than they have been in two years.

In September 2022, JLL queried 1,080 consumers regarding their holiday shopping plans, and despite the heavy hand of inflation this year, most consumers have no plans of cutting their holiday-spending budget, and the retail real estate sector is primed to accommodate.

READ ALSO: NAREE Report: Retail Real Estate’s Post-COVID Reinvention

Survey participants anticipate spending an average of $868 per person this year, compared to $870 in 2021. Approximately, 63 percent of respondents indicated that they plan to walk the store floor to do at least some of their shopping this year, placing in-store purchasing above online purchasing as the number-one holiday-shopping option for the first time since 2020.

“Consumers have reverted back to pre-pandemic levels of physical shopping versus online,” Naveen Jaggi, president of Retail Advisory Services with JLL, told Commercial Property Executive. “Stores have improved the experiential aspect of shopping by providing a cleaner and healthier environment.”

The lure of the open doors

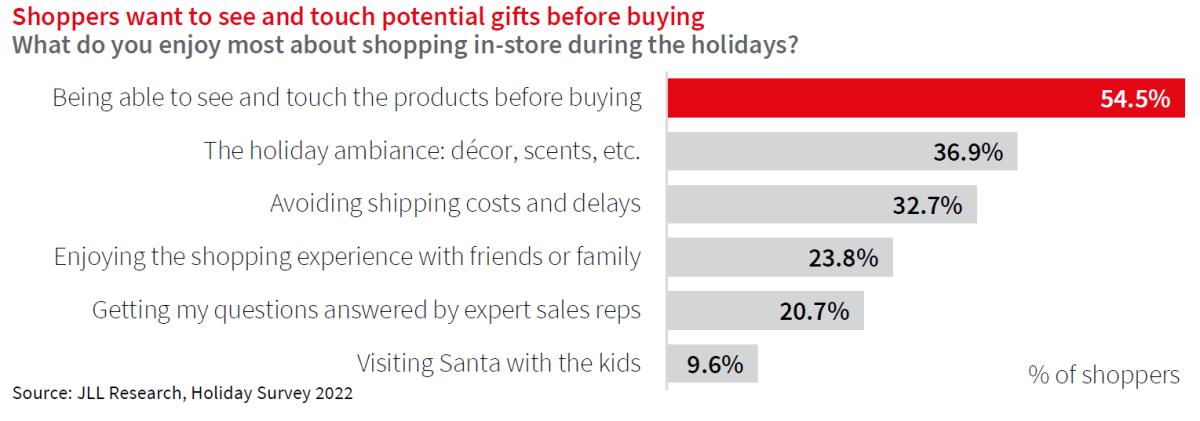

There are a handful of factors that will drive consumers into the stores this year, chief among them, the ability to touch and feel products. Approximately 54.5 percent of survey participants cited the desire to handle gifts before buying as the main reason they enjoy shopping in-store the most. A total of 26.9 percent of respondents are inclined to choose perusing the shelves over online searching so they can avail themselves of the holiday ambience, decorations and scents included. And 23.8 percent of consumers wish to be out and about to take pleasure in the shopping experience with friends and family.

Other respondents’ motivation for taking to the shops in 2022 leans toward the practical. Just over 20 percent of shoppers place a premium on the ability to consult face-to-face with expert sales representatives. For some consumers—32.7 percent of survey participants, to be exact—the almighty dollar, as opposed to festive influences, motivates their preference for in-store shopping. This segment of consumers would rather go out shopping than pay the shipping costs that accompany online buying.

“BOPIS [or buy online, pick up in store], improved layaway options and curbside delivery also encourage consumers to leave the in-home desktop experience for an improved in-person shopping experience,” Jaggi added.

Retail-segment winners

While the retail real estate sector has had its challenges, with necessity-based retail being the only segment to thrive through the pandemic, a variety of retail types from storefronts to shopping malls will benefit from the 2022 holiday season. Results of the JLL survey indicate that mass merchandisers will welcome more than 60 percent of shoppers to their locations, and department stores will see nearly 50 percent of shopping crowds pay a visit. Additionally, mom-and-pop stores will see a notable share of the shopping traffic, as 35 percent of consumers plan to open their wallets at local shops and boutiques.

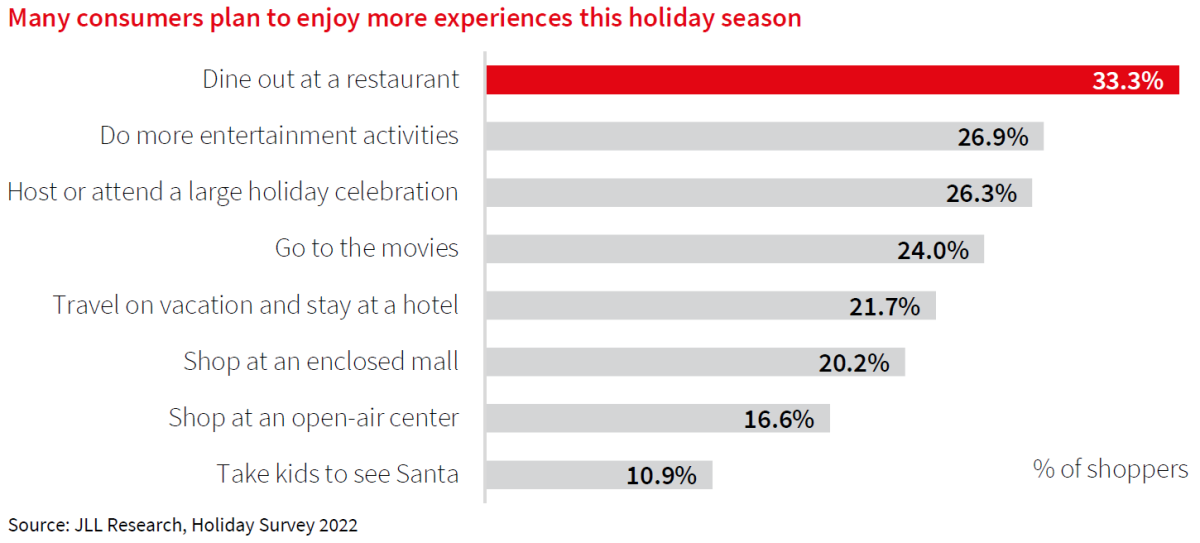

Experiences are high on the radar of shoppers this year, so restaurants will perform well, as 33.3 percent of respondents anticipate dining out more during the holiday season. Retailers in the eatertainment and bar categories will get a boost as well, as more than 25 percent of survey participants plan on partaking in additional entertainment activities. Movie theaters will also grab 24 percent of consumers’ dollars during the holidays.

Elephant in the room

Although an increasing percentage of consumers will visit stores during the 2022 holidays, the majority of them will count an e-tailer as their top shopping source. According to JLL’s survey results, Amazon continues to head the list of preferred retailers. However, a chain store is cutting into the e-commerce giant’s hold on shoppers, pushing the number-one spot down from 65.6 percent of consumer preference in 2021 to 64.3 percent in 2022. Walmart remains in the number-two spot, but it can expect to see its visitors increase year-over-year from 45.3 percent to 47.9 percent.

JLL’s survey findings are beginning to play out in stores across the country right now. “Retailers are starting holiday promotions in October to motivate consumers to shop sooner, and by visiting the stores giving their consumers a more relaxed shopping experience than waiting for the holiday rush,” Jaggi said. “And with the disrupted supply chains not back to pre-pandemic levels consumers are enticed to shop in October.”

Black Friday will be the highest traffic day for stores, from boutiques to mass merchandisers, as 39.7 percent of respondents plan to go out to do shopping on the busiest shopping day of the year. Cyber Monday will bring 26.4 percent of shoppers back into the stores.

You must be logged in to post a comment.