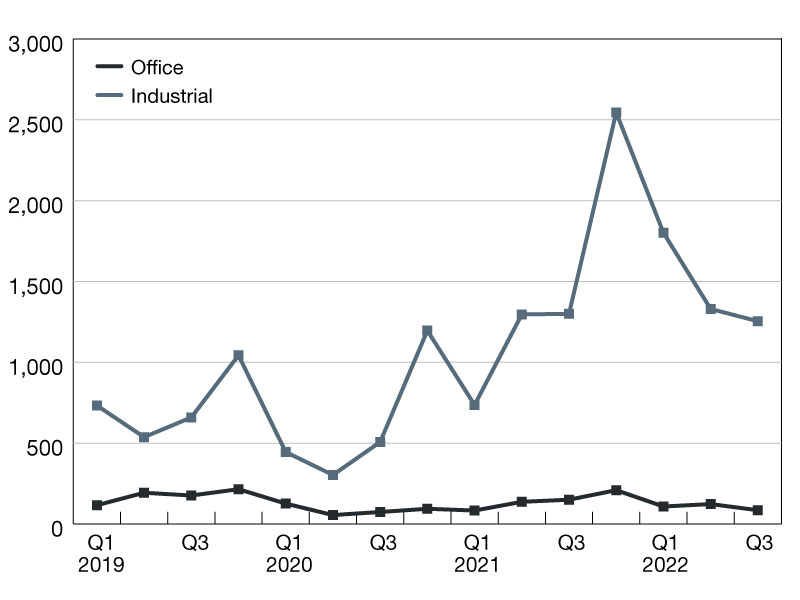

Commercial/Multifamily Borrowing Declines 13% in Q3

Year-over-year, office originations fell the most, according to the Mortgage Bankers Association.

Source: Mortgage Bankers Association

Commercial and multifamily mortgage loan originations decreased 13 percent in the third quarter of 2022 compared to the same period last year, according to our latest Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations, released earlier this month.

After a strong first half of the year, rising interest and capitalization rates began to affect deal volume during the third quarter. Increasing yields across investment alternatives—including the 10-Year Treasury yield more than doubling during the first nine months of the year—have shifted property financing and values, and it will take time for the market to fully absorb these changes.

Different capital sources have felt the slowdown in different ways – with third-quarter originations in the CMBS market down almost 75 percent from a year earlier, while originations by banks and other depositories were 25 percent higher. A broad decline in transaction activity is likely to impact all capital sources, although perhaps not equally.

Compared to a year earlier, a fall in originations for office, multifamily, and retail led to the overall decrease in commercial/multifamily lending volumes. By property type, office decreased by 44 percent, multifamily decreased by 16 percent, retail decreased 6 percent, and industrial decreased 4 percent. Lending backed by hotel properties increased 24 percent, and health care increased by 61 percent. Among investor types, the dollar volume of loans originated for Commercial Mortgage-Backed Securities (CMBS) decreased by 71 percent year-over-year, life insurance company portfolios decreased 42 percent, government sponsored enterprises (GSEs – Fannie Mae and Freddie Mac) decreased 15 percent, and investor-driven lenders decreased 8 percent. Originations for depositories increased by 25 percent.

On a quarterly basis, third-quarter originations for office properties decreased 31 percent compared to the second quarter of 2022. There was a 27 percent decrease in originations for retail properties, a 21 percent decrease for health care properties, a 12 percent decrease for multifamily properties, and a 6 percent decrease for industrial properties. Originations for hotel properties increased 45 percent. Among investor types, the dollar volume of loans for life insurance company loans decreased 37 percent, Commercial Mortgage-Backed Securities (CMBS) decreased 35 percent, originations for investor-driven lenders decreased 22 percent, and loans for depositories decreased 7 percent. Originations for the government sponsored enterprises (GSEs – Fannie Mae and Freddie Mac) increased 17 percent.

Overall volatility has been equally impactful, making the sizing of transactions extremely difficult. The result has been the first of what may be many quarters of depressed borrowing and lending activity.

To see the latest report, click here.

You must be logged in to post a comment.