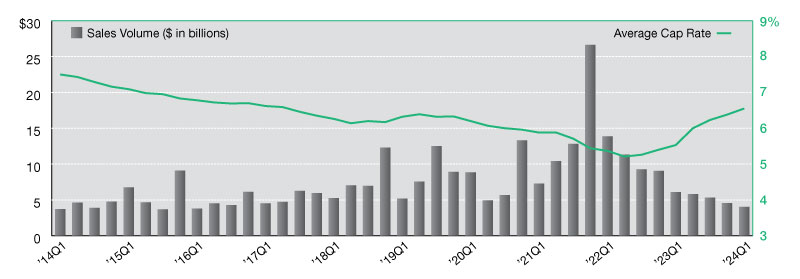

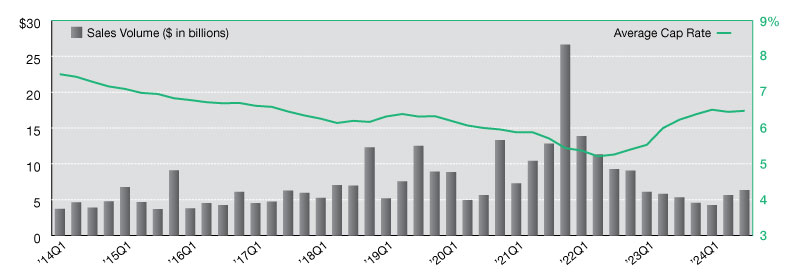

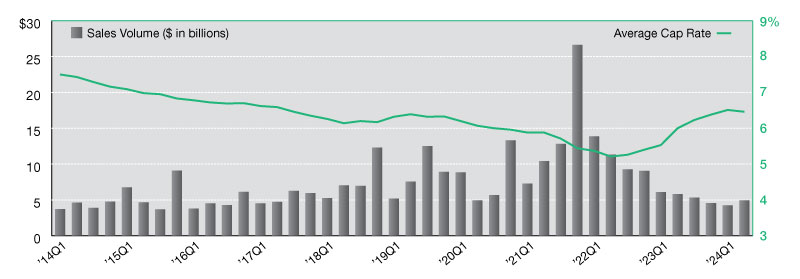

2024 Industrial Net Lease Sales and Cap Rates

Where are these trends heading? The latest update from Northmarq.

In third quarter 2024, the single-tenant industrial market remained on a path of reporting increasing sales volume. With $6.35 billion logged in the last three months, third quarter’s performance brings the year-to-date activity level to more than $16.2 billion.

If current momentum stays flat in fourth quarter, the sector would be on pace to just narrowly miss last year’s annual total, but with another 12 percent quarterly jump in activity, as was witnessed this reporting period, the sector will easily surpass last year’s performance.

READ ALSO: Industrial Sales Prices Inched Up in 2024

Average cap rates for net lease industrial transactions have, at least temporarily, leveled off. In the past two years, the market witnessed a series of sharp quarterly increases, taking the average from a low of 5.22 percent at mid-year 2022 to a recent high of 6.51 percent in first quarter 2024. Since then, rates have fluctuated only a few basis points each quarter and now sit at an average of 6.48 percent. By region, the industrial market has a narrower spread than other net lease sectors of just 99 basis points between the Northeast’s low average of 5.84 percent and the Southwest region at 6.83 percent.

Very little fluctuation has been seen across the buyer pool for single-tenant industrial assets in recent years. Most notably, there has been a slight uptick in international investor activity, with portfolio and single-asset transactions concentrated in the eastern U.S.’s primary and secondary markets. REIT activity, on the other hand, has declined somewhat from 2023, as this investor group has more frequently been pursuing net lease office and retail acquisitions this year.

—Posted on December 30, 2024

The single-tenant industrial market was the only sector to report an increase in sales volume from first to second quarter 2024. Despite the 17 percent uptick, transaction activity is still comparatively low to totals seen in the last few years. With $4.95 billion closed in the last three months, the sector still isn’t on pace to match last year’s performance, and a significant rebound in activity by year-end is not likely given that interest rates remain elevated.

Still, investors continue to seek out industrial properties, especially in markets with extremely low vacancy and slow new construction activity. Tenant demand in these areas that lack supply is helping to drive rents up, which is attractive for investors seeking yield.

READ ALSO: Why Light Industrial Properties Will Continue to Shine

Similar to the single-tenant office market, the industrial sector reported a jump in average cap rates at the beginning of the year, with a 16-basis-point increase from year-end 2023. Rates then declined in the second quarter by 5 basis points to the current average of 6.46 percent. Given the large increase in such a short period of time, it’s possible industrial cap rates could fluctuate in the remaining months of 2024. Any declines, however, are likely to be insignificant and short-lived, as the general trend has been leaning toward increases since cap rates bottomed two years ago.

Buyer activity for single-tenant industrial product has been extremely consistent in the last several years. In the first six months of 2024, private investors continue to be the most active buyer group, with 37 percent of the market. They are followed by institutional investors at 24 percent and REITs at 12 percent. International investors have been more active this year than historically, but the breakdown is extremely similar to overall ratios witnessed this decade. This suggests investors remain committed to their strategies of including industrial assets in their portfolios.

—Posted on September 30, 2024

The single-tenant industrial sector has recorded nine consecutive quarters of declining investment sales volume. With just over $4 billion logged for first quarter 2024, this is the sector’s slowest reporting period in eight years. So, is industrial falling out of favor with investors? Likely not.

Despite activity falling 11 percent quarter-over-quarter and nearly 34 percent year-over-year, many investors remain bullish on the sector given its mission-critical nature for retailers, manufacturers and more. Today’s interest rate environment, combined with other economic and political influences, are naturally contributing to slower investment volume. However, vacancy remains low which is helping to buoy rents, and demand from tenants remains healthy, even if some maintain a cautious outlook.

One challenge the sector will face in the coming years will be new supply. Construction pipelines are drying up, and with fewer groundbreakings, more tenants and investors will find themselves competing for the limited assets that do become available for lease or sale.

In recent weeks, there have been several notable announcements regarding growth across the single-tenant industrial sector. Amazon announced the expansion of its same-day delivery services, with plans to reach 100 hubs—nearly doubling the current amount. Dairy producer Fairlife broke ground on a $650 million milk processing plant in New York, which is set to be operational by late 2025, and KYOCERA began construction on a new electronics manufacturing property in Pennsylvania.

These and other developments—including Central Ohio’s Honda/LG battery plant that should deliver later this year, the TSMC’s chip plant in Phoenix and Savannah’s EV manufacturing plant by Hyundai—are just some of the projects currently underway that illustrate today’s demand for industrial facilities. However, owner-occupied assets won’t help to satisfy investor demand, and new build-to-suit single-tenant projects may be the only solution for expanding tenants if vacancy and levels of speculative development remain slow.

—Posted on May 30, 2024

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq. She is responsible for leading the content strategy for the firm and producing research reports in support of the organization’s commercial investment sales division. Beck joined Northmarq in 2022 following the acquisition of Stan Johnson Co., where she had led corporate research, marketing and communications efforts since 2013.

You must be logged in to post a comment.