Where to Find Office Investment Opportunity Now

A coast-to-coast roundup of insights on six high-potential markets in this volatile sector.

Incomm Agent Solutions sold Biscayne Center, a 156,849-square-foot office asset in North Miami, Fla. Image courtesy of CBRE

The growing pressure on the office sector is one of the key real estate trends of 2023. As CommercialEdge data shows, national investment volume dropped 73 percent year-over-year during the first quarter to just $5.7 billion. Yet amid the turmoil, experts note that some major markets are showing resilience, even in the face of fast-changing work models.

According to CommercialEdge data, office investment across the U.S. year-to-date through March totaled $5.7 billion. This accounted for a 72.7 percent decrease from the same time in 2022, when $21.1 billion in office assets was sold. While the office investment landscape is expected to shift further, some markets seem to be more resilient in the face of upcoming changes.

“I would emphasize the submarkets and locations within each market and product type more than specific markets,” Anita Kramer, senior vice president of the Urban Land Institute’s Center for Real Estate Economics and Capital Markets, told Commercial Property Executive. “There appears to be a bifurcation in the office sector, similar to what we’ve seen for decades in the retail sector, with newer buildings in well-connected, walkable locations getting the lion’s share of leasing—and subsequently, investor attention.”

READ ALSO: ULI, PwC Pick These CRE Trends to Watch for in 2023

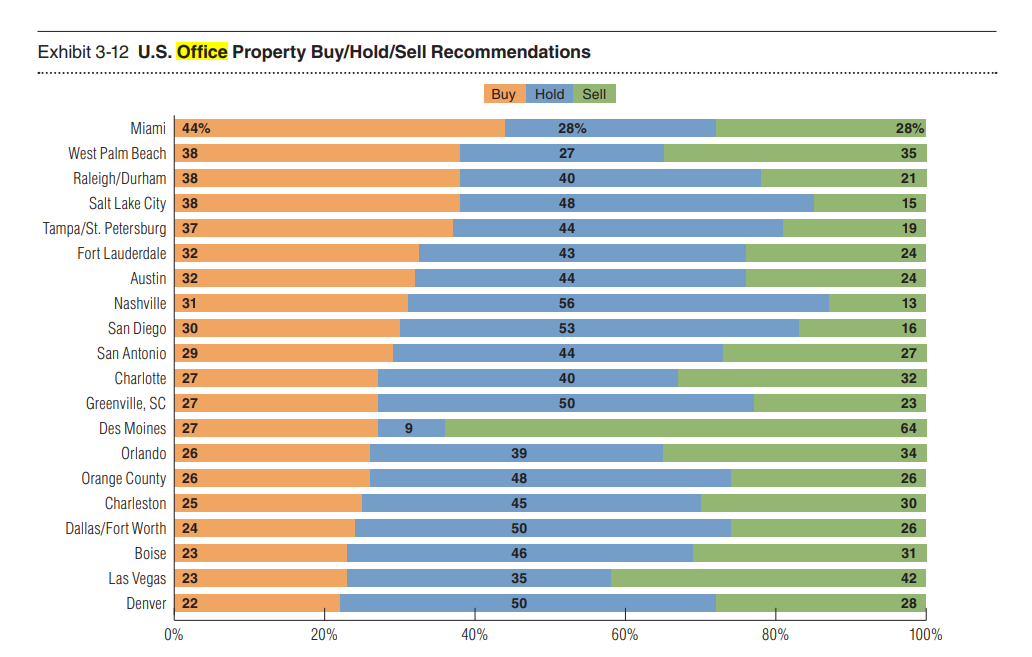

ULI and PwC’s report on Emerging Trends in Real Estate 2023 suggests that certain office markets are likely to see strong investment performance in the coming years. Exhibit 3-12 presents the 20 markets that received the highest proportion of ‘buy’ recommendations for office investments compared to other options like ‘hold’ or ‘sell.’

However, when comparing these percentages to similar exhibits for industrial and multifamily sectors, it becomes evident that the markets in those sectors have significantly stronger ‘buy’ recommendations. This highlights the uncertainty that surrounds the office market, although there are some relatively strong office markets when compared within the sector, Kramer explained.

To determine future office investment opportunities in 2023 and beyond, we analyzed investment volume data from CommercialEdge year-to-date as of March, considered metrics and forecasts from the ULI and PwC report, and consulted local experts.

1. Boston

As a market with a strong academic presence and a thriving health-care industry, Boston offers investors an opportunity to tap into a highly educated and skilled workforce. The PwC and ULI report names it as one of the nation’s knowledge and innovation centers and an ongoing world leader in life sciences.

According to a recent CBRE U.S. Life Sciences outlook, the life sciences industry—which experienced remarkable growth during the health crisis—has returned to a more typical rate of expansion in 2023. However, the demand for laboratory and research and development space continues to outperform pre-pandemic levels.

While the volume of investment sales in the sector has decreased to pre-COVID-19 levels, prices remain high and capitalization rates are at record lows due to strong investor confidence, positioning Boston as the first-ranked market for office investment on our list.

Office transaction volume during the first quarter of 2023 amounted to $680 million, CommercialEdge data shows. While this represents a steep decline from the $2.3 billion recorded in the first quarter of 2022, the market encompassed 10.5 percent of the nation’s total office sales volume at the end of March. Moreover, the average sale price for an office asset was $555 per square foot at the end of the first quarter, well-above the national rate of $195 per square foot.

Investment activity was concentrated in the Route 128 Central submarket, where TPG Real Estate sold CenterPoint, a 578,130-square-foot life sciences campus in Waltham, Mass. The property was acquired by Capital Management for $578 million, commanding nearly $1,000 per square foot.

2. Miami

Miami has experienced consistent economic growth over the years, driven by sectors such as finance and international trade. The market has diversified its economy beyond its traditional reliance on tourism, becoming a regional hub for a diverse range of industries, and providing investors with a range of opportunities to capitalize on its growing commercial real estate market.

Office sales totaled $435 million year-to-date in March, a 45 percent increase from the $239 million recorded in the first quarter of 2022. Assets traded at an average of $396 per square foot, twice the national average. The region has experienced accelerated growth due to an increasing number of individuals being attracted to its climate and favorable business conditions since the start of the pandemic.

In the Biscayne Corridor, Incomm Agent Solutions sold Biscayne Center, a 156,849-square-foot office asset in North Miami, Fla. The property changed hands in a $39 million deal in March, and underwent conversion from condos right before it was sold. Going forward, as Miami continues to attract businesses from around the globe, it is poised to sustain its momentum and serve as a thriving hub for office investment throughout the year.

3. San Diego

San Diego’s office sector is supported by a diverse range of industries, including defense contractors, health-care providers, life sciences firms and technology companies, as well as a thriving technology and biotechnology market. The presence of many universities has facilitated the growth of a vibrant biotech ecosystem and incubator culture, with the metro being a premier life sciences market as we continue into 2023.

Office investment volume in San Diego totaled $302 million year-to-date through March, accounting for a 54.2 percent decrease from the $660 million sold in the first quarter of 2022, according to CommercialEdge data. Office assets traded at an average of $295 per square foot, three times more than the national average of $195 per square foot.

According to Peter Quinn, senior vice president and investments specialist within Kidder Mathews’ San Diego office, the Carmel Valley/Del Mar Heights and University Town Center submarkets have been the most sought-after and stable office markets in the past several years. That has been reinforced in the post-pandemic period due to proximity to quality office product, executive housing, shopping and the Pacific Ocean.

The Kearny Mesa submarket emerged as the hottest area in terms of office investment in the first quarter of 2023. Three assets totaling 400,000 square feet sold for $185.4 million, with the largest sale consisting of Rexford Industrial’s acquisition of Cubic Corp.’s headquarters.

Quinn believes the pandemic has affected San Diego’s office marketplace and expects 2023 to be a slow year for new investment transactions as institutional and private investors continue to press the pause button.

"As financial markets stabilize—hopefully later this year—investors will be back in the market," Quinn said. "Traditional office investments are facing significant headwinds as valuations have taken a hit due to return expectations from investors and continued hesitancy to return to the office from workers and their employers manage through the hybrid-work model," he added.

4. New Jersey

New Jersey has adapted to the post-pandemic new normal by implementing and supporting remote work policies and investing in digital infrastructure. Demand for data center capacity occurs across North America but is most heavily concentrated in 10 primary markets, with the Northern New Jersey region emerging as one of the leaders in the field.

The market’s office investment landscape is impacted by a spillover effect from nearby Manhattan, where the price per square foot for office assets surpassed the $1,000 mark, CommercialEdge data shows. The waning office market in the borough has prompted office investors to redirect their attention and allocate their capital toward adjacent office markets.

Year-to-date as of March, office sales in New Jersey amounted to $280.8 million, representing a 78.4 percent decrease from the $1.3 billion sold in 1Q 2022. What’s more, office assets changed hands at an average of $106 per square foot, well below the national average of $195.

Most of the activity in the market is driven by single-asset purchases, with the Cranford-Union submarket emerging as the most active area. Here, two buildings changed hands for a combined $195 million. In February, Merck Sharp & Dohme sold its former world headquarters, a 108-acre Class A life science campus in Kenilworth, N.J., to a joint venture between Onyx Equities and Machine Investment Group. The $187.5 million sale included more than 1.4 million square feet of laboratory space, 500,000 square feet of office space, as well as 30 acres of developable land.

Like Boston and San Diego, New Jersey's life sciences industry exhibits strong demand, driven by the state's reputation as a leading hub for pharmaceutical and biotech sectors.

5. Orange County

According to PwC and ULI’s report, Orange County is the second—and one of the few—California markets where investment might be headed in 2023. Dominant office demand drivers in the metro include strong demographics, major education centers, entrepreneurial business cultures and growing, high-margin industries.

Like many other metros on this list, office investment in Orange County recorded a noteworthy decline when compared to last year’s figures. A total of $253 million was sold in the first three months of 2023, a 39.6 percent decrease from the $419 million sold during the same timeframe last year. The average sale price for an office asset was $239.16 per square foot, 18.5 percent above the national average.

Investment activity in the first quarter of the year was concentrated in the Irvine Business Complex, where $140 million worth of assets traded. According to Rick Putnam, executive vice president and investments specialist at Kidder Mathews’ Orange County office, the best-performing submarkets continue to be nodes with the best office product, attractive to growing industries. He distinguished the Newport Center district, the airport area and South County as being highly sought-after, thanks to activity fueled by the financial, software and biotech industries.

While PwC and ULI metrics predict a favorable future for Orange County’s office investment landscape, Putnam’s forecast involves more caution.

"A very uneven, haves and have-nots performance among specific office assets and submarkets will make for wide disparities in investment performance, while the growth of the office stock will be close to zero for the next few years, as we work through a repositioning of many assets and the financial recapitalizations which that implies," he continued.

6. Tampa-St. Petersburg-Clearwater, Fla.

Favorable demographics drive a continuous influx of residents to Florida, specifically the Tampa-St. Petersburg-Clearwater metro. Unlike other locations, the area faces geographical constraints imposed by water bodies, which restrict urban sprawl and contribute to a more focused and efficient urban development. The health-care, insurance and cybersecurity subsectors lead demand for office space.

According to CommercialEdge, office sales in the metro in the first quarter of 2023 totaled $196 million, with assets trading at an average of $165 per square foot, or 18.2 percent more than the national average of $195. The volume represents a 142.5 percent increase from the $81 million sold during the same time in 2022.

Investment activity was concentrated in the Westshore submarket, where sales totaled $86 million year-to-date through March. The submarket boasts a prime location, situated in close proximity to Tampa International Airport, major highways and downtown Tampa, making it an ideal choice for businesses that value convenience and easy connectivity.

Ken Lane, principal & managing director of Avison Young’s Tampa operations, believes the success of this submarket could be attributed not only to its new inventory, but all of the walkable amenities within its projects. Anticipating a restructuring of the interstate system around the district, developers continue to push more multifamily projects and restaurants. Others look at underperforming buildings to modify or recreate a mixed-use option on the same site. The Westshore Alliance is pushing to make everything more walkable and bike-friendly for everyone.

"While the office market from an investment standpoint is a little challenging today due to back-to-work and lending constraints, I do want to remind people that office is not dead," Lane said. "Just like retail experienced more than seven years ago, office is being redefined. From this, I believe the investors which recognize this early on will see the biggest returns once it becomes popular to invest in again. With this said, the future office will need to have more amenities offered to the tenant and its staff. If the amenities are not within the building, they need to be within a few minutes’ walk," he concluded.

You must be logged in to post a comment.