Commercial Real Estate Relies Less on Consumer Behavior Data Than Other Industries – That Needs To Change

58 percent of CRE Data Leaders Say They’ve Missed Opportunities Due to Insufficient Data

Like many other industries, Commercial Real Estate has been profoundly impacted by changes in consumer behavior in recent years. However, CRE organizations may be less likely than organizations in other industries to be fully utilizing consumer behavior data to guide the way, according to Near’s new study, the State of Global Consumer Behavior Data.

Like many other industries, Commercial Real Estate has been profoundly impacted by changes in consumer behavior in recent years. However, CRE organizations may be less likely than organizations in other industries to be fully utilizing consumer behavior data to guide the way, according to Near’s new study, the State of Global Consumer Behavior Data.

Near surveyed 590 data leaders across Commercial Real Estate, Retail, Restaurants, and Travel & Hospitality. The survey found 78 percent of data leaders agree that “consumer behavior data is critical for our team’s business decisions.” However, looking specifically at 81 data leaders in Commercial Real Estate who answered the survey, just 54 percent agree. This lower reliance on consumer behavior data could be costing CRE organizations opportunities.

In fact, 58 percent of data leaders in CRE agree that “our organization has missed business opportunities due to insufficient data,” well above the 40 percent of leaders overall who agree with that statement. To understand what’s happening, we explored some of the challenges data leaders in CRE face.

Hurdles Data Leaders Face in CRE

Compared to other industries, applying consumer behavior data to Commercial Real Estate poses some unique challenges. First, the product in CRE is highly heterogeneous, making it especially difficult to uniformly develop and apply models. Additionally, the timeline of CRE projects is protracted, often taking years between the initial decision around site selection and the completion of a development.

To add to those industry-specific challenges, CRE data leaders cited 3 top hurdles to using consumer behavior data for decision-making:

- Finding sources of high-quality data (38 percent)

- Technical challenges of blending data (32 percent)

- Not enough technical expertise in-house (28 percent)

Notably, data leaders in CRE were more likely to select two of these challenges than data leaders overall: finding sources of high-quality data (38 percent vs. 34 percent overall) and not having enough technical expertise in-house (28 percent vs. 23 percent overall). Concerns around data quality could be one key reason that data leaders in CRE were more likely to agree that “our organization has a lot of data but isn’t effective in regularly using it to inform decisions” (45 percent vs. 39 percent overall).

How Leaders in CRE Use Consumer Behavior Data – Key Use Cases and Insights

When they do overcome these hurdles, data leaders in CRE are more likely to hone in on a few key use cases. They say consumer behavior data is critical for 2.4 use cases on average, lower than the 3 for data leaders overall.

The top 3 use cases for CRE data leaders are:

- Site Selection & Real Estate Acquisition / Disposition (42 percent)

- Market Research (38 percent)

- Store Formatting & Merchandising (30 percent)

CRE data leaders are more likely to prioritize Site Selection as a use case than data leaders overall (42 percent vs. 23 percent).

Looking at the specific insights from consumer behavior data that they find most useful, CRE data leaders prioritize understanding visitors’ Home Location (41 percent) and Work Location (38 percent) as critical above all other insights. While Demographics come in as their third most valued insight (36 percent), CRE data leaders are less likely to value Demographics than data leaders overall (52 percent).

Looking Ahead and How CRE Can Embrace Data

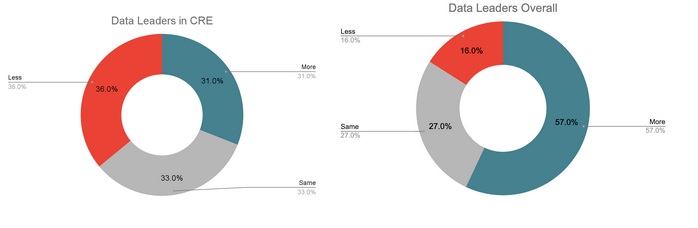

Looking ahead, data leaders in CRE say their top priority for data in the coming year is “doing more to integrate siloed data across departments” (47 percent). However, on balance they are planning to use less consumer behavior data for decision making in the coming year — with 36 percent of CRE data leaders saying they plan to use less and just 31 percent planning to use more.

Looking ahead to the next 12 months, does your organization plan to use less, more, or about the same amount of consumer behavior data for decision making as it did in the past 12 months?

This is significantly different from data leaders overall, of whom 57 percent plan to use more, versus just 16 percent who are planning to use less.

Steering away from using consumer behavior data is a risky move. CRE projects can be extremely complex and expensive, and consumer behavior data presents a much-needed way to reduce blind spots and risks. While implementing an effective data strategy for CRE presents some specific challenges, it can also uncover incredible opportunities and competitive advantages.

To get started, or expand your organization’s use of consumer behavior data, it first helps to have a data champion in the company to get teams working better with data. The good news is that many CRE organizations have that — 69 percent of data leaders in CRE reported that their organization does have a Chief Data / Digital / Information / Innovation / Technology Officer or similar role (slightly higher than 65 percent for data leaders overall).

Once a data champion is in place, there are some key steps they can take to help teams effectively use data for decision making:

- Start with clear, specific questions and use cases you want to address

- Highlight elements that are easy to understand – e.g. trade area visualizations — before getting into more technical analysis

- Equip teams with templates and guidelines for utilizing the data

- Help teams understand how to interpret the data — and how to use it in a pitch

By ramping up a strategy around consumer behavior data, CRE organizations can reduce risk in site selection, increase visibility around competitor locations, attract the best tenants for each location, keep up with market changes, and more.

Want to learn more? See how data leaders can leverage real estate analytics, or read the full study, The State of Global Consumer Behavior Data.

You must be logged in to post a comment.