Commercial, Multifamily Mortgage Delinquency Rates Increased in Q1 of 2023

The Mortgage Bankers Association's latest analysis shows an uptick.

Commercial and multifamily mortgage delinquencies increased in the first quarter of 2023, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Delinquency Report, released earlier this month.

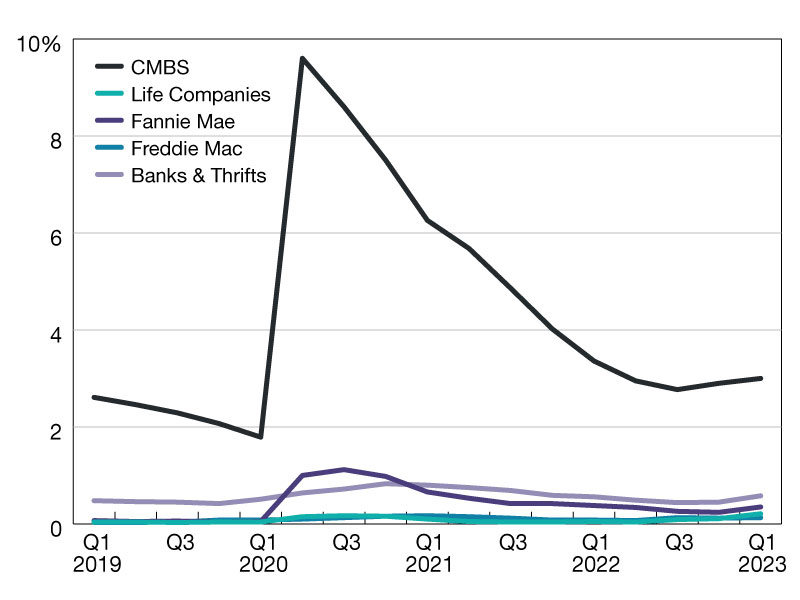

Ongoing stress caused by higher interest rates, uncertainty around property values, and questions about fundamentals in some property markets are beginning to show up in commercial mortgage delinquency rates. Delinquency rates increased for every major capital source during the first quarter, foreshadowing additional strains that are likely to work their way through the system.

MBA’s quarterly analysis looks at commercial/multifamily delinquency rates for five of the largest investor-groups: commercial banks and thrifts, commercial mortgage-backed securities (CMBS), life insurance companies, and Fannie Mae and Freddie Mac. Together, these groups hold more than 80 percent of commercial/multifamily mortgage debt outstanding. MBA’s analysis incorporates the measures used by each individual investor group to track the performance of their loans. Because each investor group tracks delinquencies in its own way, delinquency rates are not comparable from one group to another. As an example, Fannie Mae reports loans receiving payment forbearance as delinquent, while Freddie Mac excludes those loans if the borrower is in compliance with the forbearance agreement.

Based on the unpaid principal balance (UPB) of loans, delinquency rates for each group at the end of the first quarter of 2023 were as follows:

- Banks and thrifts (90 or more days delinquent or in non-accrual): 0.58 percent, an increase of 0.13 percentage points from the fourth quarter of 2022;

- Life company portfolios (60 or more days delinquent): 0.21 percent, an increase of 0.10 percentage points from the fourth quarter of 2022;

- Fannie Mae (60 or more days delinquent): 0.35 percent, an increase of 0.11 percentage points from the fourth quarter of 2022;

- Freddie Mac (60 or more days delinquent): 0.13 percent, an increase of 0.01 percentage points from the fourth quarter of 2022; and

- CMBS (30 or more days delinquent or in REO): 3.00 percent, an increase of 0.10 percentage points from the fourth quarter of 2022.

To download the current report, visit: https://www.mba.org/news-and-research/research-and-economics/commercial-multifamily-research/commercial-multifamily-mortgage-delinquency-rates.

You must be logged in to post a comment.