AI Drives Explosive Growth in Data Center Demand

Some primary markets are supply-constrained and users could find limited options unless they plan ahead, according to a new JLL report.

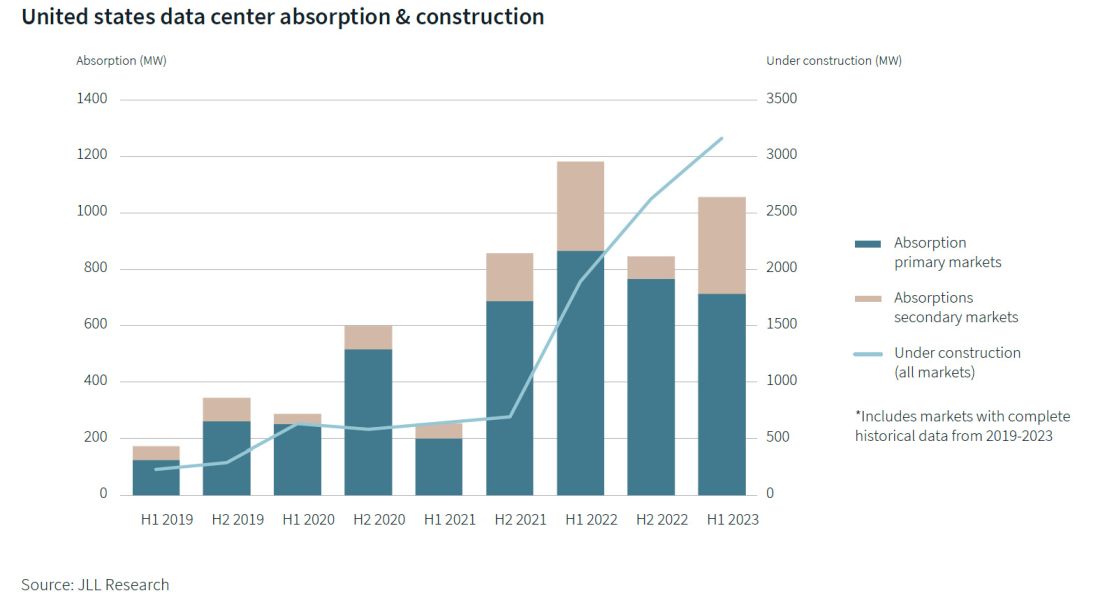

Artificial intelligence requirements and continued adoption of cloud services are driving record growth in the data center sector leading to a supply and demand imbalance in primary U.S. markets, where pricing is up by 20 to 30 percent for locations with a limited amount of colocation space, and in many secondary markets, according to a new JLL report.

JLL’s H1 2023 North American Data Center Report states most of the supply being delivered in the third and fourth quarters has already been preleased or is under exclusivity. Supply coming online in 2024 will also be preleased due to primary market power constraints resulting in limited options for users who have not secured space far ahead of their go-live dates.

READ ALSO: Data Centers Proliferate Despite Global Roadblocks

Managing Director Andy Cvengros said in a prepared statement the development timeline for new data centers has grown to three to five years or more in some cases as the demand increases. Supply chain issues and lack of available land with onsite and scalable power to satisfy future requirements are adding to longer data center development timelines. Cvengros said the explosive growth in demand is leading to completely sold-out primary markets, secondary market expansion and the development of newer tertiary markets.

The report notes that in the first half of 2023, Phoenix and the Northwest outpaced Northern Virginia, the largest data center market among primary markets, with an absorption of 194.5 MW and 185.9 MW, respectively, compared to 184 MW. Secondary markets, including Salt Lake City; Reno, Nev.; and Austin, Texas, will be taking the overflow from constrained primary markets.

The high interest rate environment, which has impacted some other commercial real estate sectors, does not seem to be an issue for the data center market. JLL reports lender and investor demand was strong for the first half of the year with the sector seeing record-setting M&A activity continuing and attracting a variety of lenders including life companies, banks, debt funds and CMBS/SASB.

AI, edge computing boost demand

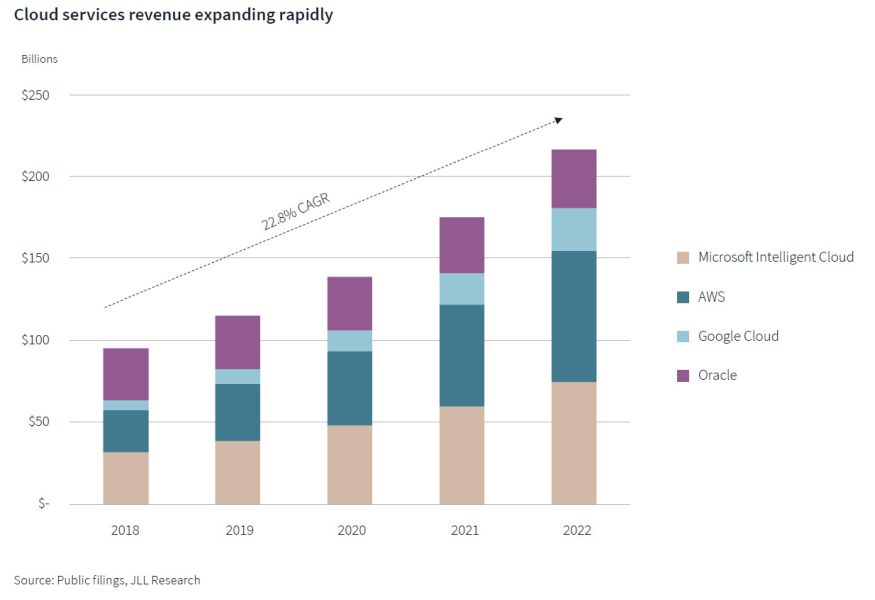

The major cloud service providers are expanding rapidly to support the growing demand. JLL notes Microsoft Intelligent Cloud, AWS, Google Cloud and Oracle have seen a combined 22.8 percent compound annual growth rate from 2018 through 2022. Hyperscalers, financial firms, health-care companies and other major enterprises are all competing for data center space leading to record absorption for the first half of 2023. Much of that accelerated demand is coming from an increasing number of companies and industries adopting AI as an important tool for meeting corporate objectives.

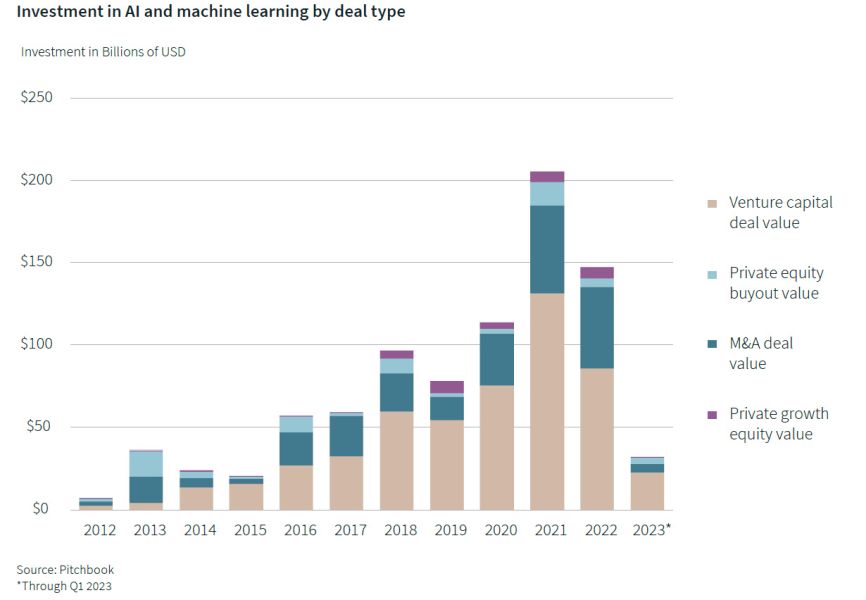

The report states venture capital, private equity and M&A activity generated $32 billion in AI and machine learning investments through the first quarter of 2023. Kari Beets, senior manager, research, at JLL, said in prepared remarks AI implementation requires significant computer power and resources, which is resulting in increasing data center leasing. Investment bank TD Cowen reports 2.1 GW of U.S. data center leases were inked in the second quarter, much of it attributed to satisfy AI developments. AI also needs higher power densities so additional infrastructure is needed at most existing data centers, Beets added. However, JLL notes additional innovations will be needed to improve cooling and energy efficiency for AI users due to sustainability goals of hyperscalers and colocation providers.

Investment in AI and machine learning by deal type, through Q1 2023. Chart by Pitchbook, courtesy of JLL

The demand for edge computing is also accelerating data center demand as cloud companies leverage edge to enhance scale and delivery of AI applications including ChatGPT and Google’s Bard. Hyperscalers and cloud companies are building smaller data centers ranging from 2 to 10 MW closer to population centers outside of core markets.

Market closeups

Northern Virginia is still seeing high demand, but users are finding a lack of available options over 1MW, and land sales are migrating farther south as few sites of scale remain in Loudoun and Prince William counties. With a vacancy rate of less than 2 percent, rents are up 15 to 20 percent year-over-year, according to JLL. For the first half of 2023, 163MW of multi-tenant data center space and 203MW of single-tenant inventory were delivered. With a total inventory of 47.7 million square feet, only 167,000 square feet was available. About 6.7 million square feet are under construction and another 45 million square feet are planned.

Demand in the Phoenix market remains strong from hyperscale and retail tenants, but available turnkey supply is very limited. Hyperscale tenants are snapping up space as soon as locations are announced, and preleasing is the norm. About 1.5 million square feet of space is under construction, with another 6.7 million square feet planned.

The Pacific Northwest is on pace for record-setting absorption in the first half of 2023. Projects under construction are up 68 percent, with nearly all developments fully preleased. The amount of land available in the popular Hillsboro, Ore., submarket is becoming constrained and JLL suggests users look to Washington state as an alternative due to tax incentives and availability. Quincy, Wash., is already seeing strong absorption for the first half of 2023. Overall, the Northwest market has about 2 million square feet of space under construction, with 1.2 million square feet planned.

The supply in Nevada, one of the hot secondary markets, is growing significantly with new campuses in Las Vegas and Reno. Novva Data Centers is building campuses in each city for a total of 160 MW. EdgeCore is planning multiple buildings at its Reno campus, which will add about 200 MW. The total Nevada inventory is about 1.3 million square feet, with 460,000 square feet under construction and 1 million square feet planned. JLL states users who want to be in Nevada need to negotiate now if they need capacity within two to three years.

Salt Lake City, another growing secondary market, is seeing providers and hyperscalers actively pursuing expansions. Novva is also active here, preleasing space as it brings more power to its campus. JLL notes preleasing is now more common in the market, which has a total inventory of about 1.1 million square feet of space, with 65,750 square feet under construction and 1.9 million square feet planned.

While still considered a secondary market, the Austin/San Antonio region is growing, and providers are looking to prelease upcoming capacities in both. JLL notes providers are looking for deregulated power north of Austin, where municipal approvals have allowed more development. With only about 4,996 square feet of space available out of a total inventory of 4 million square feet, rates are increasing. The market has about 2.5 million square feet under construction and 5.2 million square feet planned.

You must be logged in to post a comment.