Discount Grocers Stocking CRE Opportunity

Shoppers across all incomes now favor these stores, boosting demand for small-format, short-term leases.

Amid continuing change in the retail industry, one sector that’s offering shopping carts full of promise is the discount grocery channel. Chains such as Aldi, Lidl, Grocery Outlet, and deep discounters Dollar Tree and Dollar General have consistently opened new stores. Monitoring how, where and by how much they expand will serve real estate owners and investors well in the years ahead, experts say.

Small-footprint Aldi’s August announcement it will acquire 400 larger-footprint Winn-Dixie and Harvey’s supermarkets in early 2024 holds special meaning for investors and owners. So said Daniel Gielchinsky, founding partner of DGIM Law in Miami, Fla.

“The beauty of the smaller discount retailers is they’re a third of the size of the retailer that used to be there,” he said. “That enables the owner to create a mix of businesses to attract consumers to that location. These tend to be lifestyle destinations such as a movie theater, trampoline park or a gym with a juice bar or coffee shop.”

Private labels

There are a pair of factors helping drive expansion plans of discount supermarkets. First, recessionary pressures and inflation have made consumers more cost-conscious, Gielchinsky said. Second, consumers have become more brand agnostic. Even among those with six-figure incomes, reluctance to buy store brands has eroded, he added.

READ ALSO: What Retail Investors Want Now

The acceptance of these private labels is a key consideration in discount grocers’ growth, added Matt Garfield, managing director within Washington, D.C.-based FTI Consulting’s Retail & Consumer Products practice. Not only do they support margins, but good private label assortments help propel loyalty in a competitive marketplace, he noted, adding that Colliers’ December 2022 report found more than 60 percent of consumers say that in the face of persistent inflation, they would switch to private labels. The same report revealed shoppers across all incomes say they shop at discount grocers. That includes 48.2 percent of middle-class and 17.6 percent of high-income shoppers.

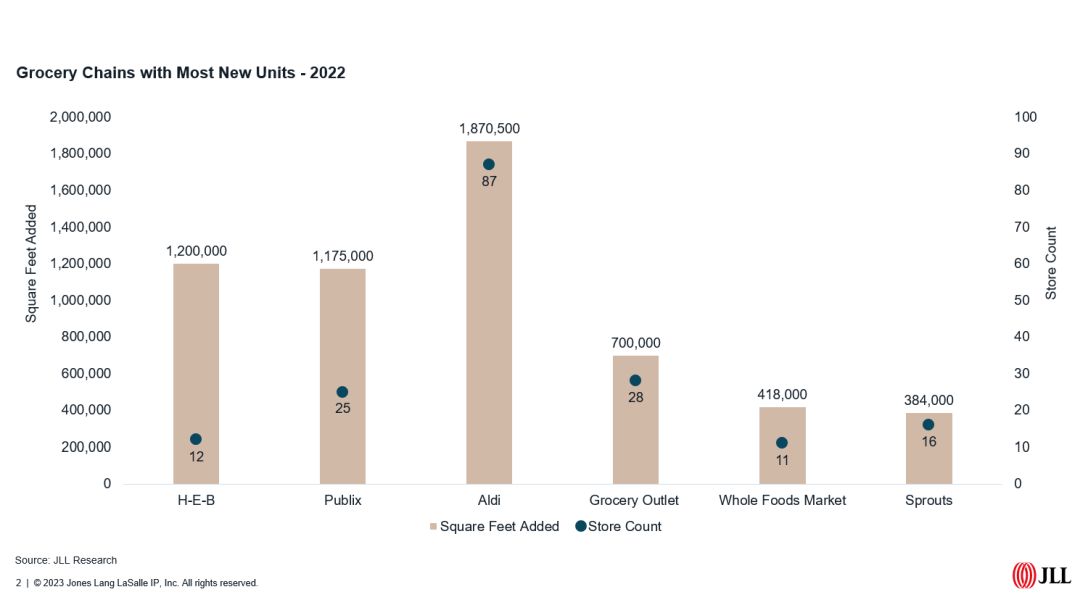

“There’s still quite a bit of opportunity in the discount grocery space,” said James Cook, director of retail research, JLL Americas, noting Aldi alone opened 87 stores last year and is on pace to open 120 more this year. “There’s also still a good number of trade areas into which they can expand.”

Damon Juha, Partner & Real Estate Practice Vice Chair, Saul Ewing LLP. Image courtesy of Saul Ewing LLP

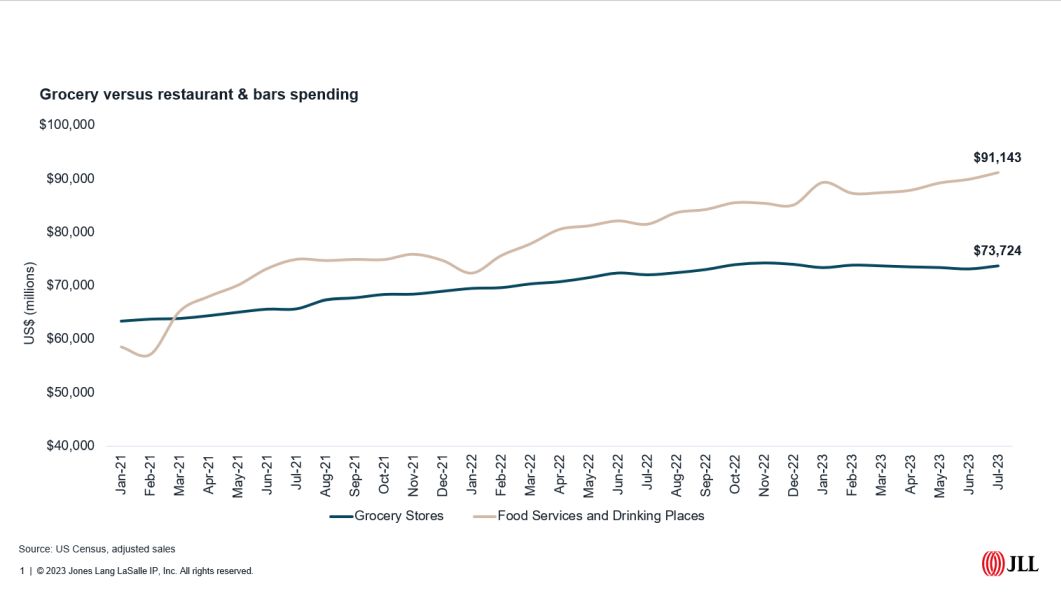

The pandemic proved a blessing for grocers in general, and economic pressures like inflation appear to be good for discount grocers, added Damon Juha, who handles transactional real estate matters for Saul Ewing LLP.

“We’re seeing many deals where clients with existing buildings from 12,000 to 25,000 square feet are willing to invest in second-generation space to lure discount grocers,” he reported. “Despite the sometimes-onerous demands by the discount grocers in terms of build-out and rent, it seems to pencil out for owners looking to get a credit tenant.”

Changing places

Ideal locations for discount grocers were once thought to be strip shopping centers and other less prized locations. “[Their] most successful locations tend to be food deserts and areas with lower income demographics,” Garfield noted.

“Given the recent economic headwinds, however, we have also seen increased penetration within high-income demographics as consumers cut back on spending.”

Discount supermarkets are increasingly emerging in more coveted locations with a higher-end retail mix, Gielchinsky agreed. They are also more often sprouting in areas with easy access from state highways and Interstates, he said.

As they scour markets for store sites to support continued expansion, discount grocers are engaging in increased diligence with respect to location identification and selection, Garfield reported. “The tight net margins for these retailers mean they cannot manage the burden of unprofitable locations across their fleet,” he added.

The lease terms discount grocers seek are typically shorter than those of larger supermarket chains, Gielchinsky said. Typical discount grocer lease terms are two to five years, as opposed to terms of 10 to 30 years for traditional chain supermarkets.

The shorter terms are necessary because of the risky nature of the business. “Very often, when a discount grocer is coming into a market, they’re making a bet that the grocery will thrive in that environment,” he reported.

Cook agrees opening new discount grocery locations is not without its financial hurdles. “The challenge is making the economics work,” he said. “If the cost to lease or build in a certain submarket is too expensive, it can be difficult or impossible to build a profitable location. Because of a relatively strong demand for retail real estate and a lack of new construction, average asking rents for neighborhood and community centers have been growing consistently for years.”

Growth outlook

Both Garfield and Gielchinsky believe the discount grocery segment will do nothing but grow in the coming years. Garfield forecasts the strong growth of recent years will continue, and added consensus projections are calling for between 5 to 10 percent growth annually. “Hard discount grocery is outpacing the growth of traditional grocery outlets,” he said. “This trend will persist, especially as consumers’ spending confidence is rattled by the current economic environment.”

Added Gielchinsky: “I think it gets larger in the years ahead. We’ve been in this recessionary period for a year, with a slowdown in real GDP. People will continue to look for the best deal. And with more consumers becoming brand agnostic, that will push the continued growth of the discount supermarket channel.”

With greater competition sure to enter the segment, the discount grocers that survive will have to be resilient, nimble and able to react to change quickly, Gielchinsky said. To thrive, discount retailers will need to get into delivery of groceries and master last-mile distribution capabilities. They will also have to look at how to make reverse logistics work for them, perhaps by installing return bars in the stores where consumers can return Amazon purchases and then go on to purchase discount groceries.

“The last one is e-commerce,” he added. “Everyone is fighting for ad space in social media. The one adept at ensuring its name appears in front of the right consumers will have an advantage in getting consumers to come to its stores,” he said.

Planning ahead

How can investors and owners prepare for the expansion of Aldi, Lidl and Grocery Outlet, and the increasing encroachment of dollar stores into the grocery channel?

If the stores are going into space once filled by bigger-box stores, proactively splitting up space makes sense. “Subdivide it into, say, four spaces, so that becomes attractive to the smaller tenant,” Gielchinsky said. “They can have it and not be concerned with going out of pocket to renovate the space to be more suitable for their size.”

Landlords will also have to become more realistic in determining lease terms, he said. “They may not be able to replicate the rent of Bed Bath & Beyond. But if they can obtain four new tenants to fill that space, they’ll be better positioned to survive long-term than landlords waiting for big-space tenants who may never arrive.”

You must be logged in to post a comment.