Behind the Project: Portman Goes Big in Philly

An in-depth look at a $330 million campus and the market trends that are driving the project.

Philadelphia remains one of industrial developers’ favorite locations in the Northeast, with the metro accounting for the largest under-construction pipeline as of August—16.8 million square feet or 3.9 percent of existing inventory—according to a recent CommercialEdge report. Banking on the area’s stable fundamentals and the growing demand for modern facilities, many developers are starting construction on new projects on a speculative basis.

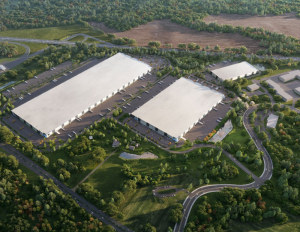

Phase I is set to bring a roughly 636,000-square-foot facility to the market. Image courtesy of Portman Industrial

Recently, site work began at Portman Industrial‘s I-76 Trade Center, a $330 million speculative project totaling 1.9 million square feet in Exton, Pa. The logistics campus is slated to encompass three facilities that will come online in two phases. The first one is set to bring to the market a 636,120-square-foot, cross-dock building with four drive-in doors, 110 dock doors, 146 trailer stalls and 508 parking spaces, while Phase II will include a 1.1 million-square-foot facility and another 154,440-square-foot building.

Built on almost 170 acres, I-76 Trade Center is slated for full completion in early 2025. Commercial Property Executive asked Portman Industrial Managing Director John Gaskin to share details about how work at the massive project is going and expand on the area’s growth potential.

What convinced you to invest in Philadelphia?

I-76 Trade Center will be attractive to multiple types of uses, according to John Gaskin. Image courtesy of Portman Industrial

Gaskin: Philadelphia has the oldest industrial inventory in the country. The existing stock of product does not have the modern amenities and building features it needs to support current demand. Now, we are seeing a more robust pipeline of advanced industrial space—such as more efficient dock doors and taller ceilings. With I-76 Trade Center, we are developing a three-building, institutional-quality logistics campus that will answer the demand for modern warehouse and logistics space in this region.

This region benefits from being in close proximity to major metros, including New York City and Washington, D.C. Philadelphia is the seventh-largest MSA in the country. With a strong trajectory for future growth, Southeastern Pennsylvania is an economic engine, supported by a wide network of expressways, trains and buses.

READ ALSO: Industrial Sector Navigates Growth Challenges

What sets the I-76 Trade Center project apart from other industrial developments in the metro?

Gaskin: I-76 Trade Center’s premier location sets it apart from other projects. With frontage along the Pennsylvania Turnpike, it is situated strategically within Philadelphia’s western suburbs and provides immediate access to Exit 312. The Interstate 76 Schuylkill Expressway, the Interstate 95 Delaware Expressway, Interstate 476, and U.S. routes 202, 100 and 30 all contribute to the region’s long-term logistics prowess. Additionally, I-76 Trade Center is equidistant to Exit 8A of the New Jersey Turnpike.

Overall, the area benefits from impressive logistical infrastructure, including the Philadelphia International Airport, Port of Philadelphia and three intermodal rail centers, as well as FedEx and UPS facilities.

Phase I is scheduled for delivery next year in August. What types of businesses do you envision as the ideal fit for the facility?

I-76 Trade Center is expected to be fully completed in the first quarter of 2025. Image courtesy of Portman Industrial

Gaskin: When starting a project like this, it’s easy to think that the obvious end user is a tenant focused on warehousing and the distribution of consumer goods. However, as we have developed this type of product over the past few years, we have been successful in attracting a variety of tenants.

Since we are developing the I-76 Trade Center on a speculative basis, it creates the opportunity for the tenant to come from any sector. In addition to warehousing and distribution, the end users could be involved in manufacturing, life sciences, data centers or cold storage. The product we are building is going to be attractive to all types of users.

Given the current economic climate, securing funding for a project of this magnitude can be challenging. Were there any obstacles in obtaining funding for the development?

Gaskin: These are turbulent times for capital markets. At Portman, we benefit from a 70-year track record of doing these types of projects with fantastic equity partners. We are fortunate to have deep, long-term banking relationships that allow us to fully capitalize our projects even when the industry is facing economic headwinds.

There’s a growing trend for developers to add recreational facilities and other amenities to industrial projects. Will I-76 Trade Center feature such spaces?

Gaskin: At I-76 Trade Center, we are building a 26-acre public park with walking trails and other amenities. We are also preserving historical farming facilities on the site. Since we are building spec, we will defer to the tenant on the specific amenities they would want included for the building, such as a basketball court, outdoor seating, etc.

READ ALSO: A Backstage Look at Hines’ Quantum 56 Project in Denver

To what extent has Portman incorporated community considerations into the planning and execution of I-76 Trade Center?

Gaskin: We are passionate about contributing to the communities we are in, and our philosophy is always to listen first. When we set our eyes on a project, we place a huge emphasis on being open and transparent with the community about our plans. We are dedicated to meeting with the neighborhood and community groups and really taking the time to get their input.

For example, at I-76 Trade Center, we listened to the township and community members and knew it was important to incorporate a public park, as well as preserve the historic farming buildings.

What are the most frequent challenges industrial developers need to face today? How is Portman addressing these headwinds?

I-76 Trade Center will include three buildings totaling 1.9 million square feet. Image courtesy of Portman Industrial

Gaskin: In our industry today, there are short-term and long-term headwinds. Currently, the short-term headwinds are the challenges with the capital markets in raising equity and debt. As inflation eases and interest rates decline, we fully expect that the capital will start flowing back into the industrial development sector.

The long-term headwinds that we are facing include dysfunction in the supply chain, longer and unpredictable entitlement periods, labor shortages and product availability—like switchgear, generators and fire pumps. In this regard, it is critically important to do your homework and plan accordingly.

What emerging technologies is Portman monitoring or actively incorporating into its development strategies?

Gaskin: Our team and the industry as a whole is laser-focused on how to achieve greater energy efficiency within industrial buildings. We are looking at innovative ways to reduce the carbon footprint of the built environment and lower operating costs. There is a considerable effort being placed on bringing alternative sources of power into these facilities, and this is something we will continue to prioritize for a more sustainable future.

Speaking of the future…we’re nearing the end of 2023. Is there a particular trends that you expect to shape the industrial market in the upcoming year?

Gaskin: While things have slowed down, leasing activity remains rock solid. There continues to be significant levels of new tenants and deals in the market. Now more than ever, tenants are doing a very careful analysis to find the right location. Companies are taking a hard look at the available space and analyzing if that area is sustainable for fulfilling labor needs, operating costs and more.

You must be logged in to post a comment.