Wave of Loan Maturities Signals Looming Office Distress

Nearly one-third of all debt in the sector will come due by the end of 2026, a CommercialEdge market bulletin shows.

Net income for office properties has grown harder and harder to maintain as the number of challenges for the sector has continued to grow. The national vacancy rate as of September was 17.8 percent, as can be seen in the most recent CommercialEdge report, having consistently gone up since the pre-pandemic 13.4 percent. The markets are burdened with large amounts of debt, much of which is slated to mature in the near future, signaling high distress on the horizon, while banks and investors are making efforts to lower their exposure to the asset class.

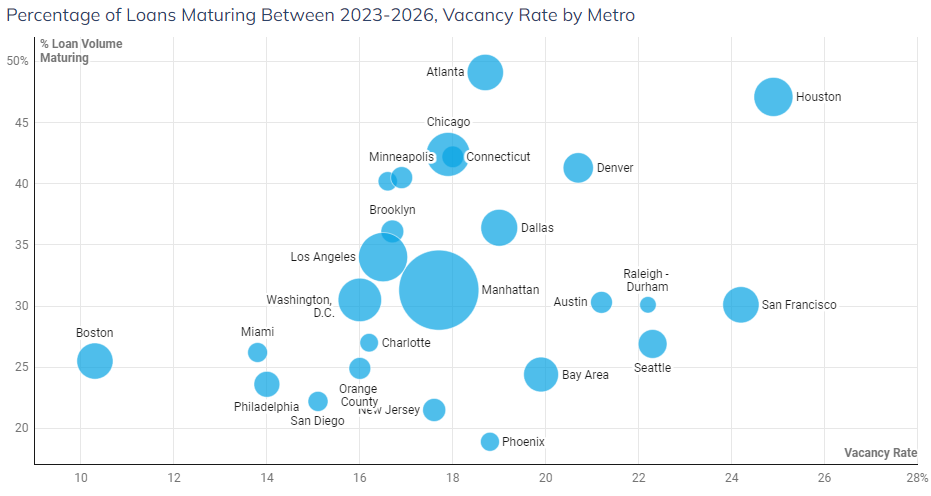

As of October, the amount of debt in U.S. office markets reached $920 billion, according to the CommercialEdge review of more than 80,000 properties. Manhattan registered by far the largest volume at $174.5 billion, almost triple that of Los Angeles, which took second place with $60 billion. On the other hand, the smallest amounts of debt were expectedly seen in smaller markets such as Raleigh–Durham, N.C., and Nashville, Tenn., both clocking in at roughly $7 billion.

Percentage of loans maturing between 2023-2026, vacancy rate by metro. Chart courtesy of CommercialEdge

Impending distress on the horizon

Nationally more than 16.1 percent of all loans are slated to mature by the end of next year, representing $148.2 billion. Metro Houston will see the highest percentage of maturities in this next year, at 29.7 percent or $8 billion. Through the end of 2026, the ratio of due loans shoots up to nearly one-third, at a total exceeding $300 billion. More than half of the debt in Atlanta and Houston will reach maturity in this time frame, at 52.6 and 50.5 percent, respectively.

Distress within the markets has registered a sharp increase, and is expected to rise further, with 5.8 percent of CMBS loans being delinquent as of October this year, 400 basis points above the figure registered in October 2022, according to the CRE Finance Council and Trepp data quoted in the market bulletin. CMBS and collateralized loan obligation issuers securitized $3.7 billion of office loans through the first three quarters of 2023, a 75 percent year-over-year drop, as revealed by Commercial Mortgage Alert.

Read the full CommercialEdge market bulletin.

You must be logged in to post a comment.