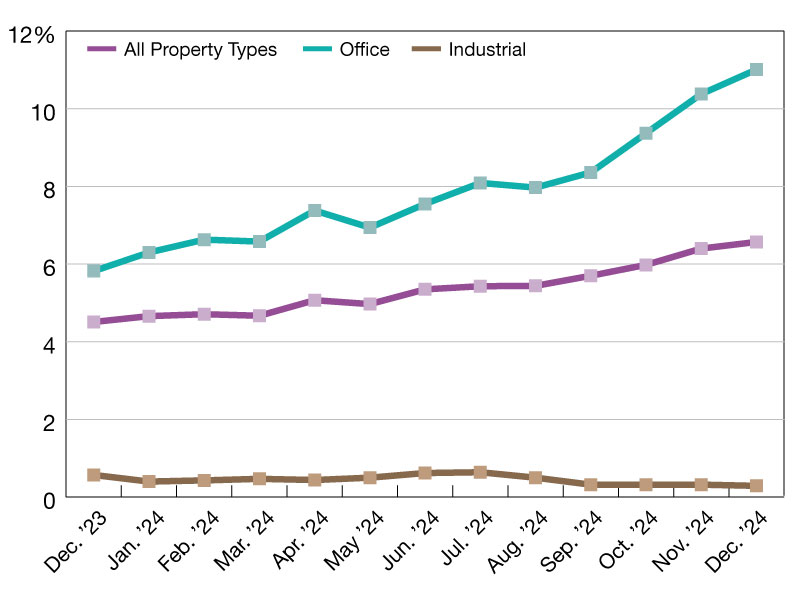

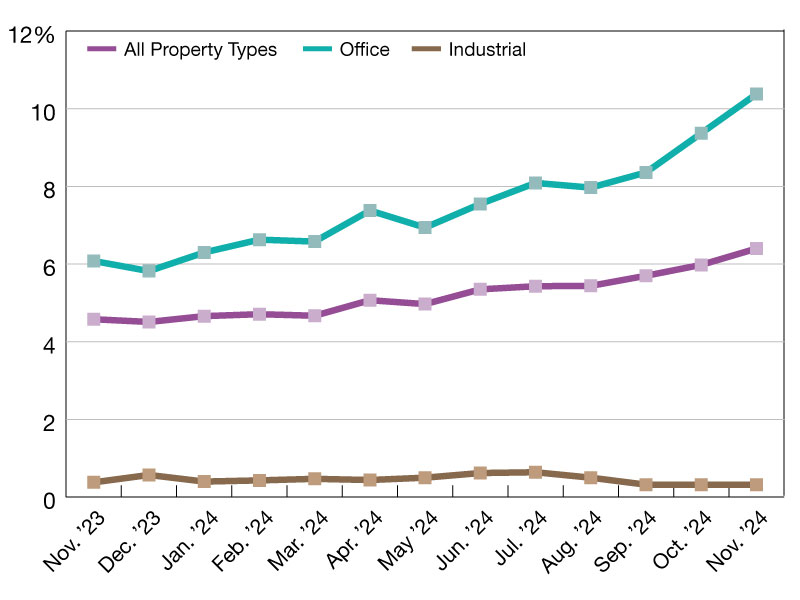

2024 CMBS Delinquency Rates

Trepp's monthly update. Read the report here.

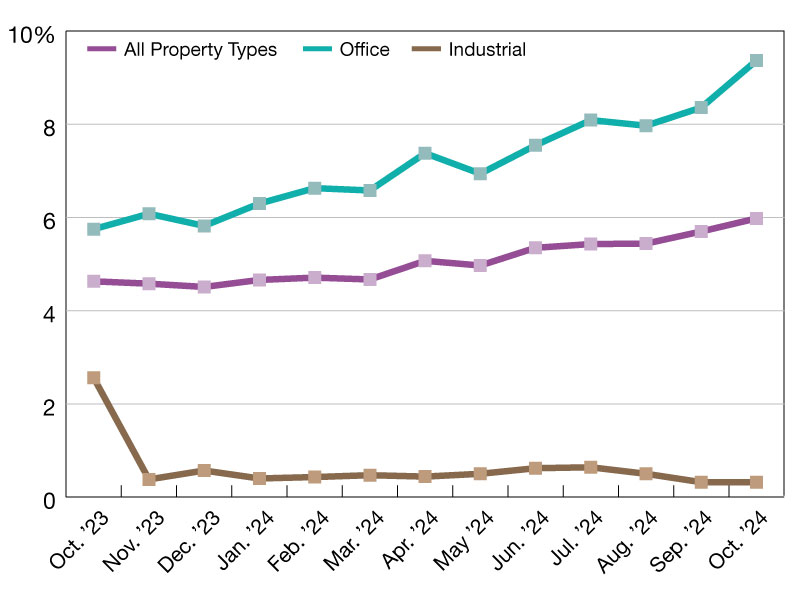

The Trepp CMBS Delinquency Rate rose once more in December 2024, with the overall rate increasing 17 basis points to 6.57 percent.

The office delinquency rate rose 63 basis points in December to 11.01 percent, surpassing the 11 percent mark for the first time since Trepp began tracking delinquency rates in 2000. Prior to this, the highest the office delinquency rate had climbed was to 10.70 percent, reached in December 2012. There was north of $2 billion in office loans that became newly delinquent in December.

READ ALSO: What’s Ahead for CMBS in 2025?

The retail delinquency rate experienced the largest respective increase across property types, jumping 86 basis points to 7.43 percent. The retail delinquency rate has increased more than 115 basis points over the course of 2024 and is currently at a 2.5 year high. The largest newly delinquent retail loan was a massive single-asset, single-borrower loan with a balance of more than $500 million.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 8.58 percent, up 57 basis points from November.

The percentage of loans in the 30 days delinquent bucket is 0.26 percent, down 26 basis points for the month. Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on January 30, 2024

The Trepp CMBS Delinquency soared in November 2024, with the overall delinquency rate increasing 42 basis points to 6.40 percent.

This month, the office, multifamily and lodging property types all saw substantial increases in the sector-specific delinquency rates. The office delinquency rate surpassed 10 percent in November, increasing about 100 basis points to 10.38 percent. There were multiple large newly delinquent office loans that drove the office delinquency rate higher, with the office sector making up 60 percent of the net change in delinquent loan amount in November.

The percentage of loans in the 30 days delinquent bucket is 0.52 percent, up 9 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on December 26, 2024

The Trepp CMBS Delinquency Rate continued its upward trend in October 2024, increasing 28 basis points to 5.98 percent.

In October, all major commercial property types saw rate decreases or remained unchanged in the

delinquency rate, except for the office sector, which saw an increase of 101 basis points. The office

delinquency rate reached 9.37 percent, up from 8.36 percent in September. The last time the office rate breached 9 percent was in 2012 and 2013, when the overall CMBS delinquency rate reached an all-time high of 10.34 percent in July 2012.

The office sector made up more than 60 percent of the newly delinquent loan amount in October.

Although there was more than $3 billion in newly delinquent loans across major property types,

almost $2 billion in loan balance was either paid off or removed from the delinquent loan category

this month, resulting in about $1 billion in net increase in the overall dollar amount of delinquent

loans in October.

A large office loan that previously was current on payments became 30 days delinquent in October

and was a main driver for the office delinquency rate increase this month. All split pieces of this

loan, one of which is a single-asset single-borrower (SASB) loan, reflected this newly delinquent

status in October.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate

would be 7.73 percent, up 58 basis points from September.

The percentage of loans in the 30 days delinquent bucket is 0.43 percent, up 26 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on November 25, 2024

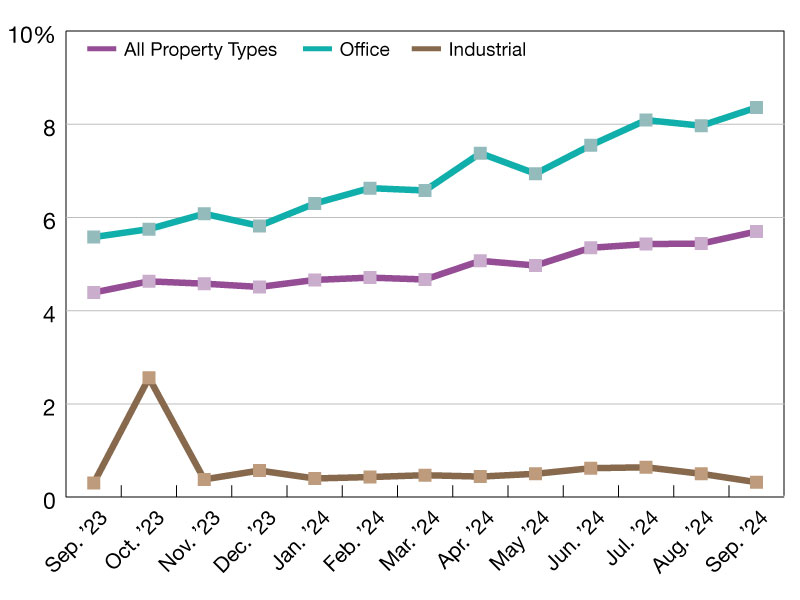

The Trepp CMBS Delinquency Rate continued its uphill climb in September 2024. Overall, the delinquency rate rose 26 basis points to 5.70 percent.

Most of the major property types contributed to the rise in the overall rate, but the retail sector contributed to about 50 percent of the net change in the total delinquent loan amount.

The retail delinquency rate rose 86 basis points in September, reaching 7.07 percent. The last time the retail delinquency rate was above 7.0 percent was in April 2022. A large single-asset single-borrower (SASB) deal that had previously been current on payments but now shows a delinquency status of nonperforming matured balloon, was one of many large retail loans to turn delinquent in September.

The office sector accounted for 37 percent of the $2 billion net increase in the overall dollar amount of delinquent loans in September, with the office delinquency rate increasing 39 basis points to 8.36 percent.

If we included loans that are beyond their maturity date but current on interest payments, the delinquency rate would be 7.15 percent, down six basis points from August.

The percentage of loans in the 30 days delinquent bucket is 0.17 percent, down eight basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on October 28, 2024

The Trepp CMBS Delinquency Rate inched up again in August 2024. Overall, the delinquency rate rose one basis point to 5.44 percent.

Unlike many months, the office sector was not responsible for the slight uptick in the overall rate. Although there was $1.25 billion worth of newly delinquent office loans, counteracting this was $1.55 billion worth of office loans that were delinquent a month prior, but were no longer delinquent in August (otherwise known as “cured”). In August, the property type that contributed the largest net change in delinquent dollars was the multifamily sector, with a total of $407.77 million.

The multifamily delinquency rate rose 67 basis points in August, reaching 3.30 percent.

This is the highest the multifamily rate has climbed in more than three years. The last time the rate even eclipsed the 3.00 percent mark was in July 2021. For context, there was a large multifamily loan that accounted for north of 54 percent of the property type’s newly delinquent total. This was a portfolio loan that had previously been current on payments but now shows a delinquency status of non-performing matured balloon.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 7.21 percent, up 43 basis points from July.

The percentage of loans in the 30 days delinquent bucket is 0.25 percent, unchanged for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on September 25, 2024

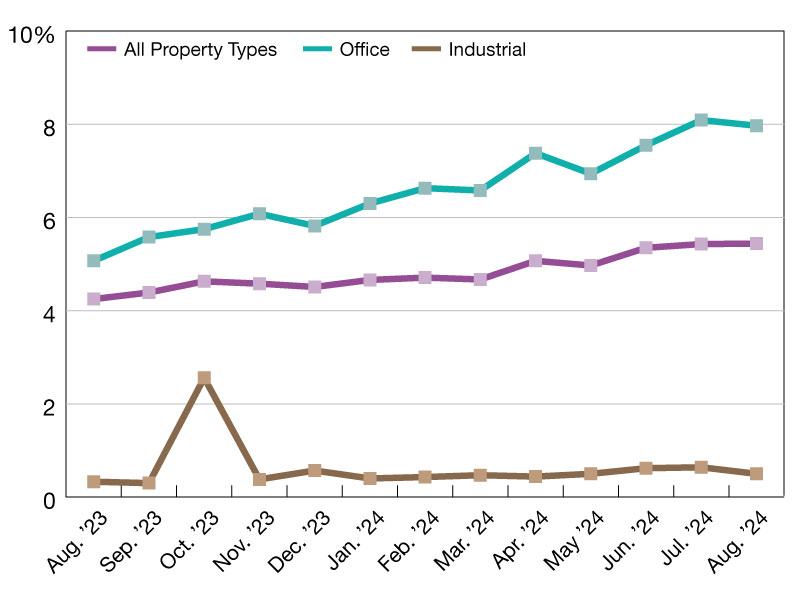

The Trepp CMBS Delinquency rate continued ticking up in July 2024. Overall, the delinquency rate increased 8 basis points to 5.43 percent.

The increase was primarily driven by the office sector, which accounted for almost two-thirds of newly delinquent loans in July. The office delinquency rate is now above 8 percent for the first time since November 2013 when the rate was at 8.58 percent. About $1.88 billion in office loans became newly delinquent in July, which was offset by just shy of $600 million in office loans that were 30+ days delinquent in June but were no longer delinquent in July.

The two property sectors that saw a decline in the delinquency rate were retail and lodging.

The largest loan that became delinquent in July contributed to about one-third of the amount of newly delinquent office loans. It was an office loan that had its delinquency status turn back to nonperforming matured balloon from performing matured balloon. The status on the loan has flipped back and forth a couple times since the loan defaulted at maturity in December 2023.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 6.78 percent, up 24 basis points from June.

The percentage of loans in the 30 days delinquent bucket is 0.25 percent, down 11 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on August 28, 2024

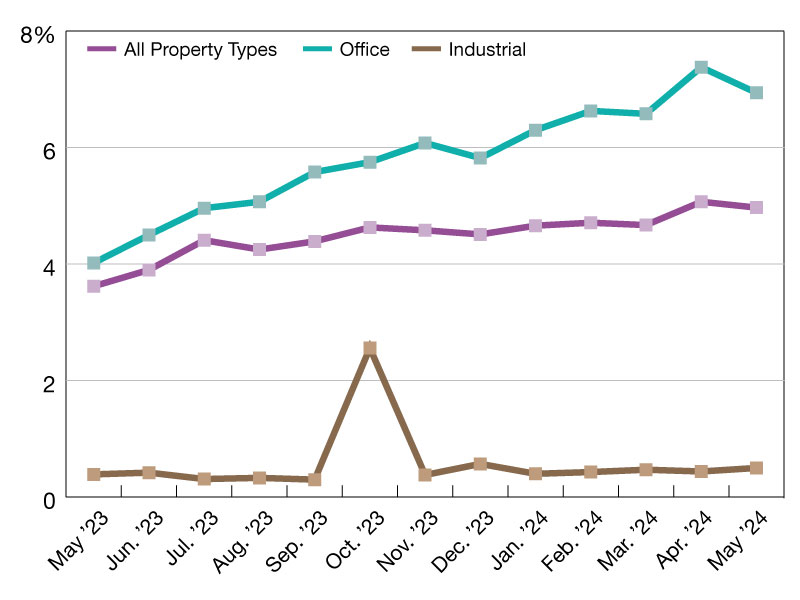

The Trepp CMBS delinquency rate jumped back above 5% in June 2024. The increase is somewhat expected after last month’s slight retreat given that the CMBS delinquency rate has been on an upward trend, increasing in four of the last six months. Overall, the delinquency rate increased 38 basis points to 5.35 percent.

The net increase in delinquent loans in June across the five major property types was just shy of $2 billion, with the office sector accounting for half of the net increase. There was roughly $1.87 billion in newly delinquent office loans during the month which was offset by roughly $900 million in office loans that were 30+ days delinquent in May but were no longer delinquent in June.

The other two sectors that posted large increases in their respective delinquency rates were retail and multifamily, accounting for 27 percent and 20 percent, respectively, of the $2 billion net increase in the overall dollar amount of delinquent loans in June. The retail sector had a roughly $525 million net increase in the volume of delinquent loans in June. The four largest loans that became delinquent in June had balances greater than $100 million and were all malls.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 6.54 percent, up 54 basis points from May.

The percentage of loans in the 30 days delinquent bucket is 0.36 percent, up 1 basis point for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on July 24, 2024

The Trepp CMBS Delinquency rate dipped back below 5 percent in May 2024, a welcome sign after last month’s surge. Overall, the delinquency rate declined 10 basis points to 4.97 percent.

The decrease was primarily driven by some sizable resolutions in the office sector. A little more than $2 billion in office loans resolved in May, either because the loans flipped back to non-delinquent during the month, or because the loan was disposed. Five office loans accounted for $1.7 billion of the $2 billion. If the $2 billion in office resolutions had remained delinquent, the overall May CMBS delinquency rate would have been almost 26 basis points higher at 5.33 percent and the May office delinquency rate would have been roughly 90 basis points higher at 8.48 percent.

Since the overall rate only decreased 10 basis points, what offset the sizable amount of office resolutions? Ironically, it was also due to office, at least in part. There were approximately $1.2 billion in newly delinquent office loans in May. In addition, the retail, lodging, and multifamily sectors also had sizable amounts of newly delinquent loans, with $995 million in newly delinquent retail loans, $238 million in lodging loans, and $245 million in multifamily loans. The net increase in delinquent loans for each of these three sectors was less since, similar to the office sector, there was a solid amount of loans that resolved in May as well.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 6.00 percent, up 16 basis points from April.

The percentage of loans in the 30-days delinquent bucket is 0.35 percent, up 12 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on June 27, 2024

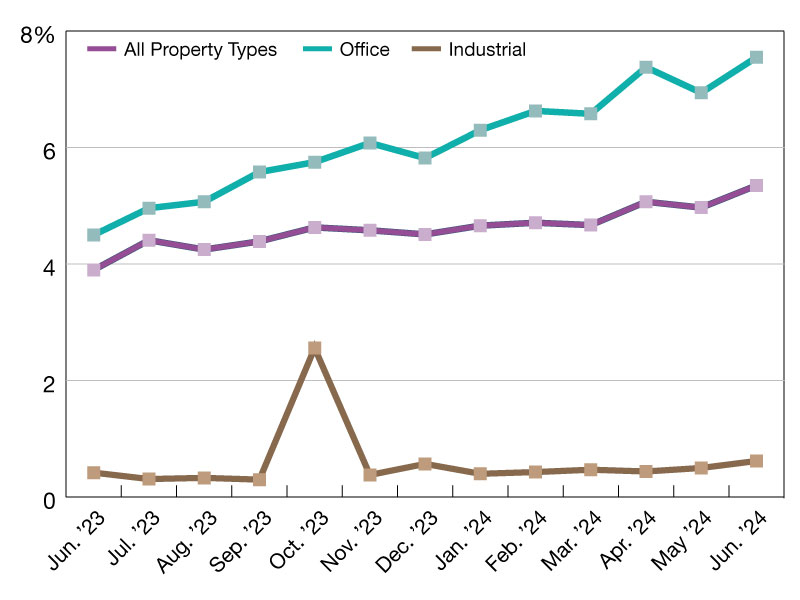

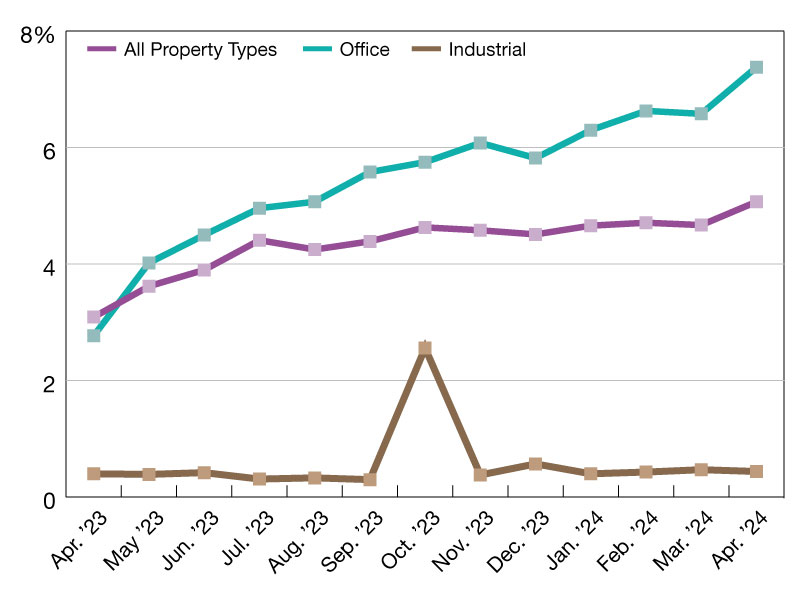

The Trepp CMBS Delinquency rate surged in April 2024 after posting a slight decline the month prior. Overall, the delinquency rate increased 40 basis points to 5.07 percent, the highest since September 2021 when the rate was 5.35 percent.

The increase was driven by spikes in the office, lodging, and retail sectors, with more than a dozen loans with outstanding balances greater than $100 million becoming delinquent during April. The size of the month-over-month increases for each of these three property sectors was the highest in almost a year.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 5.84 percent, up 41 basis points from March.

The percentage of loans in the 30 days delinquent bucket is 0.23 percent, up 7 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on May 29, 2024

The Trepp CMBS Delinquency rate dropped slightly in March 2024. Overall, the delinquency rate declined 4 basis points to 4.67 percent.

The decline was almost exclusively due to the continued improvement in the retail sector as it notched its fourth consecutive monthly decline. The retail delinquency rate declined 47 basis points in March to 5.56 percent.

Ironically, the office sector was one of only two sectors that saw a decline in the delinquency rate. The office delinquency rate declined 5 basis points to 6.58 percent.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 5.43 percent, down 26 basis points from February.

The percentage of loans in the 30 days delinquent bucket is 0.16 percent, down 14 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on April 30, 2024

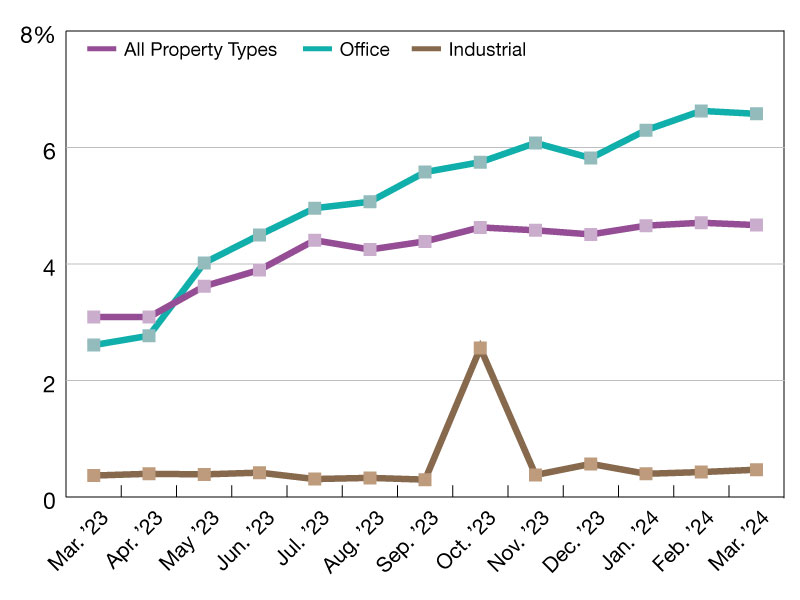

The Trepp CMBS Delinquency rate inched up in February. Overall, the delinquency rate rose 5 basis points to 4.71 percent.

In the heavily watched office segment, delinquencies jumped 33 basis points to 6.63 percent. The month-over-month increase in February is roughly in-line with the average monthly increase for the sector over the prior 12 months, increasing by 37 basis points per month on average.

The retail segment notched the largest decline of all property sectors for the month, dropping 24 basis points to 6.03 percent.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 5.69 percent, up seven basis points from January.

The percentage of loans in the 30 days delinquent bucket is 0.30 percent, up six basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on March 28, 2024

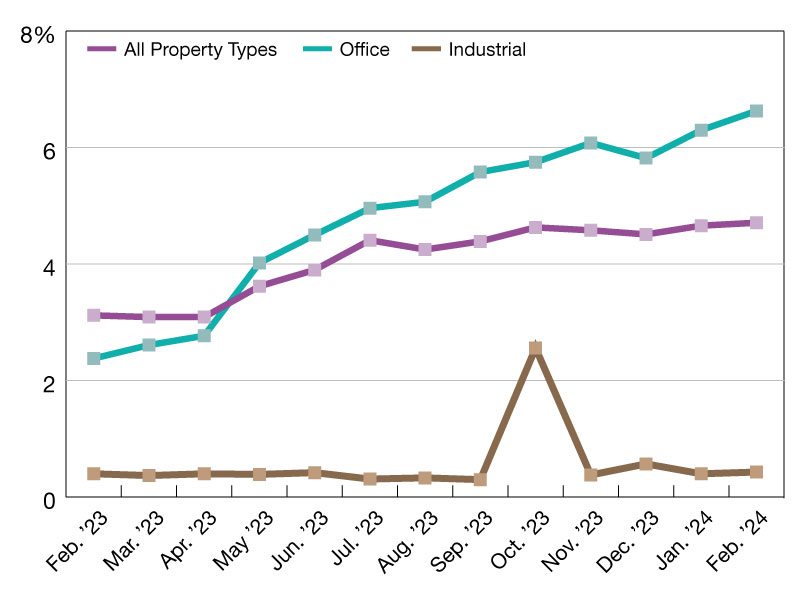

The Trepp CMBS Delinquency rate rose modestly in January The Trepp CMBS Delinquency rate rose modestly in January 2024. Overall, the delinquency rate rose 15 basis points to

4.66 percent.

Delinquencies in the heavily-watched office sector experienced their most significant increase since September 2023. The office delinquency rate jumped 48 basis points to 6.30 percent.

The multifamily segment notched a substantial decline, dropping 71 basis points for the month. The decline can be attributed to a large 2019 single-asset, single-borrower (SASB) apartment loan in San Francisco that was disposed in January.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 5.62 percent, up 13 basis points from December.

The percentage of loans in the 30 days delinquent bucket is 0.24 percent, up one basis point for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on February 29, 2024

You must be logged in to post a comment.