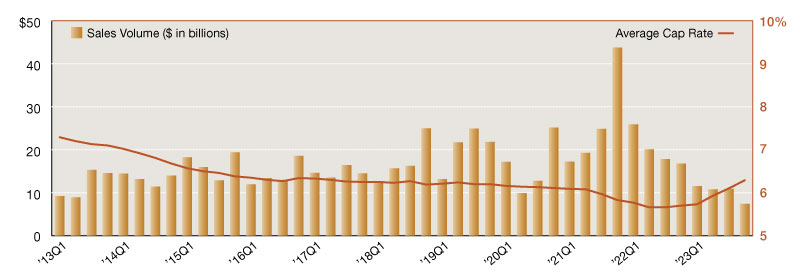

2023 Net Lease Overall Sales Volume and Cap Rates

Below are a few of the top trends impacting the market, according to Northmarq.

The single-tenant net lease market continued to experience significant reductions in investment activity throughout 2023, and volume declines have now been reported in seven of the last eight quarters. With $40.6 billion in sales, investment activity reached a recent annual low not seen since 2012. Quarterly sales volume, at just $7.4 billion for the fourth quarter 2023, was down 31.7 percent from the third quarter and 57.9 percent year-over-year. Across the three net lease sectors—office, industrial, and retail—quarterly and annual volumes saw widespread reductions as well, with the most significant changes reported for retail (down 40.8 percent from the last quarter) and office (down 63.5 percent from the last year).

Average cap rates continued their upward climb during the fourth quarter 2023, rising 19 basis points to a new overall average of 6.29 percent. Since the end of 2022, the overall average has risen 62 basis points, driven primarily by increases within the industrial sector. While all single-tenant property sectors reported rising cap rates during the fourth quarter 2023, the retail sector posted the most dramatic quarterly increase at 23 basis points, and its average is now back above the 6.0 percent mark.

Looking ahead to 2024, opportunities for all-cash investors, as well as those able to secure favorable financing, will be available across all property types. Health care assets remain popular, which will continue to lend support to the office sector until it regains its footing. Investors may also be able to capitalize on distressed office assets as debt comes due and owners look to trade out of the sector. Industrial product of all kinds continues to play a critical role across the industry, and expanding net lease retailers are expected to deliver a host of new product to the market in the coming months, offering newly constructed properties with stable, long-term leases in place. Overall investment volume is likely to stay muted, especially early in the year, and the markets are continuing to watch interest rates closely. Once financing becomes more accessible to borrowers, investors are expected to return in earnest, provided seller pricing aligns with expectations and the listing supply is ample enough to satisfy demand.

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq. She is responsible for leading the content strategy for the firm and producing research reports in support of the organization’s commercial investment sales division. Beck joined Northmarq in 2022 following the acquisition of Stan Johnson Company, where she had led corporate research, marketing and communications efforts since 2013.

—Posted on Feb. 28, 2024

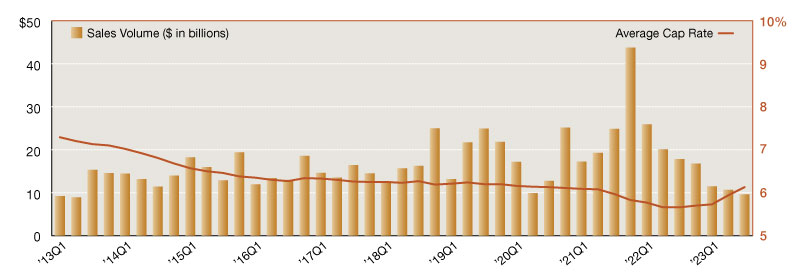

Investment sales activity for the single-tenant net lease market has posted declines in each of the last seven quarters. Since reaching an all-time high at year-end 2021, quarterly activity has been reduced by more than 78 percent, illustrating just how substantial an impact economic uncertainties can have on the market. Rising interest rates have sidelined many investors this year as the Fed works to drive inflation below their target range, and these actions have resulted in a less than impressive year-to-date sales volume total of only $31.7 billion for the net lease sector. With just $9.6 billion logged in the last three months, and another interest rate increase possible during fourth quarter, the commercial real estate investment market is not likely to see a year-end rally.

Despite market-wide muted activity in 2023, a few bright spots remain. The single-tenant retail sector has quietly been holding strong. Sales activity in 2023 has been on par with historical averages, once you remove the fourth quarter 2021 anomaly, and the sector even reported a 51.4 percent uptick in activity during the last three months. Additionally, the future of the industrial sector remains bright, even with reduced sales volume in recent quarters. Expansion plans announced by many retail brands across the U.S. promise to translate to continued demand for traditional warehouse, manufacturing, and distribution space, not to mention more specialized industrial facilities including cold storage, food processing, and last-mile distribution. Lastly, each reporting period that witnesses below-average investment activity adds to the growing pent-up demand that will positively influence sales volume in future years. The story we tell about investment activity in 24 to 36 months, for example, is very likely to have a different narrative.

Today, however, there remains a pricing gap between what sellers believe their properties are worth and what buyers are willing and able to pay. Until that gap shrinks, the motivation to transact will be reduced on both sides of the negotiating table.

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq. She is responsible for leading the content strategy for the firm and producing research reports in support of the organization’s commercial investment sales division. Beck joined Northmarq in 2022 following the acquisition of Stan Johnson Company, where she had led corporate research, marketing and communications efforts since 2013.

—Posted on Nov. 30, 2023

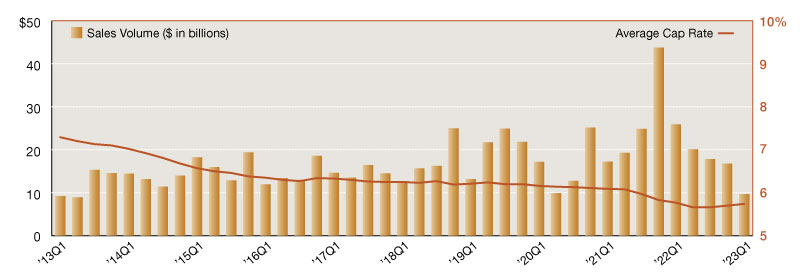

As expected, the single-tenant net lease market witnessed a fifth consecutive quarter of slowing activity. With just $9.68 billion posted for first quarter 2023, overall transaction volume is down more than 42 percent quarter-to-quarter and almost 63 percent year-over-year. Following several quarters of strong activity, along with a record setting end to 2021, predictions called for a slow start to 2023 as investors continue to respond to rising interest rates and changing economic conditions.

Buyers and sellers continue to struggle finding alignment with pricing net lease assets, as higher debt costs translate to reduced buying power for some investors. As a result, some subsets of the market have seen all-cash transactions rise in popularity, and we continue to see 1031 exchange activity fuel a good portion of the net lease sector’s demand. Sale leaseback transactions too have contributed to first quarter gains, as companies look to leverage their owned real estate. While private investors have held on to their dominant market share, we’ve witnessed a return of foreign capital, especially within the single-tenant industrial and retail asset classes.

Cap rates have risen across all three primary commercial property sectors, with the largest quarterly movement occurring for industrial. With an 11-basis-point jump during first quarter 2023, single-tenant industrial cap rates now sit at an average of 5.50 percent – the highest in 18 months. Office cap rates increased six basis points in the last three months, as retail rates only reported a two-basis-point rise since year-end 2022. While cap rate increases have been more pronounced in the office and industrial sectors as of late, the retail market isn’t lagging too far behind. Watch for single-tenant cap rates to continue rising throughout 2023, but do not expect significant quarterly spikes in the overall net lease average.

Lanie Beck is the Senior Director of Content & Marketing Research at Northmarq. She is responsible for leading the content strategy for the firm and producing research reports in support of the organization’s commercial investment sales division. Beck joined Northmarq in 2022 following the acquisition of Stan Johnson Company, where she had led corporate research, marketing and communications efforts since 2013.

—Posted on May 31, 2023

You must be logged in to post a comment.